-

Observers say it's unlikely Congress will be able to strike a deal to stop across-the-board budget cuts from going into effect next week, raising concerns for bankers and regulators alike.

February 22 -

The FDIC's third-quarter report on the health of the industry shows lending climbed upward, but reduced loss provisions and sales of existing assets are what boosted earnings.

December 4 -

FDIC's Quarterly Banking Profile shows broad improvements in the number of institutions making more loans. But with rock-bottom interest rates squeezing margins, banks yet again looked toward reduced loss provisions to drive earnings.

August 28

WASHINGTON — Banks had another banner quarter at the end of 2012, but their near-record earnings performance belies significant challenges ahead.

Federal Deposit Insurance Corp. Chairman Martin Gruenberg, presenting the agency's fourth-quarter update on the industry's health, said the current period of robust income — driven by lower loan-loss expenses — appears to be winding down.

"While there is still room for further income growth, we don't expect the pace of earnings growth to continue at these levels," Gruenberg said at the release of the FDIC's Quarterly Banking Profile.

Although banks are lending — having increased their loan balances for the sixth time in seven quarters — and attracting record numbers of deposits, they continue to face eroding net interest margins from the effects of prolonged record-low interest rates, as well as further uncertainty about the nation's fiscal situation.

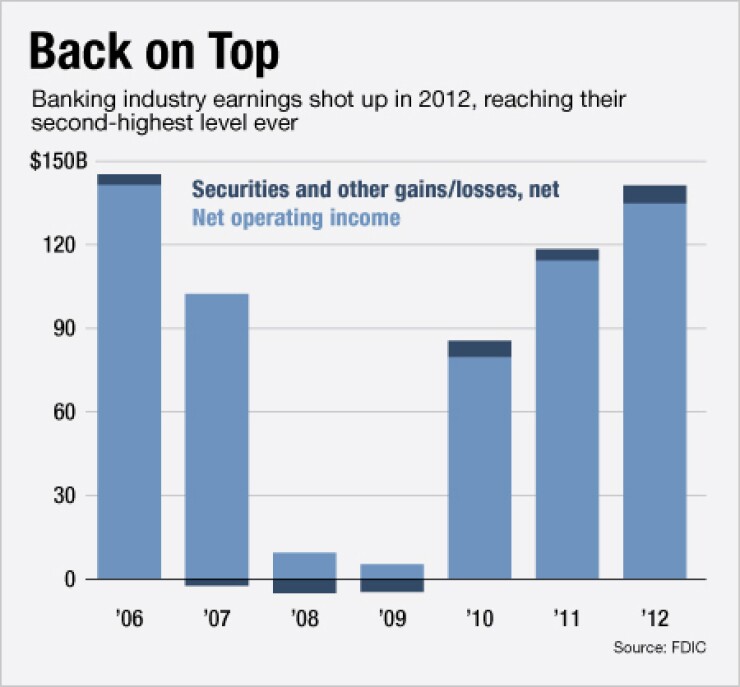

So even though institutions earned their second highest full year profit ever in 2012 — of $141.3 billion — banks saw their lowest quarterly amount for net interest income since late 2009.

"Narrow interest margins have been one of the factors holding down … revenue. It's why we've been somewhat encouraged by the growth in loan balances," Gruenberg said. "The net income increases that we've seen from the industry over the past few years have really been driven by reductions in loan loss reserves. We think that's probably playing out."

Following another quarter in which income benefited hugely from lower loss provisioning, Gruenberg said the industry's recent profit surges are likely not sustainable without further expansions of loan portfolios. (The 2012 profit total trailed only that of 2006, when institutions earned $145.2 billion.)

"Going forward, we think industry earnings are really going to depend on increased credit by the industry," Gruenberg said.

After accounting for more than 90% of income improvement over the last three years, Gruenberg said, the "contribution" from lower loss provisions to earnings "has been diminishing."

"While further reductions in loss provisions are possible, most of the benefits to earnings from lower provisions have already been realized," he said.

Meanwhile, as automatic cuts in federal spending — known as the "sequestration" — are set to take effect this week without a budget agreement between Democrats and Republicans, Gruenberg said banks could face the effect of whatever impact the cuts would have on a still-fragile economy.

"That's clearly a potential consequence," he said. "The industry recovery over these past few years has been aided by the slow but stable growth in the economy over that period. Anything that could impact economic growth could have potential consequences for the banking industry as well. That's obviously a factor we're watching closely."

Still, the persistent reduction in costs associated with bad loans from the crisis is reason for optimism. The $15 billion set aside for loss provisions in the fourth quarter was nearly 25% less than the quarterly provision a year earlier, and was the smallest fourth-quarter provision since 2006. It was the 13th straight quarter with a year-over-year decline in provisions.

Overall, banks and thrifts earned $34.7 billion in the quarter, a 37% increase over the fourth quarter of 2011 and was the highest total for a fourth quarter since 2006. Higher loan-sale gains and revenue, coupled with fewer losses on foreclosure sales, also boosted quarterly noninterest income, which grew 18% from a year earlier to $64.6 billion. Gains from loan sales skyrocketed 132% from the total in the fourth quarter of 2011. Trading revenue spiked by 75%, while losses on foreclosure sales dropped by 72%.

About 60% of institutions had better year-over-year quarterly earnings, and the industry's return on assets for all of 2012 reached 1% for the first time in six years.

"The improving trend that began more than three years ago gained further ground in the fourth quarter," Gruenberg said. "Balances of troubled loans declined, earnings rose from a year ago and more institutions of all sizes showed improved performance."

Following the FDIC's briefing, James Chessen, the American Bankers Association's chief economist, said the results were "a signal that the industry is gaining health very quickly."

But, he noted, the impact of low interest rates and declining margins is "the big problem now and for the next few years."

The Federal Reserve Board's interest rate policy is "by design" as the central banks tries "to stimulate more aggressive behavior for people to take loans out at low interest rates," Chessen said.

"But for a bank, there's not a lot of great opportunities out there at these rates. Banks are keeping their lending short because they know in two or three years the Fed is going to increase rates and do so very dramatically.

"The hope is that as the benefit to income from provisions goes down, there is an increase in loan demand generally, even at low interest rates. So at least you're trying to balance out that part of it."

Indeed, the lower loss provisions and higher noninterest income were needed to offset a 2.5% decline — from a year earlier — in quarterly net interest income, to $104.4 billion. It was the lowest net interest income total since the fourth quarter of 2009. The average net interest margin declined 25 basis points from a year earlier to 3.32%, the lowest level since the fourth quarter of 2007. Nearly 70% of all institutions had lower margins compared to a year earlier.

Even though the industry's earnings did not seem to come from credit-related revenues, loan balances are still on the rise. Loans accounted for more than half of a 1.6% increase in total assets — from the third quarter — to $14.45 trillion. Net loans and leases rose by 1.7% to $7.5 trillion. Commercial and industrial loans increased by 3.7% to $1.51 trillion, while credit card balances were up by 4.2% to $696 billion. Residential mortgages showed a slight uptick of 0.2%, to $1.89 trillion.

"While the rate of growth and overall increase in loan balances were greatest at banks with more than $10 billion in assets, a majority of smaller banks also increased their loan balances," Gruenberg said.

The approaching expiration of a temporary FDIC program to cover all non-interest-bearing checking deposits — which ended on Dec. 31 — did not appear to push back the nation's deposit growth. On the contrary, domestic deposits posted a record $386.8 billion increase — or 4.3% — from the previous quarter, mostly from growth in certain large denomination deposits.

The FDIC said failures in the fourth quarter, which totaled just eight, fell to a four-and-a-half year low. But the industry closed out 2012 as the first year in history that no new reporting institutions were added, and it was the second year in a row without any start-up "de novo" charters. Institutions on the agency's "problem" list declined for the seventh straight quarter, falling from 694 to 651, and assets of the institutions on the list decreased by 11% to $233 billion.

The agency's ratio of insurance reserves to insured deposits grew by 10 basis points over the quarter to 0.45%, with the balance of the Deposit Insurance Fund rising by $7.7 billion to $33 billion.