Bank consortium R3 CEV, one of the most well-funded blockchain working groups, has been meticulous in developing its framework. For this it it has endured a fair amount of criticism.

Since its inception the technology company has

But what's to doubt? It's just part of the evolution of any technology, according to Steve Wilson, a principal analyst at Constellation Research.

"With every generation of technology we have the tension between standardization and agility," he said. "Standards are a real pain in the butt, they slow you down. They're actually supposed to slow you down because if you want everyone to be doing more or less the same thing, at the same level, then the price you pay is a loss of agility."

Blockchain technology will be most effective if there is a

There lies the problem with the idea of smaller but faster-moving working groups. Goldman and Santander have not spoken publicly about why they left R3 (but reports suggest Goldman was

"They’ve learned enough to go off and do their own thing," he said. "So they're being 'more agile,' but by splitting away they risk developing their own walled gardens."

Last May, as R3 was becoming a household name among bankers, San Francisco-based startup Chain debuted a blockchain protocol it had been

"There’s been a tremendous benefit for standards setting and participation in broad communities," said Jeff Penney, a senior adviser at McKinsey, at an industry gathering hosted by Broadridge Financial in the fall. "But to get to market and build things and get them in production, a smaller leadership group could move more quickly or efficiently than large industry consortia because it would get very focused with firms that are front footed, can make commitments and decisions and provide leadership."

Last April, Santander along with Bank of New York Mellon, Deutsche Bank and UBS, launched Utility Settlement Coin, a blockchain-based clearing and settlement system. In September Santander with five global banks

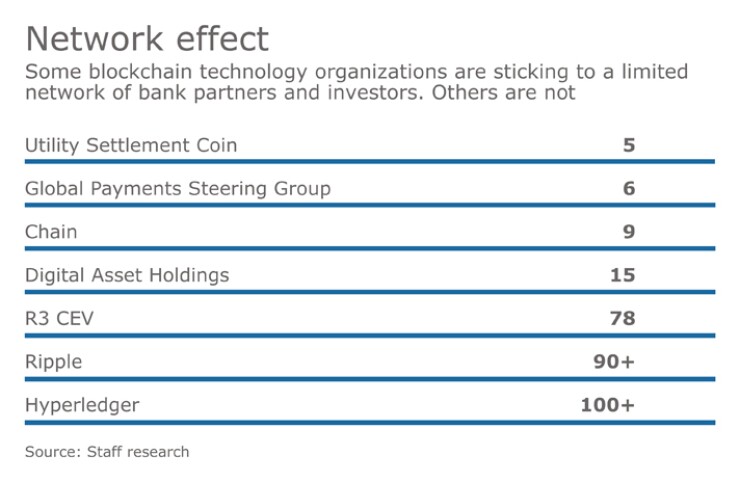

Choosing collaborative groups isn’t an either/or proposition. Some banks work in large and small networks — Citi is an investor in Digital Asset Holdings as well as R3, for example — and have said it's important to do both. Santander's Faura suggested the bank would rather work small now and scale later.

“You're better off getting into a working mode with a few fellow partners that are equally passionate about execution and try for real on a very small scale so you can see what the challenges are," Faura said. "When you get the solutions ready, it’s better to open it up to as many industry groups as possible — both to consortiums and other financial institutions. At that point we’ll know what works and doesn't and be better positioned to propose solutions.”

Faura would not comment on R3's endeavors.

Chris Owen, vice president of TD Bank's blockchain practice, said while it's certainly easier to move faster with, say, two participants than 10 to 15, the correlation between the number of players and the use case isn't nearly as important as looking at the level of complexity of a use case.

"It's the nature of the use case that drives the complexity, which drives the number of players" at the table and more careful consideration of the outcome, he said.

When it comes to external collaboration, Owen likes to look at use cases on a spectrum.

"On the far right, use cases are broad-reaching, global industry processes; they’re complex, there are lots of stakeholders, potentially many geographic jurisdictions to consider, different regulators with different requirements and different politics," he said. One such use case would be trade finance. TD finds industry consortiums like R3 valuable for such applications.

The other end of the spectrum is for more localized activities. TD is exploring the implications of launching a digital currency in Canada with the country's other major banks.

"We can control the audience a little bit more, we don't need an R3 situation," Owen explained. "Instead of 70-plus players… we can restrict that population to five or six parties — not exclusively because it allows us to move faster, more that adding more players is just a distraction because [a Canadian currency project] doesn't affect people outside our local domain."

Owen said TD actually did invite R3 into that exercise, but not to advance the use case. R3 is working with institutions in other geographies looking to do the same kind of work. Engaging R3 allowed TD to learn from the digital currencies discussion in international jurisdictions, he said.

R3's managing director of business development and marketing, Charley Cooper, said that considering the uncertainty about blockchain (

"We launched the consortium in September 2015 and

The presumption that an initiative can build a product fast and establish the ground rules later is more aligned with the technology industry's approach to work but doesn’t really suit the complexity of regulated financial institutions, Cooper added. It's not like the early days of the internet when developers could freely "scramble, roll the dice, be agile."

"We have a set of laws by which we need to operate and if we fail to do that, you can be agile as hell but it won't matter if the regulator tells you to go home because what you do is not acceptable," he said.

Still, blockchain observers and enthusiasts constantly make the comparison to the internet. If you think that comparison is overused and exaggerated, you're partly right, according to Wilson.

"It’s funny when people compare blockchain to TCP/IP," he said. "The early days of internet were dominated by standards bodies… they were standards setters. If we really believe blockchain is going to take over world we need to start to trade off some of that agility."