Want unlimited access to top ideas and insights?

WASHINGTON — Despite facing tougher scenarios, the 18 banks undergoing the Fed’s stress testing program this year easily passed the first examination, known as the Dodd-Frank Act Stress test, posting similar capital losses as in previous years.

The DFAST results, published Friday afternoon, showed banks with an aggregate loss of $410 billion under the Fed’s severely adverse scenario, which was down from $464 billion in losses across those same 18 firms in 2018.

“Aggregate loan losses as a percent of average loan balances in the severely adverse scenario have declined since early stress test exercises, due in large part to improvements in firms’ portfolio quality,” the Fed said in its report of the results. “The loss rates in DFAST 2019 are well in line with loss rates in the 2015-17 stress test exercises.”

That performance came despite the 2019 severely adverse scenario being

This year’s scenario featured a 6-point increase in unemployment, a 50% drop in stock values, a 70% increase in the VIX market volatility index, a 25% drop in home values and a 35% drop in commercial real estate values, as well as severe recessions in the eurozone, the U.K. and Japan.

Federal Reserve Vice Chairman Randal Quarles said the results underline the positive effect that the Fed’s supervisory practices have had on the safety and soundness of the banking sector and its ability to withstand highly volatile economic conditions.

“The results confirm that our financial system remains resilient,” Quarles said. “The nation’s largest banks are significantly stronger than before the crisis and would be well positioned to support the economy even after a severe shock.”

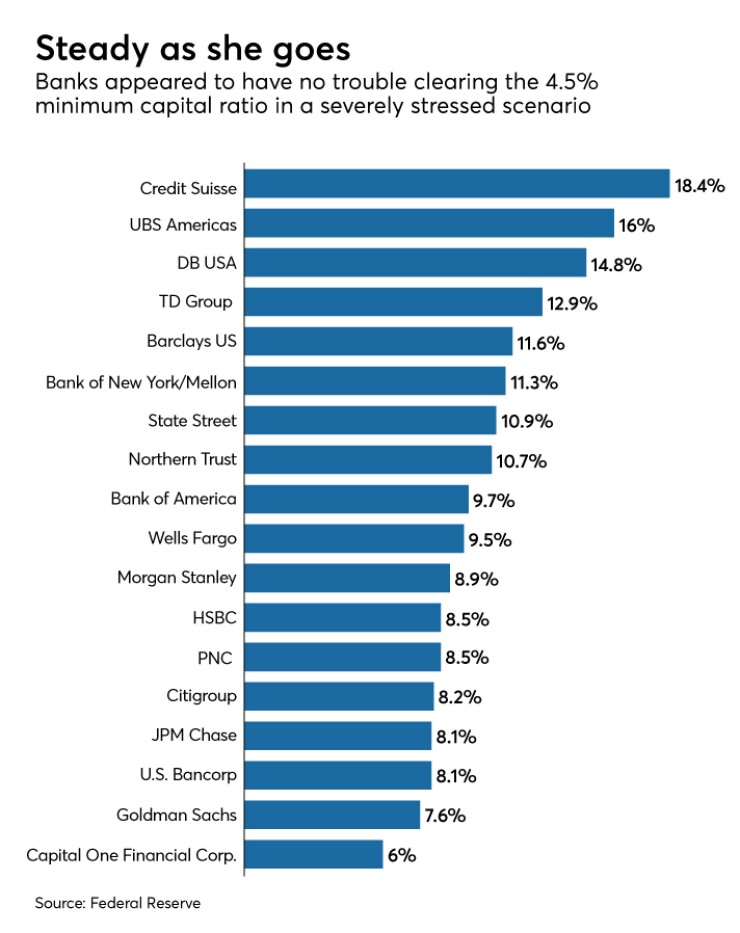

Some banks showed particularly heavy losses, particularly in credit card portfolios, trading and counterparty losses and commercial and industrial loans. Capital One, Barclays US, Goldman Sachs, Citigroup and JPMorgan Chase faced the largest loan losses under the severely adverse scenario, but all of those banks retained post-stress minimum capital levels above regulatory minimums.

The Fed said that it incorporated some adjustments to its stress testing model in this year’s DFAST examination. The Fed adjusted the way it calculates projected defaults and projected losses for auto loans. It also fully phased in changes to the way it estimates credit card losses. Both of those alterations resulted in higher projected losses for banks with auto loan and credit card exposure, the Fed said. The Fed also refined its treatment of corporate loans for which there is incomplete data, adopting a “conservative” model that resulted in a “small decrease in overall losses” over prior iterations of the model.

The Dodd-Frank Act Stress Test started in 2013 and is one of two supervisory stress tests, along with the Comprehensive Capital Analysis and Review stress test, which began in 2011. Both tests determine how a bank’s balance sheet would perform under hypothetical economic conditions over a period of nine consecutive quarters in the future.

While banks cannot “fail” DFAST, regulators watch for whether a bank’s capital levels dip below the required minimums at any point over that nine-quarter period. For example, a bank must maintain a 4.5% minimum Tier 1 common equity ratio under the severely adverse scenario. All 18 banks easily cleared that threshold this year, with Capital One Financial Group the closest to it at 6%. All but two banks, Goldman Sachs and Capital One, were above 8% Tier 1 common equity under that scenario.

But that does not necessarily mean that the CCAR results, due to be released on Thursday, will be the same. The fundamental difference between DFAST and CCAR is that the Dodd-Frank test uses a standard capital management plan, while CCAR runs its models based on the bank’s actual capital management plan. As a result, a bank could clear the thresholds under DFAST, but might encounter trouble in CCAR if its capital distributions were too aggressive.

If a bank falls below the regulatory minimum capital requirements under CCAR, the Fed may ask a bank to modify its capital management plan or require the bank to restrict dividend payments until it no longer falls below the regulatory minimum. The Fed can also issue a qualitative objection to a bank’s internal processes or models if it believes the bank’s internal risk controls are inadequate or their models insufficiently accurate.

But the Fed has been tinkering with the stress testing regime over the last several years, gradually