For a hot second in 1908, Fifth Third Bank existed as Third-Fifth.

The 166-year-old financial institution was born out of a merger between Third National and Fifth National, two Cincinnati banks. The numbers in the name were reversed after two days so Fifth National got top billing. In the midst of the Prohibition era, "there is a legend that we were not named Third-Fifth because it was too close to three-fifths of whiskey," said Amy Purcell, corporate storyteller and historian at Fifth Third. But that is not true. Most likely, the president of Fifth National won out because his bank had more capital.

No matter the order in which Fifth and Third appear, the name still sounds like a mathematical fraction that makes no sense. But the $214 billion-asset institution has decided, over its 16 decades of existence, to "embrace the quirk," Chief Marketing Officer Melissa Stevens said.

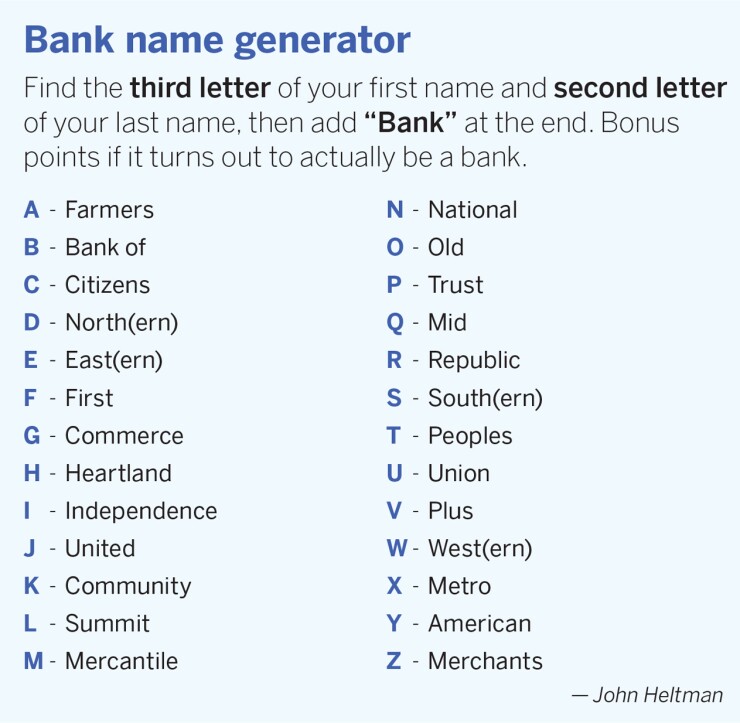

In a sea of bank names that blend together — "First Bank of X," "Community Bank of Y" — a memorable moniker is something to marvel at. Some terminology is particularly popular.

There are about 700 banks in the U.S. with "first" or "1st" in their name and more than 200 with some combination of "first national," according to data from the Federal Deposit Insurance Corp. "Citizens" appears in 166 designations. Sometimes all three appear at once, as is the case with Citizens 1st National and First Citizens National.

The word "community" is woven into 247 bank titles, whereas 173 contain the word "Farmers," 63 of which also include "Merchants." Thirty-five banks feature "union," with six Union Banks (seven if you count The Union Bank), another eight Union State Banks, the alliterative United Bank of Union, and, of course, a Farmers & Merchants Union Bank.

Even more niche names cannot escape this fate. For instance, Five Star Bank in Warsaw, New York, is not to be confused with Five Star Bank in Roseville, California, nor is it to be confused with 5Star Bank in Colorado Springs, Colorado.

The reason that so many First Nationals exist dates back to the 1860s. But today, how much does sharing a generic designation matter?

For FirstBank in Lakewood, Colorado, the answer is not much.

The $28 billion-asset bank started its life as First Westland National Bank in 1963, when it opened inside the newly built Westland Shopping Center in Lakewood, Colorado. It was renamed FirstBank in 1978 as it expanded geographically.

Dave Fisher, president of marketing at FirstBank, acknowledges that customers and even reporters have contacted the bank with questions that were clearly intended for another institution. It sometimes fields Consumer Financial Protection Bureau complaints that were meant for another entity.

Still, these mix-ups have been "a rare and relatively easy problem to solve," Fisher said.

For other banks, it matters a lot. In May 2023, Pacific West Bank in Portland, Oregon, published a jittery press release and placed a banner on its homepage emphasizing that it was not the similarly named Pacific Western Bank, or PacWest Bancorp, in California. This was an important distinction because PacWest had lost billions of dollars of deposits in the first few months of that year and was teetering on the verge of collapse before its sale to Banc of California in July.

Thomas Geisel, CEO of Republic First Bank in Philadelphia, made a similar plea on the institution's website in April 2023 that it was not to be confused with First Republic, the San Francisco bank that would

There are less drastic reasons to ache for a change. A sleek name can boost online search results and stand out in the minds of prospective customers, including those who gravitate to neobanks with catchy labels like Chime and Current. Sometimes it aligns with what people are already calling it colloquially. More universal branding makes sense when a bank is expanding beyond the county it was founded in that still designates its name. Legal disputes can erupt when one bank encroaches into the territory of another with a similar moniker.

Banks make a lot of decisions out of fear that they will be the administration that tanks the bank, that crashes this 150-year-old ship on the rocks, even when competitive factors indicate it's time to change.

But the ordeal of changing a name is daunting. Even when employees buy in, there is the question of whether to pursue a trademark and refresh the logo simultaneously. Every branch sign, brochure, deposit slip and individually wrapped mint bearing the old title must be scrapped and started over. "On how many Little League fields do you have signs?" said Alex Cook, president and CEO of a community bank in Middlesboro, Kentucky, that swapped out its original Home Federal name for Hearthside in 2021.

Josh Mabus, president of the bank marketing firm Mabus Agency, estimates a cost of $10,000 to $100,000 to transform each branch with new signage and collateral.

"You have to be in the capital position to afford it," Mabus said. "But can you afford not to?"

People, places and concepts

Bank names stem from a variety of sources. Some institutions are named for places: Bank of America. U.S. Bank. Citi, whose original name was City Bank of New York. Bank of the West, the San Francisco-based subsidiary of French institution BNP Paribas, was acquired by the Toronto-based BMO Financial Group in 2023 (a brand name of BMO, which stands for Bank of Montreal). But there is still a Bank of the West in Texas, The Bank of the West in Oklahoma and a Bankers' Bank of the West in Colorado.

Others are named for people: JPMorgan Chase. Wells Fargo. Goldman Sachs. Still others are a blend of the two, such as BNY Mellon, or Bank of New York Mellon — but even this bank, the oldest in the country, just underwent a rebrand.

Others signify industries, such as Manufacturers and Traders Trust Company, or M&T Bank. They may evoke concepts: Citizens, Union, Liberty. Freedman's Bank was chartered in 1865 to service newly freed African American slaves.

Facebook paid MetaBank $60 million to change its name after the social media giant transitioned to Meta Platforms in 2021. MetaBank chose Pathward because it connoted a "path forward" for people in their financial journeys.

During the Civil War, the rules around bank names were briefly much stricter, with two national banking laws that governed how banks could label themselves. Before the National Currency Act of 1863 launched the national banking system, nearly all institutions were chartered by states or founded by private bankers, according to Richard Sylla, professor emeritus of economics at New York University Stern School of Business.

The act mandated that the first bank to obtain a charter in a given city would be called the "first national bank" of that city, followed by the second, the third and so on.

"The law was draconian in the sense of naming," said Sylla, because old state banks would have had to change their names if they adopted national charters. "They rebelled against this."

To settle the issue, the 1863 law was amended in the National Banking Act of 1864 to allow state banks to keep their names and add "N.A." for "National Association" to the end. These acts created the Office of the Comptroller of the Currency to charter and regulate national banks, and made it a part of the Treasury Department.

Few restrictions exist today. A national bank must use the word "national" in its corporate title, per the OCC. Federal savings associations do not have such requirements.

Some banks have since chosen to streamline their names. First National Bank of Omaha traded its state charter for a national designation in 1863, becoming the first nationally chartered bank located in Omaha. It rebranded to the pithier acronym FNBO in 2019. (FNBO is its trade and "go-to-market" name; First National Bank of Omaha remains the charter name and legal designation.)

The $31 billion-asset bank wanted to boost search results online and become more easily noticed, especially by the next generation of customers.

"If a customer can find and differentiate us, they will reward us with higher click-through rates and traffic to our website," said Tammy Williams, managing director of brand promotion, creative and advertising at FNBO.

The migration to FNBO lasted from 2019 to 2022. It meant updating nearly 100 branches and consolidating 11 web domains in different markets down to one: fnbo.com.

The transition has boosted organic search and meant less competition and lower prices for branded keywords in paid search campaigns, because other banks are not bidding on the term FNBO. Two years after the rebrand, it is seeing more people search for "FNBO" than "First National Bank of Omaha."

If a customer can find and differentiate us, they will reward us with higher click-through rates and traffic to our website.

Others choose to start from scratch. There were about 100 banks with "Home Federal" in the name when Home Federal Bank in Middlesboro was rebranding.

"In a digital world, we wanted to stand out," Cook said. "We don't share cultures or values with other banks and we wanted our name to reflect that."

The $520 million-asset community institution recruited Mabus Agency and a law firm to navigate the transition, which meant not only a new name but also one it could trademark. They considered hundreds of possibilities, with names that spoke to their values, their history and their mountainous region in Southeastern Kentucky and Northeastern Tennessee.

"There were some we liked but we couldn't get past the federal trademark piece," Cook said. "There were others we liked but we didn't believe they had the same meaning."

They eventually settled on the concept of the hearth. Most of the bank's branches feature a stone fireplace that is surrounded by cozy armchairs and abstract art. The new branding launched in 2021.

"We believe that a lot of good memories happen gathered around a hearth," Cook said.

Trademark disputes lurk behind some bank name changes seen by Andy Spillane, an attorney at law firm Godfrey & Kahn. Hearthside, before it changed its name from Home Federal, faced legal pressure of its own when Home Federal Bank of Tennessee filed a complaint against it in 2018. The Tennessee-based bank alleged unauthorized use of its "word" and "design" marks, which caused confusion among consumers.

The matter was eventually resolved in October 2020, and both banks declined to comment about the litigation for this article.

"It's not uncommon to see banks chartered for 80 to 100 years," Spillane said. When one institution enters the geographic space occupied by another with a similar name, the feeling can be, "we've been operating in this market for decades under this name," he said. "You're new here. We can enforce our trademark against you."

Sometimes the banks negotiate an agreement where the new entrant will operate a regional division under a different trade name but retain its legal charter designation. Or it may change its legal name entirely, as operating under multiple titles could lead to confusion among customers.

More often than not, Spillane sees banks choose the second approach. "If you want to expand your reach beyond the immediate orbit of your home office, there is justification for a name that suggests we are servicing a broader region," he said.

Sometimes a tweak formalizes what people were already saying in their heads.

In June, BNY Mellon announced that it was whittling its company umbrella brand down to BNY. The decision took nine months to make and involved multiple rounds of market research, employee focus groups and defining BNY's position as a global financial services company.

"BNY allows us to fully represent all that we do," said Natalie Sunderland, global head of marketing and communications. "We are more than just a custodian."

The bank observed that companies both inside and outside the financial services industry were shifting to shorter, punchier names, such as Ernst & Young becoming EY. As banking and other activities move to digital channels, there is less physical space — on smartphones, on Instagram — to denote a name.

In the end, BNY's strategy was to simplify.

"Our clients tell us they already refer to us as BNY," Sunderland said.

The full rollout will take an estimated 12 months, between tasks as massive as replacing more than 1,000 pieces of signage in more than 100 offices around the world to ones as subtle as modifying the image of the corporate credit card that BNY employees select when ordering an Uber.

Other banks decide not to fix what isn't broken. FirstBank has considered changing its name to something more unique from time to time. But brand equity, reputation and name recognition test well with current and prospective customers in priority trade markets, "to the point where a rebrand felt unnecessary," said Fisher, the bank's president of marketing.

The time-consuming nature of concocting a fresh identity and rolling it out across hundreds of channels, partners and locations also deters him.

"Rebranding is not for the faint of heart," he said.

One day, it might be worth it. "But for now, we love being a 'first bank,'" he said.

'Like playing not to lose'

Even when a closely held, family-owned community bank understands the benefits of a refresh, Mabus finds it can be hard for them to truly pull the trigger. Sentimental attachment runs deep.

"Their association is with sitting on grandad's lap when he was running the bank or opening their first account," said Mabus, the president of the marketing agency.

They also worry that customers will leave.

"Banks make a lot of decisions out of fear that they will be the administration that tanks the bank, that crashes this 150-year-old ship on the rocks, even when competitive factors indicate it's time to change," Mabus said.

But in his view, "not changing your name to keep existing customers is like playing not to lose."

To ensure that all goes smoothly, he advises that banks start by getting buy-in from management and the executive team. They should spread the brand story to employees, because they will be the ones relaying it to customers, and then send a letter to existing customers explaining the change.

In a digital world, we wanted to stand out. We don't share cultures or values with other banks and we wanted our name to reflect that.

One selling point that Mabus sees a lot of banks hold onto — one, in fact, that was emphasized by several of the banks interviewed for this article — is their longevity, or how many years they have been around.

"It matters zero to consumers," Mabus said. "Your people don't care that you've survived world wars. They care about right now."

Embracing the quirk

People have been fascinated by the Fifth Third name basically since its founding. The name Fifth-Third National persisted from 1908 until a merger with Union Savings Bank & Trust, completed in 1927, modified it again to Fifth Third Union Trust Company. The title was officially shortened to Fifth Third Bank in 1969.

Everyone was calling the bank Fifth Third anyway, Purcell said.

Interest in the unique name usually increased as the company moved outside of its Hamilton County market, Purcell said. In its home market of Cincinnati, the moniker usually didn't raise an eyebrow.

In a 2003 article in The Tennessean, former Fifth Third executive Todd Clossin noted, "Once people hear the name, they tend not to forget it."

Fifth Third started capitalizing on this curiosity more intentionally in 2017 with a brand campaign it has continued to this day: the idea of banking a "Fifth Third" better, which it calculated by dividing five by three and converting the result to a percentage.

"We don't just give it 110%, we give it 166.7%, because that's a 'fifth third' better," Stevens said.

Banking a fifth-third better can be applied to free checking or receiving a paycheck two days early, but the bank is careful not to apply the tagline too liberally.

"If you answer the phone in the operations center and the person is talking about a serious issue with their financials, they are not necessarily looking for a fifth third better," Stevens said.

Since it started these campaigns, Fifth Third has seen improvements to marketing measures such as effective recall or the ability of consumers to recall the name of the bank from an ad and brand linkage, or the likelihood of connecting the bank to its tagline.

"The name can matter a lot if you put meaning behind it," Stevens said. "The name has to come to life."