Banks spend a lot of time thinking not only about

This is especially true of young

Though banks might be hard-pressed to offer similar wages — average starting salaries at Uber, Pinterest and Airbnb are all over $220,000, according to Paysa — they can offer something most tech companies don’t: a student loan repayment benefit plan.

It may not be enough to sway every potential hire, but more and more banks say it's a perk they need to offer if they hope to compete for in-demand tech talent.

“Maybe they can’t pay as much as a starter role in a software firm, but for many people coming out of college with student debt, this kind of benefit can make up for that,” said Christine Pratt, senior analyst with Aite Group.

Some banks are starting to pay notice; Gradifi, a provider of student loan repayment solutions, is a subsidiary of San Francisco-based First Republic Bank. First Republic acquired Gradifi in late 2016 after seeing the success of offering it to its own employees.

“We initially were a partner with First Republic, and they had hundreds of employees sign up within the first 24 hours it was offered,” said Meera Oliva, Gradifi's chief marketing officer. “There’s a lot of research that shows younger professionals with student debt overwhelmingly want this benefit.”

Banks that offer it can get ahead of the game, she added, noting that only a small percentage of U.S. employers currently offer such a benefit. That makes it a bit of a double-edged sword, because many banks might want to wait until they see more concrete results of offering these benefits before doing so themselves.

“In general, it is so new and very few companies have been offering this long enough to put your finger on exact data points,” said Oliva. “But forward-thinking banks are looking at providing these benefits.”

Like a 401(k), benefits of such savings plans vary by employer. MidWestOne Bank in Iowa City, which operates 44 branches across Iowa, Colorado, Minnesota, Wisconsin and Florida, is matching up to $75 a month for employees with five years or less of tenure, and $100 a month for those over five years, with a lifetime cap of $10,000.

MidWestOne is working with startup Tuition.io, a student loan repayment firm that also features Mint.com-like digital monitoring tools for enrollees to keep track of the debt they are paying down.

According to the bank’s president and CEO Charles Funk, it decided to offer Tuition.io to its employees after seeing a demo at an American Bankers Association conference. MidWestOne isn’t using the service to recruit any specific type of employee, such as tech, but combined with its workplace culture believes makes for an attractive work destination for millennials, said Funk.

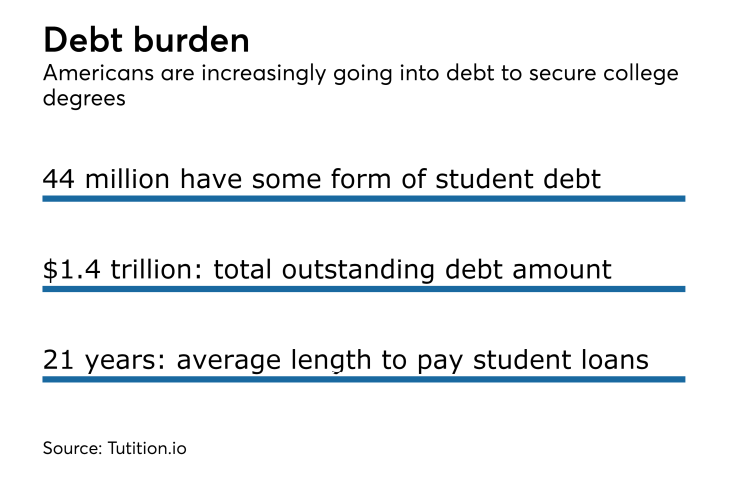

“We always lead with our culture, but anytime you are trying to attract people to come work for you the menu of benefits options you have is important,” said Funk. “I just thought from the start this was a good idea; student debt is a big issue in our society. Increasingly, millennials are coming into the workforce with a lot of student debt, and I think once they see what effect this kind of benefit has it probably helps with retention as well.”

Since offering the benefit in May of last year, Funk said, a little more than 100 of the bank’s 640 full-time employees have signed up.

“It’s so new so we don’t have much data, but we estimate from the start in May through the end of October we have saved our participants a cumulative 53 years in terms of shortening loans,” he added. “And that’s just in that short time; you multiply that by three or four years and that’s a lot of discretionary income freed up.”

According to Scott Thompson, CEO of Tuition.io, companies that begin offering their service usually get about 30% of their workforce to sign up almost immediately. “It’s a benefit that directly affects [the employee] and that’s why I think you are starting to see it catch on,” he said.

For millennials, an employer-matched student loan repayment benefit is often more important to them than an employer-matched retirement program, such as the venerable 401(k), Pratt said.

“It used to be when you’re looking for a job, things like health insurance and retirement plans might distinguish one office from another,” she said. “Now, a lot of millennials might be staying on their parents' insurance until they’re 26, and they’re not really thinking about retirement right now.”

Such benefits may be able to help banks recruit the best tech talent from other industries, Pratt said.

“Many banks have a rough time attracting millennials as customers, much less as employees," she said. "But this is a benefit that appeals [to millennials] as something that affects them right at this moment.”

It's an offering that also speaks to the stability of a career with a bank, Oliva said.

“Tech startups are flush with benefits, but they may not be the most meaningful: things like free beer, snacks and pingpong tables,” she said “That’s all good, but it doesn’t have the impact on your life like paying down a student loan. Banks have an opportunity to be a differentiator because this benefit hasn’t really caught on yet in the tech industry.”