-

Overdraft elephants are hiding in plain sight in bank and credit union boardrooms. No one admits seeing them. No one talks about them. The less said the better.

November 9 -

The entire banking industry has lost revenue as a result of the changes in overdraft rules, but the development is probably hurting community banks the most, analysts said.

June 24 -

Banks have long argued that processing debit card transactions by starting with the largest dollar balances and working their way to the smallest benefited customers. Here's an alternate explanation of what might have motivated them: "Multiple Millions $$$$$$$$$$$$$$$$$$$$."

September 26

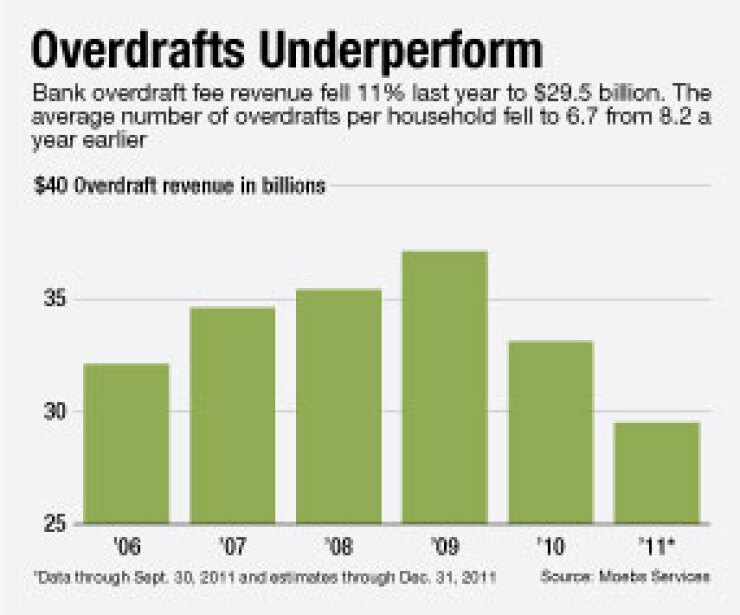

Banks lost billions of dollars in overdraft revenue last year, even as they passed on higher fees to consumers, according to a study by Moebs Services Inc.

Overdraft revenue fell by $3.6 billion to $29.5 billion in 2011, while the median fee customers paid per overdraft rose a record $2.50 to $30 in the same time period, according to the analysis released last week.

Now banks are trying to make up some of the revenue they have lost by raising the prices for customers who do elect for overdraft protection programs.

"Every banker we talked to said, 'We increased the price to reflect the increased cost of regulation on overdrafts,'" says Michael Moebs, chief executive of Moebs Services, whose firm spoke with over 100 bankers as part of the survey.

But the number of overdrafts per household is also falling, offsetting the fee increases banks have been imposing.

In 2011 households averaged 6.7 overdrafts per year, down from 8.2 overdrafts in 2010 and 9.8 in 2009, according to Moebs' data.

Moebs argues that community banks and credit unions are missing out on an opportunity to bring in more customers by not lowering the fees they charge for overdrafts.

"If the banker would look at this from a price and a volume basis, I think what they will see is they could make more money here and service their customer better, at least those who frequently use overdrafts, if the banker would concentrate on volume and lower the price," he says.

He adds the opportunity is especially ripe for community banks now that the Consumer Financial Protection Bureau

Banks can learn from payday lenders' streamlined lending approach, says Moebs.

"The thing that I've admired about that industry is it's extremely efficient. They would make a banker's head spin with how fast they can make a loan and how good they are at it," he says.

Payday lenders "take ten minutes to make a payday loan and the banker takes an hour," he adds.