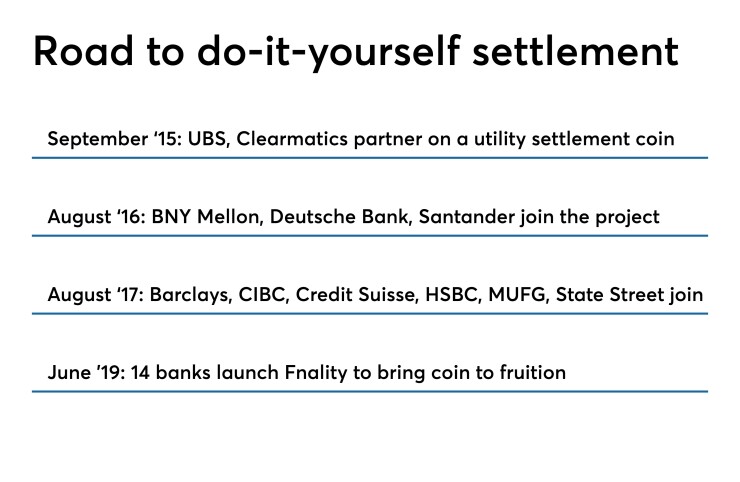

A group of banks including State Street, Bank of New York Mellon, UBS, Credit Suisse, Banco Santander, Barclays and Canadian Imperial Bank of Commerce have formed a new company called Fnality — and raised $63 million for it — in a bid to fulfill their vision of a utility settlement coin.

What is a utility settlement coin? It's a bitcoin-like token that banks could use to settle transactions with one another over a distributed ledger without having to go through a third party. The utility settlement coin would be fully collateralized by a fiat currency held at a central bank. So far the project supports five currencies: the U.S. dollar, the British pound, the euro, the Canadian dollar, and the Japanese yen. Settlement would be handled automatically using smart contracts, following local laws and regulations.

Banks could use this system to settle balances with one another, to handle cross-border payments, to deal with large corporate deposits, or for other purposes. If it works like it is supposed to, it could mean greater efficiency, a better way to manage liquidity, and reduced settlement, counterparty and market risk.

“We’ve always viewed this as a strategic pillar in our blockchain strategy,” said Emmanuel Aidoo, head of digital market assets at Credit Suisse.

Cross-border payments were the use most discussed this week in connection with Fnality's launch. This may be partly due to the impact of Ripple, which has signed up some banks for its cross-border payments software and has attracted a great deal of media attention for the success of its XRP digital currency. Also, a lot of attention has been focused lately on the possibility that blockchain technology could offer a lower-cost, faster alternative to traditional cross-border payments.

Part of the thicket in the current system involves banks' use of so-called nostro (from the Latin for "our") accounts with each other to reconcile cross-border payments. "Many institutions have multiple nostro accounts, and balances in all those nostros,” said Rhomaios Ram, CEO of Fnality. “Instead of that, they could pool their money, and speed up use of that liquidity.”

Another reason for the focus on cross-border payments is that success seems more within reach than other potential applications of the technology, Aidoo says.

“The use cases that are more complex, will take more time, and involve multiple jurisdictions, they will take more time to reach fruition,” he said.

That said, many other uses for utility settlement coin are planned.

“Investors have been seeing a move toward tokenized models, driven by the cost of operations, compliance and risk,” Ram said. “There’s all kinds of projects in different stages of development, all moving toward tokenizing the underlying assets and being able to settle them.”

The participants hope to have their utility settlement coin go live in a jurisdiction in 12 months, Ram said. But the project has to go through a regulatory process, and because this has never been done before, there is no regulatory process yet.

The technology

The blockchain research and development firm Clearmatics has been building the technology that underlies the utility settlement coin project. Its architecture is similar to the Ethereum blockchain, according to CEO Robert Sams. He worked on the Ethereum project in its early days.

“The protocol is interoperable with the Ethereum ecosystem even though the system is not involved with the Ethereum public chain,” he said.

Clearmatics takes a protocols-based approach, he said. Other companies could use the protocols his company creates and develop their own software for it.

“Over time, we want to build an ecosystem involving the Ethereum community, academia and other fintechs, with multiple teams implementing the protocol, and independently developing systems that use it” Sams said.

That way, monopolies are less likely to form, he said. And having many different software platforms written on one protocol could allow for interoperability and redundancy that lessens the risk of a breakdown.

“I think regulators will mandate that having mission-critical infrastructure on a single code base is not something that is sustainable long term,” Sams said. “That’s one of the things we’re looking to solve.”

Transparency with anonymity

A challenge that Ripple, Swift, Fnality and any company helping banks implement blockchain-style technology all need to deal with is the fact that banks do not want their competitors to see their transaction flows or their balances. So any shared ledger they are going to agree to use has to be designed to preserve the privacy of transaction amounts and balances.

“One thing we spent time with Clearmatics on is using their network and technology to put information on a network so there’s no ability for anyone maliciously or unintentionally to view traffic or amounts or payment information that is deemed private,” Aidoo said. “That was one of the achievements in this last phase of utility settlement coin.”

A type of smart contract that runs on Ethereum, called Mobius, protects transactions on a network using cryptographic devices such as ring signatures and stealth addresses. This could be used to mask the value of transactions on the Fnality ledger.

Another focus for Aidoo and the other bankers in the group has been establishing that transactions on this blockchain network are final — hence the name Fnality.

“One of the most key characteristics we worked on over the last year and a half in this phase was to ensure that value transfer on this network was deemed final and we could get banks and central bankers comfortable that transfer had occurred and that it would be considered to be final,” Aidoo said. “As you can imagine, settlement finality is a big deal.”

Editor at Large Penny Crosman welcomes feedback at