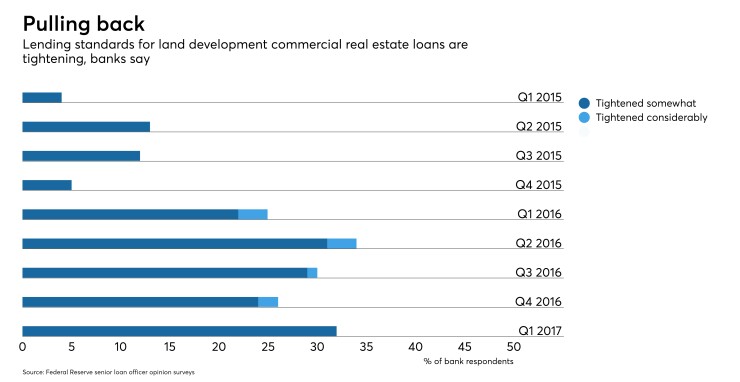

WASHINGTON — Banks are increasingly tightening lending standards for commercial real estate loans and are likewise seeing a drop-off in demand, according to a report released Monday by the Federal Reserve Board.

The quarterly

“In doing so, banks cited a less favorable or more uncertain outlook for CRE property prices, capitalization rates, and vacancy rates or other fundamentals as their most important factors,” the report said. “Participants also cited a reduced tolerance for risk as an important reason for tightening CRE credit policies.”

The CRE findings were part of special questions asked in the survey. They examined three subcategories of CRE lending: construction and land development loans, loans secured nonfarm residential properties and loans secured by multifamily residential properties.

Of the banks surveyed, more than 40% said they had widened the spreads of land development loans over the last year. That trend was even more acute among large banks, with more than half of respondents saying their land development loans cost more than they did a year ago. The survey said that 20% of banks indicated the loan-to-value ratios had decreased over the past year, suggesting the properties leveraged as collateral are decreasing in value.

The same trend holds true for nonfarm residential and multifamily residential CRE loans as well, with roughly 32% of respondents seeing widening spreads for nonfarm residential secured loans and roughly 45% seeing wider spreads for multifamily residential secured loans. Other indicators of lender trepidation — such as maximum loan size, maximum loan maturity and size of market areas served — indicated general tightening, but were more likely to be unchanged.

Other lending categories have not generated the same level of skepticism from bankers, the survey said. The terms for various categories of commercial and Industrial lending have remained unchanged or even eased somewhat in the first quarter of 2017, the survey said, and demand and terms for most kinds of residential mortgages appears similarly unchanged. The demand for revolving home equity lines of credit appears to have increased somewhat, and banks seem moderately more willing to approve credit cards.

Auto loan demand appears to have dropped since the beginning of the year, with about 15% of respondents saying they have seen weaker demand for auto loans and about 10% of respondents saying they are tightening lending standards on auto loans.