Want unlimited access to top ideas and insights?

The consumer credit card business is so top-heavy — five large banks have roughly 70% market share — that competing head-on can be daunting.

So in recent years, numerous midsize banks have made an end-around, convincing plastic-wielding Americans to refinance their existing debt at a lower interest rate. Taking a page from fintechs' playbook, these banks have launched online platforms that allow personal loans to consumers from coast to coast.

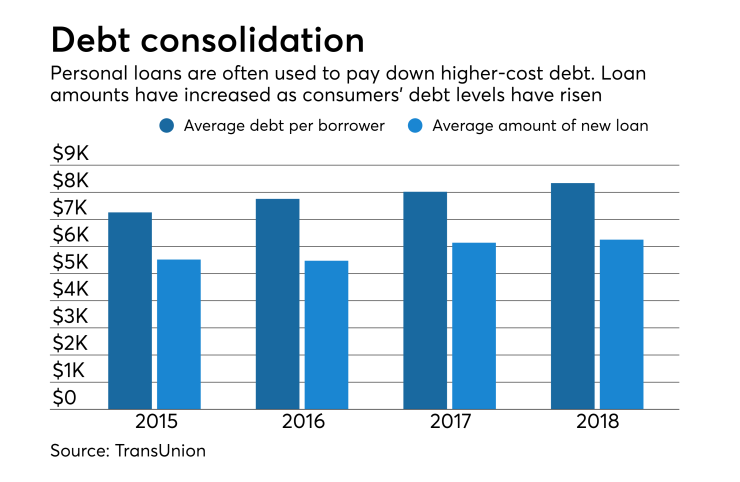

But as more and more banks adopt this strategy, the risks are building. Total personal loan balances reached $132 billion in the third quarter, a 59% increase in just three years, according to TransUnion. And evidence suggests that many borrowers are using the loans to fuel additional consumption, rather than to pay down existing debt.

For now, the U.S. unemployment rate remains low, and industrywide losses on personal loans are manageable. But more of these loans are expected to go bad when the economy inevitably weakens.

Banks maintain that they are lending to customers with solid credit scores, in contrast with online lenders that take bigger risks. Still, unsecured installment loans to prime borrowers have a limited track record.

“We don’t really know how these loans will operate in a recession,” said Todd Baker, a senior fellow at the Richman Center at Columbia University.

The personal loan business was once mainly the province of companies that targeted subprime borrowers, and in the immediate aftermath of the financial crisis, the market was left for dead. But online lenders such as LendingClub, Avant and Prosper Marketplace quickly stepped into the void.

For borrowers, applying for loans from these upstarts was fast and easy, particularly in comparison with home equity loans available at banks. For the issuers, personal loans offered both strong margins and a relatively straightforward way to gain a toehold in the consumer finance business.

One of the first banks to take notice was SunTrust Banks. In 2013, the Atlanta-based bank, which operates branches mostly in the Southeast, launched an online lending platform, LightStream, designed for consumers with good to excellent credit.

Since then, SunTrust has made more than $7.5 billion in loans on its LightStream platform. It offers loans for a range of goods and services — from recreational equipment to medical procedures to adoptions — and funds those loans with low-cost deposits, an advantage that other banks are also leveraging as they seek to compete with online lenders.

“It’s not surprising that other banks are now thinking: How do we copy the success that SunTrust has had?” said Todd Nelson, a senior vice president at LightStream. “Most lending businesses at the end of the day are scale businesses, and banks are good at building scale.”

Birmingham, Ala.-based BBVA Compass started offering its Express Personal Loan to noncustomers earlier this year. Borrowers may qualify for up to $35,000, repayable over as many as six years, and can receive the cash in less than 24 hours.

“The general population is fairly savvy with digital products,” Shayan Khwaja, executive director of consumer lending at BBVA Compass,

Goldman Sachs, the Wall Street giant that is now making a play for Main Street customers, has been offering online personal loans under the Marcus brand since 2016. Loans of up to $40,000 carry annual percentage rates of between 6.99% and 24.99%.

Lloyd Blankfein, who retired as Goldman’s CEO in September, has indicated that the bank sees an opportunity to shave away some of the profits enjoyed by large card issuers. “Traditional banks in this space don’t have much of an incentive to refinance credit card balances,” he

As banks become more active players in personal lending, loan volume is surging. As of Sept. 30, there were 20.3 million personal loans outstanding at banks, credit unions and nonbank lenders, up from 17.5 million in the same quarter last year and 14.3 million three years earlier.

Banks with their eyes on the U.S. personal loan market include HSBC, Barclays and Citizens Financial.

HSBC’s U.S. bank announced in October that it plans to make its new online loan platform available to consumers in the first half of next year.

Pablo Sanchez, who heads HSBC’s retail banking business in the U.S. and Canada, said in an interview that personal loans have enjoyed a compound annual growth rate of 23% over the last four years. “And quite frankly, we don’t see that slowing,” he added.

Rising interest rates may boost the demand for personal loans, since credit card users who are paying more to borrow have an incentive to consolidate their debt at a lower rate.

Consumers who are paying 18% on their credit cards may be able to reduce their interest rate to 10% or 11% with a personal loan,

Lenders often ask borrowers how they plan to use a personal loan, but they are typically have no way of knowing how the funds are actually spent. Instead of paying off their credit cards, some consumers use them to pay for home improvements, to buy a car or a boat, or to pay for a wedding. And there are signs that despite its rapid growth, the personal loan market is not chipping away at credit card balances.

Revolving consumer credit hit an all-time high of $1.04 trillion in August, according to the Federal Reserve Board.

What’s more,

“Overall, these findings suggest that fintech lenders enable households with a particular desire for immediate consumption to finance their expenses and borrow beyond their means,” the study’s authors wrote.

As new entrants continue to stream into the market, Discover Financial Services, a longtime issuer of personal loans,

“There’s definitely risk,” said Nick Clements, a former card industry executive, adding that some banks will prove to be much better than others at managing that risk.

Clements, who co-founded the loan-shopping site MagnifyMoney, said that banks offering personal loans need to build collections operations that are large enough to handle higher call volumes when the next downturn hits. He also said that banks need to be wary of extending too much credit to heavy users.

“We’re taking a very considered, prudent approach,” said Ben Harvey, the head of consumer lending for Barclays U.S., which started making personal loans on an invitation-only basis in 2016, and recently opened its doors to more customers. “We’re not changing our credit appetite.”

A recent survey by LightStream found that 15% of U.S. adults have a personal loan. By comparison, 43% of those surveyed had credit card debt, 32% had a mortgage, and 16% had student loans.

“As far as the size of the market and the potential,” said Jason Laky, a senior vice president at TransUnion, “there’s a tremendous amount of room for personal loans to grow.”