The proposed merger of South State and CenterState Bank presents more evidence that small regional banks are looking for ways to build scale, expand their geographic reach and free up funds to invest in digital channels.

Large-scale M&A, including the

A substantially larger balance sheet and cost-cutting plans should help the combined company become more efficient. It should also be able to spread tech investments across a broader base, allowing the bank to compete more effectively with companies such as Bank of America that have gotten strong digital traction.

“Clearly, digital is the future,” John Corbett, CenterState’s president and CEO, said during a conference call to discuss the deal.

The companies decided to finalize a deal “before the opportunity passed us by,” added Corbett, who will retain his title at the company, which will use the South State name but keep CenterState’s headquarters in Winter Haven, Fla. Robert Hill, South State’s CEO, will become executive chairman.

Industry observers agreed that digital channels are critical to the success of most, if not all, banks.

“This is a cutthroat business as it is, and now, more and more, you have to invest in the digital and mobile services that people expect,” said Kevin Fitzsimmons, an analyst at D.A. Davidson. “I think they made it very clear that digital is huge.”

South State will have $24 billion in loans and $26 billion in assets, roughly doubling the current size of each company. South State said it will become the eighth-biggest bank in the Southeast, coveted territory due to the region’s economic vibrancy and population growth in key markets.

The bank will operate in many of those markets, including Atlanta; Charlotte, N.C.; Charleston, S.C.; and the Florida cities of Miami, Orlando and Tampa.

Executives noted during the call that they had been in talks, on and off, for two years.

CenterState has been an aggressive acquirer, announcing four bank deals in the last three years, including the

While South State is the legal acquirer, CenterState’s shareholders will own the majority of the company’s shares. The management team and board will be evenly divided. The companies pledged to keep an operational center in Columbia, S.C., where South State is based.

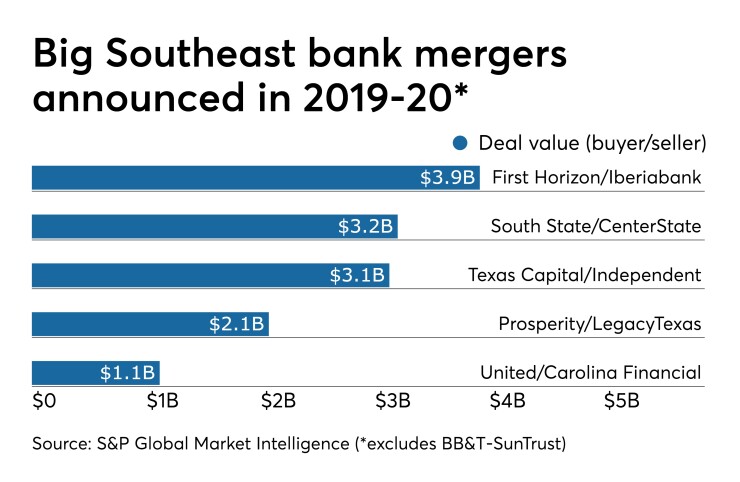

The deal follows several other large mergers of similar-sized banks, including the combinations of BB&T and SunTrust, which created Truist Financial, and TCF Financial and Chemical Financial. The First Horizon-Iberiabank and Texas Capital-Independent Bank Group mergers are still pending.

Industry experts said more deals like those could be coming.

“We’ve been hearing lots about other possible combinations,” Fitzsimmons said. “And now you would think even more boards would have to at least have conversations about this.”

The CenterState-South State deal is expected to be 20% accretive to the company’s earnings per share. The plan is to cut $80 million in annual noninterest expenses, or roughly a tenth of operating costs.

Adding scale and upgrading technology could help the company attract more talent over time, said Charles Wendel, president of Financial Institutions Consulting. He said bankers know that their long-term success depends on them being able to work at companies with the strong digital capabilities that clients increasingly demand.

A lack of significant overlap should also help South State and CenterState retain the people they already have.

“The bankers stay on, disruption is limited, and customers aren’t affected in a negative way,” Wendel said.