-

Lenders are lowering rates and stretching out loan terms to win business, and that combination could spell trouble when interest rates rise.

February 28 -

Texas Capital Bancshares (TCBI) relied on loan growth and fee income to offset pressure on its net interest margin during the third quarter.

October 25 -

Don't think of this business as residential lending. It's really a low-risk form of asset-based lending.

May 1 -

As they struggle to find new revenue sources, some community banks have latched on to a business line that once was the domain of big banks — mortgage warehouse lending. Community banker said they like the business due to a lower risk profile and because it's a natural fit with past experience in residential real-estate lending.

October 27

When does a warehouse loan become a loan, and who owns it?

If regulators get their way in the answers to those fundamental questions, dozens of community banks would have to set aside twice as much capital as they do now for the warehouse lines of credit they extend to nonbank mortgage lenders.

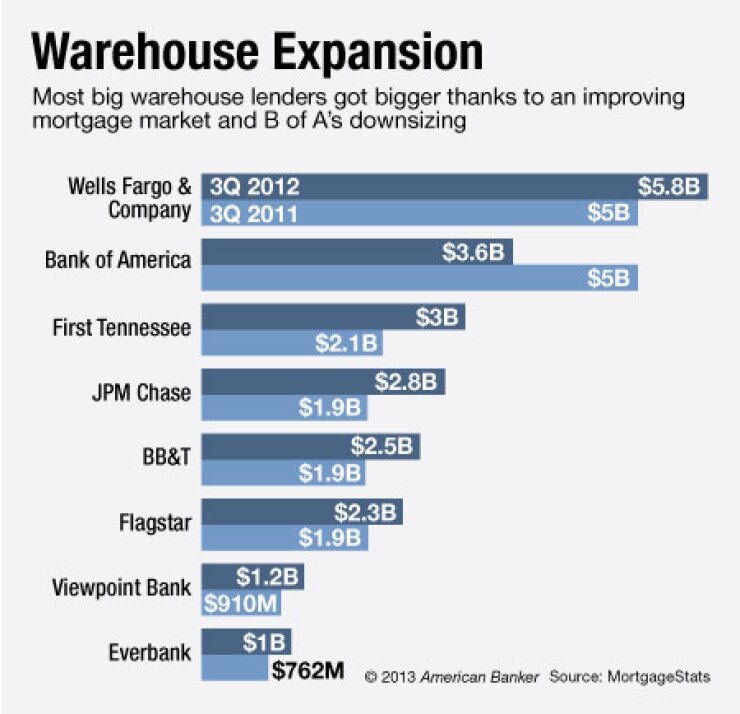

The clash occurs at a critical time for small banks as big banks expand their share of the $20 billion-plus warehouse market, profits are tougher to come by and regulators and investors demand gaudier capital metrics.

"Banks want to have higher capital ratios, and one way to do it is to have lower risk-weighted assets," says Brady Gailey, a senior vice president of KBW, a unit of Stifel Financial.

The spark occurred last year, when the Office of the Comptroller of the Currency said national banks must assign a risk-weighting of 100% to warehouse mortgages. Large banks generally do so already, but community banks have typically given them a risk weighting of 40% to 50%.

Large banks treat the mortgages as collateral for funds they advance to originators, giving them the same risk weighting as commercial and industrial loans.

But small banks structure them as purchase and sale agreements or participating interests, and argue that they take legal ownership of the mortgage loans for a small period of time — usually about 15 days — before the loans are packaged and sold in the secondary market. Because the loans are classified as "held for sale," the banks argue, they have control over the loans and therefore should receive a lower risk-weighting.

Banks also use participating interest to avoid the risk of repurchasing a loan if it goes sour, and to maintain ownership of the loans in the event that the mortgage originator files for bankruptcy. Typically a bank will have a 99% participation interest in each of the mortgage loans, while giving the nonbank originator the remaining 1% interest.

"These loans are on my books for 15 days — why should I tie up the capital if it's a government agency that is going to take me out?" Jerry Davis, a senior vice president for warehouse lending at ViewPoint Bank (VPFG) in Plano, Texas, says in referring to loans that are bundled into securities backed by Fannie Mae, Freddie Mac and Ginnie Mae.

But John C. Lyons, Jr., the OCC's senior deputy controller and chief national bank examiner, issued a four-page supervisory memo in December that said current practices are too risky. (

"A warehouse line of credit when such mortgage loans serve as collateral does not qualify for this 50% risk weight," Lyons wrote in the memo.

The OCC declined to provide officials to speak on the record for this story, but a spokesman said the memo reiterated longstanding policy, served as a reminder to bank examiners and is in line with the policies of other agencies.

The agency says it

Some bankers are pleading with the OCC to change its mind, arguing that the requirement would force them to pad capital and curtail lending to small and midsize mortgage banks at a time when liquidity is vital to the housing recovery.

"The bottom line is, this does have the potential to take liquidity out of the market and will be a detriment to warehouse lending because of a reduction of capital and yield," said Davis of ViewPoint, which has assets of $3.7 billion.

George Jones, the chief executive of Texas Capital Bancshares (TCBI), has vowed to "defend his position" and "prevail" in persuading the OCC to let the Dallas bank maintain its 40% risk weighting.

"We believe strongly that that [40%]number is right, and we believe strongly that the industry should continue to oppose" a switch to 100%, Jones said at an investor conference last month.

The $10.5 billion-asset Texas Capital disclosed in a regulatory filing last month that the OCC was questioning its risk-weighting of mortgages in warehouse lines. The company would have to raise $185 million, lowering its earnings by as much as 10%, KBW's Gailey said.

Some banks have asked the OCC at least go through the formal rulemaking process and take public comments as opposed to issuing a supervisory memo. But the OCC says it has received public comments on the issue for more than 25 years and that a handful of banks have consistently committed errors in their call reports that made the scope of their warehouse lending hard to track.

Yet one expert says the impact would be widespread.

"If they all are forced to go to commercial loan treatment, they would have to have twice the capital to hold the same portfolio, which means they would have to reduce their warehouse lending portfolio by a minimum of 50% or more," says Michele Perrin, a principal at Perrin & Associates, a warehouse lending advisory firm in Tustin, Calif. "This is a big, big deal."