-

The state that forged a middle ground on payday lending serves as both a potential model and a warning sign for the Consumer Financial Protection Bureau.

November 7 -

Hot topics like cybersecurity, M&A and Operation Choke Point caused a lot of debate at American Banker's annual regulatory symposium. But in just about every case, the conversation inevitably circled back to a common theme: reputation is everything. So some, including U.S. Bancorp's Richard Davis, contend playing it safe is just plain playing it smart.

October 26 -

The Financial Services Authority is finally cracking down on how prime brokers protect client assets.

April 19 -

Prime brokerage was not a priority at either JPMorgan Chase & Co. or Citigroup Inc. until recently, but both companies are emphasizing the business at a time when it may be a standout among other market-related businesses.

May 20

Higher capital requirements, lower margins and growing concerns about risky clients are prompting banks to pull back from the prime-brokerage business.

Banks that offer prime broker services have shifted their strategies dramatically from the juiced-up precrisis years, when they aggressively chased clients of all sizes and largely ignored the potential for contagion.

The financial crisis showed that this risk is substantial. The wide range of services prime brokers offer their hedge-fund clients from trading and financing to securities lending and cash management --make them mutually susceptible to a number of risks, and during the crisis both funds and banks got burned by their relationships.

Now, banks that once dominated the prime brokerage industry have started dumping clients whose risk is not worth the revenue. Others have become much more selective about bringing new funds on board, and are taking a close look at everything from the funds' trading strategies to their founders' backgrounds to reduce the danger to their balance sheets or reputations.

In other words, banks are starting to treat hedge funds particularly smaller funds and startups like other less-regulated companies that pose a financial, regulatory or reputational risk.

"Banks have [sometimes] argued that that lending is lending, whether it's to a hedge fund or to somebody like Morgan Stanley," said Charles Geisst, a finance professor at Manhattan College. "But when you step into the hedge fund world, you're stepping into something different."

The most striking example of a bank being hurt by its ties to a hedge fund is JPMorgan's

More recently, the many banks that were prime brokers for Steven Cohen's SAC Capital Advisors had to weigh the reputational and legal risks of continuing to work with the fund after Cohen's indictment for insider trading in June 2013. Some banks notably Goldman Sachs, which had enjoyed a long and lucrative relationship with Cohen

Another reminder surfaced last month of how the wrong client can cause financial as well as public-relation problems. Credit Suisse is pursuing a former client of its prime brokerage business who disappeared after the bank accidentally wired him $1.5 million,

Joseph Galbraith, founder of the hedge fund Galbraith Capital Management, has refused to return the money and cannot be found, the bank said in a

It is no wonder that banks which have cut ties with clients

This is a lesson they learned during the financial crisis, said John Mangano, an analyst for Aite Group, a research and consulting firm.

"Before 2008, prime brokers would sign up anyone, and if they blew up [the brokers] would deal with the media fallout. That's no longer the case, and brokers are a lot more selective in who they're taking on," he said.

Hedge funds, too, learned a harsh lesson in the financial crisis. Lehman Brothers had a large prime brokerage business, and when it failed, it brought down many funds that had no other funding source. Some are still trying to recover their assets through the courts.

In response, hedge funds diversified their relationships. Before Lehman failed, most funds had just one prime broker. By 2009, large hedge funds had an average of just under five prime brokers, according to the Tabb Group, a firm that researches capital markets. That number has since ticked down as the economy has stabilized.

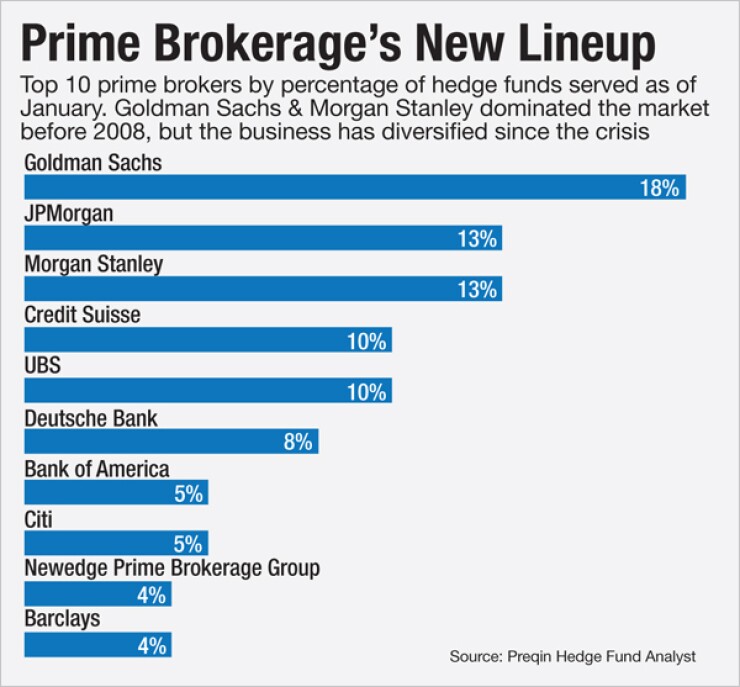

As a result of this diversification, the industry became less top heavy. In 2006, Goldman Sachs and Morgan Stanley together controlled more than half the prime brokerage market. Since then, JPMorgan, Credit Suisse, UBS and Deutsche Bank have all in increased their market share, and now Goldman and Morgan Stanley combine for 31% of all prime brokerage relationships, according to the Preqin Hedge Fund Analyst . Meanwhile, dozens of small and midsize brokers sprouted up.

As it has become more diverse, the prime brokerage business has become less profitable. Low interest rates have compressed brokers' margins, and revenue from lending securities for short selling has tanked, as the stock market has risen.

The risk-reward calculation for banks has shifted in response: serving as a prime broker has become less profitable, and the risk is perceived as higher. So banks have begun turning away more business and raising fees, industry observers say.

"Risk management departments have so much more power in banks now that they can make calls that might cause the bank to lose revenue," Mangano said. "The overriding issue is that senior management doesn't want to deal with another Lehman-type event."

Goldman has cut ties with less-profitable hedge fund clients and raised fees for others,

Banks are "reviewing the profitability of individual clients relative to the amount of balance sheet they consume," said Josh Galper, managing principal of the consultancy Finadium. "Small clients may prove unprofitable in an environment where regulatory capital charges are high."

Basel III is a key factor in banks' reassessment of the risk-reward tradeoff of the prime brokerage business. The new liquidity rules, set to take effect in 2019, are expected to raise banks' cost of capital, squeezing their profit margin on loans.

The rules will further encourage banks to discard unprofitable clients and raise costs for the rest, JPMorgan analysts wrote in a report this year on how Basel III will affect the industry.

"Hedge fund managers should expect banks to become more discerning in their allocation of equity to support new and existing business redirecting resources away from businesses that are expected to earn low returns on equity," the analysts wrote.

There is still fierce competition for large funds' business, and banks are unlikely to cut off clients that offer the potential for large commissions, as suggested by Goldman Sachs' decision to keep doing business with SAC Capital despite Cohen's guilty plea to insider trading charges.

But many smaller funds, or those without much track record, are finding themselves at a disadvantage. Instead of working with the largest banks, they are forced to work with smaller prime brokers that offer higher-cost funding. Some of the smallest hedge funds have been pushed to lightly regulated offshore companies, which have filled the gap left by the large banks' retreat.

It is a new, more sober landscape for prime brokers, one that offers less profit but also, banks hope, less risk.

"Banks are pulling back," Mangano said. "The days of sending out fifty salespeople to talk to every hedge fund startup are over."