-

The collaboration between financial institutions and technology firms runs deep, but banks' recent criticism of lax regulatory oversight for nonbanks reveals fissures.

September 25 -

The federal government's first broad inquiry into the fast-growing peer-to-peer loan industry raises several important questions, including whether banks will lobby for a clampdown on these lightly regulated competitors.

July 22 -

The Treasury Department launched an inquiry into the marketplace lending industry on Thursday, seeking information on its business models, customers and whether such firms should be forced to keep some "skin in the game."

July 16

Until this week the U.S. banking industry was tight-lipped about the competitive threat posed by the marketplace lending craze.

But that has changed abruptly, as banking trade groups have gone on the attack in response to Washington's first major inquiry into the rapidly expanding sector.

The banking industry's submissions, along with related interviews, suggest a gathering storm over the regulation of marketplace lending, sometimes known as peer-to-peer lending or alternative lending.

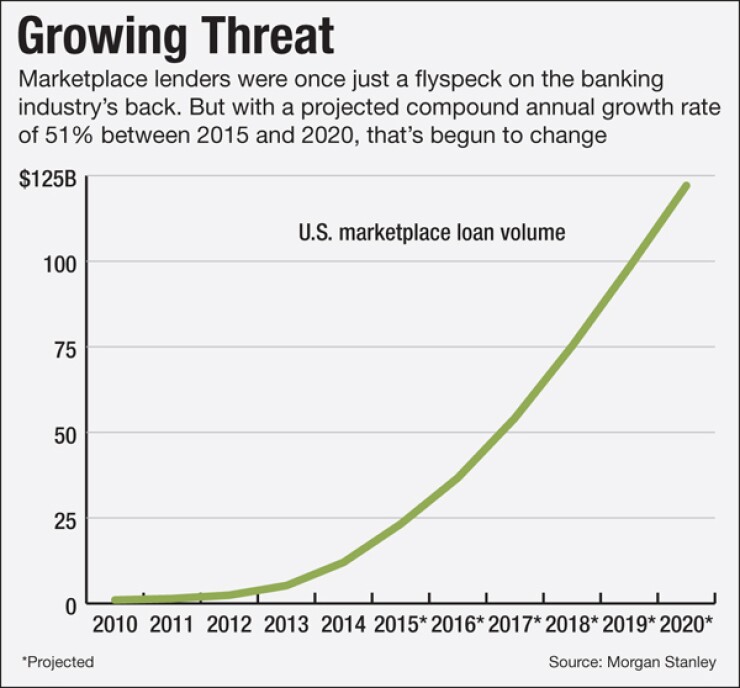

The tech-driven sector, which is centered in Silicon Valley, ballooned from $1 billion in U.S. loans originated in 2010 to $12 billion last year, according to Morgan Stanley, which projects an industrywide loan origination volume of $122 billion in 2020. Barely a day goes by without the announcement of a new venture-capital investment in an online lending platform.

Banks got their chance to weigh in formally after the Treasury Department issued a request for comment in July. And in letters made public this week, groups representing traditional financial institutions suggest that the online industry's rise is at least partially due to its exploitation of gaps in regulation.

The harshest comments came from the Independent Community Bankers of America, which represents small banks around the country.

The Washington-based trade group is calling for scrutiny of

"Ventures similar to these online marketplace lending platforms always promise attractive returns for investors while providing liquidity to grow small business in underserved and emerging markets," the small-bank trade group wrote. "However, these ventures never contemplate economic recessions, hardships and the impact of deteriorating economic conditions on a borrower's ability to appropriately manage a loan contract that he or she has limited ability to understand."

In an interview, ICBA Vice President James Kendrick attacked what he characterized as "predatory" online lenders that "charge some crazy, obscene" interest rates.

Some marketplace lenders offer high-cost credit to small businesses that would not qualify for a bank loan. Another crop of companies sells loans to consumers with subprime credit scores. At the same time, some of the nation's largest marketplace lenders refinance existing consumer debt, and generally offer lower interest rates than borrowers are being charged on their credit cards.

Kendrick argued that during the next economic downturn, small banks will still be around to service their loans, but many marketplace lenders will not survive.

"Who's going to be there for that borrower when the economy turns?" he said. "I think the big concern is that this doesn't end well."

Other trade groups representing banks and credit unions expressed similar concerns, though their rhetoric was less colorful.

In a joint letter to Treasury, the American Bankers Association and the Consumer Bankers Association argued that marketplace lenders are not being adequately examined by regulators.

"It is not enough to simply put rules in place that protect consumers. We must ensure that these rules are clearly articulated and that lenders fully comply," the two banking industry groups wrote. "Currently alternative lenders have little regulatory oversight and typically only see examinations in response to consumer complaints."

The National Association of Federal Credit Unions also called for closer scrutiny of marketplace lenders, expressing concern that "consumers may enter into an online loan without receiving full disclosure about the terms and fees of the loans."

Here are three more conclusions drawn from the letters to Treasury, which were due Wednesday.

• Comments from bank-affiliated organizations were not entirely negative, underscoring the complex reality that some banks have decided it is smarter to partner with marketplace lenders than to compete with them.

One firm that submitted largely upbeat comments was Alliance Partners LLC, which advises more than 200 small banks through the BancAlliance network.

BancAlliance has a partnership with Lending Club, the nation's largest marketplace lender, under which small banks receive a fee for referring borrowers to the online loan platform. The partnership allows banks to earn some money from customers who are looking for products that the banks themselves do not offer.

• There is a split within the marketplace lending industry over whether regulators should apply greater scrutiny to what lenders disclose about their small-business loans.

This is an issue that has been percolating in recent months, with companies such as Lending Club and Funding Circle having signed onto a self-regulatory pledge that requires the disclosure of an annual percentage rate, among other steps.

Blue Elephant Capital Management, an

"Harm can be done by platforms offering very high rates for short-term loans, especially on the small-business side where usury laws do not apply," the firm wrote. "Regulators should take a hard look at any platform that does not disclose the rate being charged — these lenders are likely to harm less savvy borrowers."

But not everyone is onboard with the notion that small-business loans should be subject to the kind of disclosure requirements that apply to consumer loans.

OnDeck Capital, a publicly traded online lender that has not signed the self-regulatory pledge, wrote: "It would be premature and potentially harmful to small-business owners if additional regulation were imposed to codify particular lending models or credit products at this early stage of industry development."

GLI Finance, which invests in five U.S.-based loan platforms that specialize in small-business lending, added: "We welcome the current 'light touch' regulatory regime for alternative finance platforms."

• Marketplace lenders are playing offense, putting forth a wish list of industry priorities that they want Washington to address.

For example, Lending Club and OnDeck both want the Internal Revenue Service to implement new technology that would make it easier for borrowers to voluntarily share their tax information with online lenders. That would cut down on the work required by the lenders to verify borrowers' income.

San Francisco-based Lending Club is also calling for the creation of tax breaks for investors who provide capital to so-called underserved areas and to small-business owners who have low or moderate incomes.

In an interview, Lending Club Chief Executive Officer Renaud Laplanche acknowledged the possibility that such changes to the tax code might lead to the misallocation of capital.

But he argued that the private-equity and venture-capital industries got started as a result of a reduction in the tax rate for long-term capital gains, and said that small businesses that need credit could reap similar advantages.

"I think it's worth trying," Laplanche said.