Wealth management units have been a surefire source of fees for banks over the last few years, as low rates dragged down spread income. But a long-dreaded policy change will likely be a crucial test to the business model.

At 11:30 a.m. on Wednesday, the Obama administration is expected to unveil new rules that will change the way firms provide advice on retirement investments. The rule is widely expected to change the way financial advisers charge fees — including, in most cases, prohibiting commissions.

The fiduciary rule comes as banks face broad-scale declines in advisory fees, following a tumultuous few months for the stock market. The timing of policy change makes one thing clear: Wealth management — and the money that business contributes to the bottom line of banks — is set to face significant challenges.

-

The financial industry and the White House are gearing up for a fresh battle this spring over investment advice for retirement savings.

April 30 -

A top official with the Labor Department defended the controversial plan to expand the definition of "fiduciary" to cover people providing advice to retirement plans on a commission-based model, a proposal strongly opposed by industry groups representing independent broker-dealers and advisors.

October 5 -

With the Department of Labor poised to toughen rules for consultants and advisers to retirement plans, industry practices are under a new spotlight.

December 1

"If the rule is too complex and the scope is too broad, that will put a dent in our wealth management activities," said Chris Cole, executive vice president and senior regulatory counsel at the Independent Community Bankers of America.

Any move to roll back commissions "would be difficult" for banks that focus on asset management, Cole said. He added that the rule likely would not affect small banks that sell traditional IRA products.

"Because the rule is so complex, there will not only be handwringing about what the rule says, but all of the things the rule doesn't say," said Tim Keehan, vice president at the American Bankers Association.

The rule will likely be a "game changer" for the wealth management units, Keehan added.

Moving away from commissions could make it too expensive for banks to advise less affluent clients with small-value accounts. Banks may cut ties with those customers, or push them onto self-directed, robo-adviser platforms, according to Keehan.

Several bankers contacted for the story declined to comment on the pending regulatory change.

The looming policy change follows a

Adviser fees have emerged as a key source of revenue for community banks — particularly as crisis-era rules have made mortgage lending less profitable, Cole said.

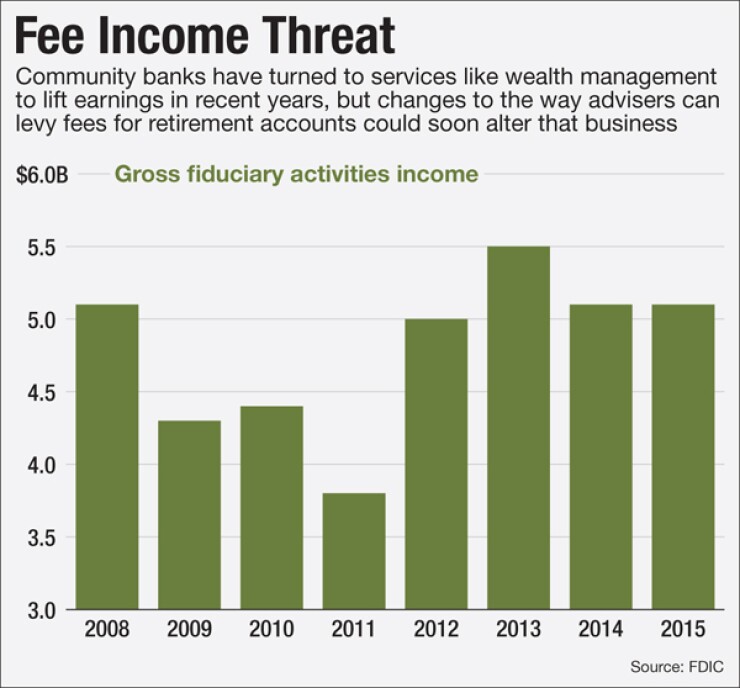

Indeed, banks with less than $20 billion in assets have increased their fiduciary revenue by 15% over the past five years, to $5.1 billion, according to Dec. 31 data from the Federal Deposit Insurance Corp.

Additionally, more than a third of community bankers describe wealth management as their biggest driver of revenue growth, according to a 2015 survey from the

But the fiduciary rule comes at a time when the revenue from that business line is already starting to show some signs of stress.

Big swings in the equity markets earlier this year have been a drag on fees over the several months. Some of the biggest players in the industry — such as

Continuing declines are expected given the market's performance, specifically in the beginning of the year. When the industry starts reporting first-quarter results this month, the reports will likely show that lower wealth management fees were a drag on earnings, Casey Orr, an analyst with Sandler O'Neill, said in a recent note to clients.

Under the policy changes expected Wednesday, the Department of Labor will require financial advisers to act in the best interest of clients when providing retirement advice. Advisers currently benefit from backdoor payments and hidden fees buried in the fine print, the White House says. Such fees are costing investors a collective $17 billion per year, according to an analysis by the White House Council of Economic Advisers.

Banks that provide retirement advice will be required to meet a "fiduciary standard" under the Employee Retirement Income Security Act of 1974. The Labor Department first proposed the rule six years ago but withdrew it in 2010

Keehan said it will likely take several days for the industry to sort through the complex regulatory overhaul. Still, banks are preparing for big increase in compliance costs for wealth management services.

"This will make it more costly for banks to be able to service their customers," Keehan said.

Other industry observers emphasized that the regulatory changes will create new business opportunities for retail banks.

"Obviously it depends on what the rule says, but certainly there are opportunities out there," said Samantha Regan, a managing director at Accenture Finance and Risk Services.

The new rules could also push retail banks to overhaul their wealth advisory products and make them more cost-efficient for clients. For instance, banks will likely invest in self-directed brokerage services, Regan said.

Notably, investments in online brokerages have been a key aspect of several recent deals.

While the fiduciary rule provides a host of new compliance challenges for banks — including changes to billing and disclosure procedures — the industry's biggest firms in particular have been getting ready for years, Regan said.

JPMorgan Chase, for instance, told investors last month that it was ready for the long-anticipated regulatory challenges.

"When we think about the DOL changes, there are going to be lots of them for the industry," said Mary Callahan Erdoes, head of JPMorgan's asset management division.

"We have spent a lot of time on them," Erdoes said.