In some ways, the outlook for commercial real estate lending is brightening.

Lodging — the sector hit hardest by the coronavirus pandemic — is coming back as people resume traveling. Retail is moving in the right direction as consumers start spending money at stores and restaurants. Even the office sector, CRE’s pandemic wild card, is holding its own for now.

But while fears of mass defaults have eased as the economy continues to improve, CRE lenders now have another worry: Weak loan demand.

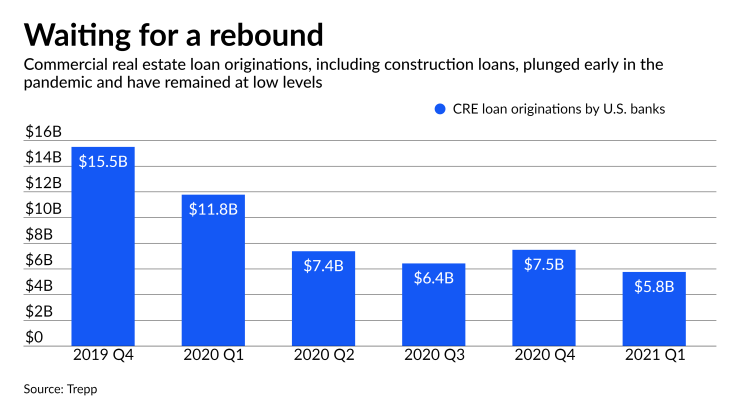

Loan originations are still nowhere near pre-pandemic levels and industry watchers say demand is likely to remain tepid at least through the end of this year, largely because companies are sitting on so much cash that they don’t need to borrow. Moreover, competition for quality CRE loans is escalating, threatening to further narrow banks’ profit margins on loans.

“There’s a lot of money out there ready to be deployed and there’s a lot of competition on new loans,” said Matt Anderson, a managing director at Trepp, a data and analytics firm that tracks commercial real estate trends. “And that’s probably going to eat into the juicy margins that banks might have been hoping for.”

Across the industry, total CRE originations on commercial mortgage loans and construction and land loans are still well below pre-pandemic levels. Among large and midsize banks surveyed by Trepp, originations in the first quarter totaled $5.8 billion, down 51% from a year earlier and 63% from the fourth quarter of 2019.

Trepp data shows that first-quarter loan originations were down across all categories except commercial mortgages for multifamily properties and construction and land loans for office and retail sites.

Commercial mortgages for office, retail and lodging loan volumes were just 33%, 42% and 10%, respectively, of the 2019 quarterly averages for each of those categories, the data shows.

Trepp’s findings are based on loan level and performance data it collects every quarter from large and mid-sized commercial banks and inputs into an anonymized loan level repository called T-ALLR. The data represents nearly 10% of all CRE loans at banks in the U.S.

Apart from competition, record low interest rates and a flood of deposits in the banking system pose the biggest threats to banks’ net interest margins. Banks have lots of

Overall, the industry’s net interest margin in the first quarter

“The anemic loan production we’ve seen over the last year, that’s been a contributing factor to the weak net interest margins we’re seeing at banks,” Anderson said. “Deposits are flowing in, but banks for the most part haven’t been turning around and making new loans.”

Among the factors affecting demand for CRE loans are higher building costs, brought on by supply chain issues, and a shortage of skilled labor. With materials and workers in short supply, some developers are putting off construction projects, experts say.

And for those loans that are being made, banks are facing increased competition from nonbanks, according to Mark Fawer, a partner in the real estate practice of Greenspoon Marder law firm. Private equity funds in particular, which have been eager to do CRE lending, have been “very aggressive” with pricing lately, Fawer said.

Private equity “can offer loans at cheaper rates” and wind up with “very high returns,” he said.

Some bankers are optimistic that demand is poised to pick up. At the $2.1 billion-asset Evans Bancorp in Williamsville, New York, the loan pipeline is heavily weighted toward CRE, said President and CEO David Nasca.

“We’re getting production and that will help offset any margin compression,” he said. But, he added, other banks “that aren’t getting a lot of production and are sitting on lots of deposits” could struggle with profitability.

Increased volume will help ease the margin pressure, Piper Sandler analyst Frank Schiraldi agreed. But he isn’t expecting demand to meaningfully pick up until companies start spending all the cash they are sitting on.

“At the end of the day, we’re looking for origination volume to come back,” Schiraldi said. “But I think some of that hopefulness will get pushed back into early 2022.”

Perhaps the best news for banks on the CRE front is that credit quality has held up better than expected, as evidenced by the fact that so many banks have been releasing loan-loss reserves they had built up early in the pandemic. .

“We feel pretty good in terms of credit losses on the CRE book,” Don McCree, the head of commercial banking at the $187 billion-asset Citizens Financial Group in Providence, Rhode Island.

“We took a couple of big write-downs in the middle of last year on a couple of mall exposures, so that’s kind of behind us and we feel like we have line of sight into any future CRE losses,” McCree said during an industry conference this month. “You could always have a surprise, but we think things are stabilizing pretty nicely.”

At PNC Financial Services Group in Pittsburgh, loan-loss reserves were released in the first quarter, but the $560 billion-asset company “actually continued to build reserves against the real estate sector,” Chairman and CEO William Demchak said at a separate industry conference also held this month.

“There continue to be clients out there that are hurting,” Demchak said. “We’re well-reserved for it, but that’s going to play out over a long period of time, I think.”

For many banks, the office sector remains a big question mark. How the pandemic will affect return-to-office plans and how much working space employers will need or not need has yet to play out.

“There’s a concern that office is being propped up a bit by the fact that office leases tend to be long-term,” Schiraldi said. “In general, it’s a property type where it may take a little bit longer to see a fair reflection of what the values are.”