In this year's roundup of top banking news for 2024: The tug-of-war between regulators and Capital One and Discover executives over the landmark merger deal; bankers react to the Federal Reserve's first rate cut in more than four years; President-elect Donald Trump's predicted impact on the banking industry; and more.

Data breach affects 57,000 Bank of America accounts

Article by

A data breach at Infosys McCamish, a financial software provider, compromised the names, addresses, dates of birth, Social Security numbers and other account information of 57,028 deferred compensation customers whose accounts were serviced by

An unauthorized party — apparently a ransomware group known as

The breach occurred on Nov. 3, 2023, according to the letter, and Infosys McCamish notified

'Fundamental breakdown': How USAA landed in regulators' hot seat

Article by

Few companies can match USAA's stellar reputation, gained over a century of offering financial products to military members. But behind the scenes, the San Antonio bank and insurer is navigating a minefield of its own making.

USAA's banking arm has grown its customer base for years, all while failing to make the investments needed to keep both its regulators and some decades-long customers happy, according to a joint investigation by American Banker and the San Antonio Current.

A series of regulatory penalties hasn't sparked enough internal change. Neither has the reshuffling of key leaders, the latest move being the upcoming retirement of CEO Wayne Peacock. Another problem: nonexistent profits at USAA's bank, which has turned to layoffs to cut costs.

Trump 'uncertainty' contributes to hawkish shift at Fed

Article by

The Federal Reserve is entering a "new phase" in its approach to monetary policy, and uncertainty related to policy shifts by the incoming Trump administration is playing a role.

The central bank lowered its policy rate by a quarter percentage point following Dec. 18's Federal Open Market Committee meeting but did so with a warning that further reductions could be fewer and farther between in light of higher inflation expectations.

Fed Chair Jerome Powell, in his post-meeting press conference, noted that a range of factors contributed to this decision, including inflation readings, which have ticked up in recent reports, stalling progress toward the Fed's 2% inflation target. For some committee members, policy uncertainty affected their economic expectations.

Regions Bank unwittingly invited a surge in check fraud last year

Article by

In response to an analyst's question late last year about the spike in check fraud,

"We opened the door too wide, bad people came rushing in, and we didn't close the door timely enough," Turner added in his comments at the BancAnalysts Association of Boston Conference in November. "That's on us."

How Project 2025 would affect bankers

Article by

A powerful conservative organization with advisors close to former

In 2016, Trump won the presidency as a relative unknown in banking policy circles, said Ed Mills, managing director and Washington policy analyst at Raymond James.

"And the banks woke up the day after the election without knowing virtually anyone in the Trump orbit, and they didn't have a plan about what they wanted to ask for from the Trump administration," he said. "Neither Trump nor the banks are going to make the same mistake this time."

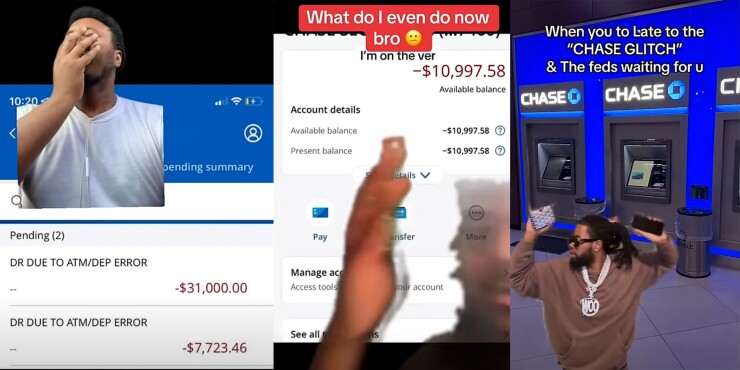

Check fraud against Chase goes viral on TikTok

Article by

A form of

The scheme was portrayed as a glitch rather than

"Let's go to the ATM, let's go to the ATM, let's go to the ATM," one person said to his friend in a TikTok video reacting to the trend.

Truist plans to shrink branch network by 4% in March

Article by

The closures come amid Truist's $750 million cost-cutting initiative, which was

What bankers need to know about Trump's World Liberty Financial

Article by

In a

"We're embracing the future with crypto and leaving the slow and outdated big banks behind," Trump said in the short video about the company, World Liberty Financial.

Trump has pledged during his presidential campaign to turn the U.S. into the "crypto capital of the planet," as he put it in

Capital One acknowledges Discover merger won't close this year

Article by

Capital One Financial acknowledged that its proposed $35 billion acquisition of rival Discover Financial Services — a deal that faces new antitrust scrutiny from New York state officials — won't be finalized this year.

Richard Fairbank, Capital One's longtime CEO, said he anticipates the Discover transaction will close in early 2025, subject to the approval of shareholders and regulators.

When the Discover acquisition

In addition to the New York state antitrust probe, Capital One is waiting on action by federal bank regulators and the U.S. Department of Justice, which can either approve or seek to block the company's proposed acquisition.

What big-bank CEOs are expecting — good and bad — from Trump 2.0

Article by

Now that the U.S. presidential election is over, bankers have traded one type of uncertainty — who will win — for another, as they wait for impending policy changes.

Top executives at both large and regional banks said in December that they anticipate a business-friendly climate under the incoming Trump administration, which should generally play out in banks' favor. Regulations should lighten, loan growth should materialize and more mergers should happen, bankers said in comments at

Capital rules are likely to be less stiff than they would have been under a Democratic president. And the Biden administration's effort to rein in late fees on credit cards — which was already struggling in the courts — may finally be put to bed.