-

To court young talent, banks are reimagining their ads for positions like call center agents and video tellers as YouTube clips. They are also finding ways to make applications easier to fill out on mobile devices.

March 2 -

As branch transactions continue to decline, banks are increasingly requiring expertise in an area they paid less attention to in the past: digital design. BBVA and Capital One's recent purchases of user-experience and design firms underscore the increasingly important trend.

April 20

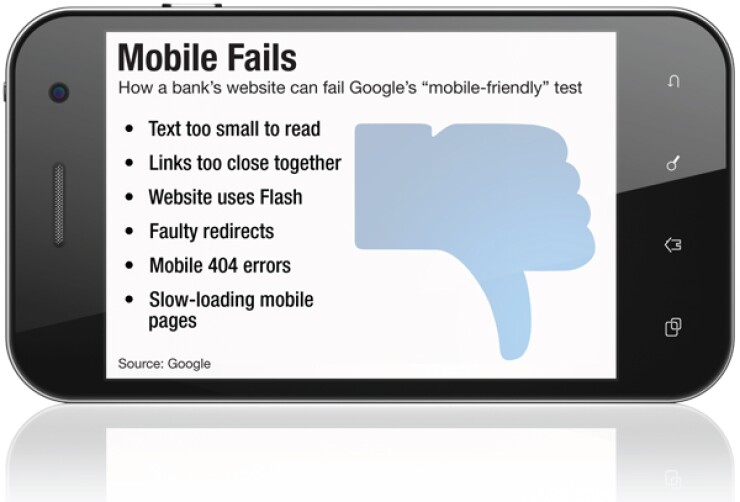

Many banks may need to overhaul their websites after Google made a significant change to its search algorithm last week that is influencing the way companies' pages show up in search results on mobile devices.

The tech giant is favoring individual web pages it deems "mobile-friendly" an algorithm revamp some experts and media outlets are calling "Mobilegeddon" because some brands are at risk of falling into the search results abyss.

"That's a big deal," said Ted Schadler, an analyst at Forrester Research and co-author of The Mobile Mind Shift. "That's how people find stuff."

Some institutions, like PNC and Ally Bank, are well positioned for the change. But research conducted by Jack Henry found that about two-thirds of banks and credit unions do not pass Google's mobile-friendly test.

Google's update requires websites to be usable on a small device with text that can be read on a compact screen and links far enough apart that they can be easily individually tapped. The idea is to make the consumer's journey less maddening on a device that increasingly is their entrée to the internet.

In a

Failing the Test

In recent weeks, digital marketing agency Portent

"Ninety percent of the time, they are pretty far from ok," said Ian Lurie, chief executive and founder of Portent. "It's not a subtle thing."

The obvious mistakes come from forcing the website designed for the desktop to be presented as-is on a small screen, which makes navigation difficult. As a result, text can be hard to read and navigation near impossible.

"Everything is tiny," Lurie said.

That kind of experience can alienate an audience.

"There are a lot of people using the [smartphone] as their first consumption device," said David Gerbino, a digital and database marketing consultant for financial services companies.

"Why would you want your content to be lowered in the rankings because it's not optimized for smartphones? Why would you put yourself at risk?"

He said the need to improve goes well past Google's recent change. Almost two-thirds of Americans own a smartphone while "19% of Americans rely to some degree on a smartphone for accessing online services and information and for staying connected to the world around them,"

"A lot of homepages have an overuse of graphics," said Arnold, managing director of Jack Henry & Associates, which acquired Banno.

A typical website layout, three columns of product description with a huge banner ad, creates a horrible experience for consumers who are forced to pinch and zoom to find relevant content.

One way banks can approach the situation is to embrace responsive design, mobile URLs and dynamic serving.

Responsive design is one way to tackle the Google algorithm challenge. Mobile URLs and dynamic serving are among the

Arnold said Google's change is the latest example of its continued focus on the consumer. "By doing this, the whole internet gets better," said Arnold.

Gerbino hopes the algorithm switch will light a fire within the banking industry.

"I would think by now every website would be mobile optimized and they are not," he said. "It's really kind of weird."

James Robert Lay, founder and chief executive of direct marketing firm CU Grow, said Google's change is unlikely to be dire for banks in the short-term. But as mobile traffic continues to increase, Lay said there is a growing importance for banks to whip their sites into shape that goes beyond the algorithm alterations. Consumers could surf for "checking accounts," after all, and abandon a process that is too cumbersome.

"That is where the battle of new accounts is to be won," said Lay, who advocates for websites becoming much more than glorified brochures.

The problem is that much more acute for banks gunning for underbanked and millennial audiences, who are more likely to use smartphones as their only connection to the internet.

To be sure, mobile-friendly is only one signal of Google's algorithm criteria to determine which content comes up on top. Google said high quality content could still outrank mobile-friendlier pages. "The intent of the search query is still a very strong signal so even if a page with high quality content is not mobile-friendly, it could still rank high if it has great content for the query," blogged Google.

Still, Forrester's Schadler said Google's mobile search overhaul is an opportunity for banks to give attention to a channel in need of specific experiences.

"People have mobile devices at all times," said Schadler. "The urgency and intimacy someone has with the banking relationship goes up tremendously [in mobile.]

"Don't let the crisis go to waste."