WASHINGTON — U.S. banks reported strong profits for a second consecutive quarter, though the industry relied on a decline in provision expenses as net interest margins fell to another record low.

The nation’s banks reported net income of $70.4 billion in the second quarter of 2021, which was 8% lower than the previous quarter’s profits but more than 280% greater than a year earlier, the Federal Deposit Insurance Corp. said in the Quarterly Banking Profile, released Wednesday.

The industry’s second-quarter profit was driven by a 117%, or $73 billion, decline in loan-loss provisions from a year earlier to negative-$10.8 billion, according to the FDIC. However, provisions rose $3.7 billion from the previous quarter.

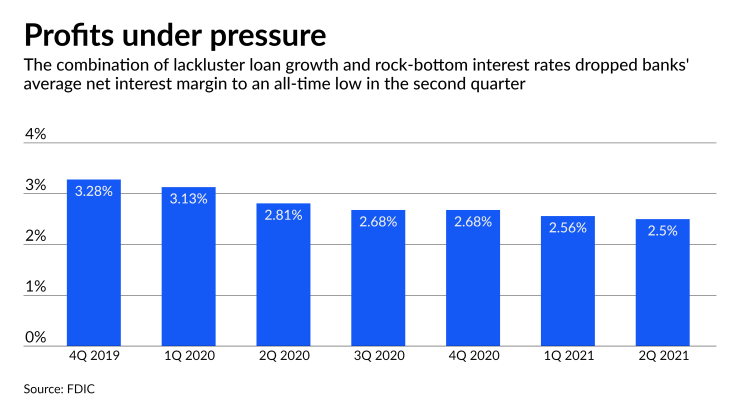

Meanwhile, the banking sector’s net interest margins continue to vanish. The average NIM slipped by 31 basis points in the second quarter from a year earlier to 2.5% — the lowest level on record for a second consecutive quarter.

The most recent contraction is less severe than it was in the first quarter of 2021, when the average net interest margin fell by 57 basis points year over year.

In prepared remarks, FDIC Chair Jelena McWilliams welcomed the strong results but noted the continued decline in banks’ interest income.

“Notably, the banking industry reported a modest quarterly increase in total loan balances for the first time since second quarter 2020, reflecting an uptick in loan demand, while the net charge-off rate reached a record low,” McWilliams said. “However, persistent low interest rates contributed to further contraction in the average net interest margin, which reached a new record low this quarter.”

Banks’ balance of loan and leases increased 0.3% from the previous quarter to $33 billion. That included a nearly $31 billion increase in credit card balances and $18.9 billion increase in auto lending.

But lending overall remained sluggish amid the ongoing pandemic. Compared with the same time last year, loan and lease balances fell 1.2% to $134 billion.

The sector's noninterest income also continued to increase in the second quarter, growing by 7% or $5 billion from a year earlier, despite declines in trading revenue and lower net gains from loan sales.

Banks also appear to be keeping noninterest expenses in check. While salary and benefits costs rose by $3.7 billion or 3% since the second quarter of 2020, the FDIC reported that banks’ noninterest expense as a percentage of assets hit a record low of 2.23% — a 14-basis-point decline.

Deposit growth appears to be winding down, growing by just 1.5% in the second quarter of 2021, an increase of $272 billion. That’s a far cry from the scorching 3.6% rate of deposit growth the FDIC reported in the prior quarter.

That slowdown helped the FDIC partly recover reserves in the Deposit Insurance Fund. The fund's ratio of reserves to estimated insured deposits grew by 2 basis points to 1.27%. But that is still below the statutory minimum of 1.35%.