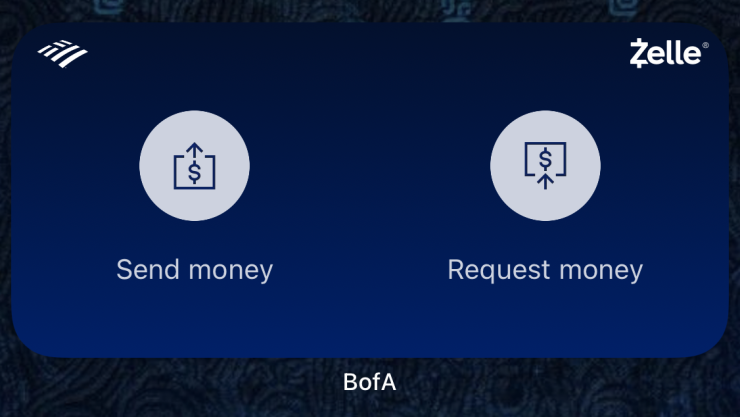

Bank of America is the first financial institution to roll out a Zelle widget, cutting the steps required to send or request funds through the peer-to-peer payments service on mobile devices.

The move could give BofA an edge among consumers who primarily access banking and payments from their phones, though other Zelle banks are likely to follow with widgets of their own.

Widgets are icons that can take up a large portion of a smartphone's home screen, providing details such as weather reports and calendar reminders without requiring users to open an app. They can also provide shortcuts to common functions, as in the case with BofA's implementation.

The use of a widget also improves privacy and security, according to Julie Harris, BofA’s chief digital executive for global banking. Harris also recently became the bank's head of digital payments.

“When you’re about to send funds via Zelle in a crowded area or even with friends or family standing nearby, you don’t necessarily want everyone to see your bank balance or any other details while you’re opening the mobile app to get to the Zelle screen," Harris said. "With the widget, you skip that process and go directly to the screen for sending funds."

To access the Zelle widget, users must already have the Bank of America mobile app installed and authenticate themselves via a biometric trait or password. Those who don’t want to add a bulky icon to their home screen may also access BofA’s Zelle screen by long-pressing the mobile banking app’s icon to bring up a menu of shortcuts to payment services.

“We’ve created a deep link giving users a fast-track way to transfer money with one click, and it also removes the awkwardness of worrying whether anyone is looking over your shoulder at your bank balance,” Harris said.

BofA’s Zelle widget automatically displays the user's six most recent transfers to further streamline the process of sending funds to frequent recipients.

“A lot of our younger consumers have already discovered the Zelle widget, and for others we’re promoting it online and in social media,” Harris said.

Being the first bank out with a Zelle widget could set BofA apart as a trendsetter, as more banks are likely to follow suit, adding widgets for a wide range of activities, according to Richard Crone, a principal with Crone Consulting.

“There could be a sort of ‘land rush’ in the short term for banks that want to be ‘top of home screen’ with widgets, but artificial intelligence and voice commands are likely to play a bigger role in the future, anticipating and facilitating access to the apps consumers use most often,” Crone said.