NY Green Bank, a state-financed backer of sustainable infrastructure projects that previously relied only on public money, has received a $314 million investment from Bank of America.

The nine-digit investment represents the largest-ever private fundraising deal by a green bank in the U.S., according to the Coalition for Green Capital, a nonprofit organization that helps governments establish green bank finance institutions.

The investment is timely. Last year, NY Green Bank realized that it faced a liquidity challenge amid rising demand for sustainable energy projects. It turned to banks for help, targeting those with an interest in making environmental, social and governance-related investments, acting President Andrew Kessler said in an interview Monday.

“Rather than going back to the state and saying, ‘Look, we have more unfinished business here. Can we find more state capital?,’ we now have a business and a portfolio that’s attractive to ESG lenders and gives us an opportunity to crowd in private sector capital,” Kessler said.

The state-backed investment fund ultimately decided to work with Bank of America, which offered good terms, flexibility and an experienced team, he said.

Under the arrangement announced Monday, NY Green Bank will sell a portion of its growing energy portfolio to BofA in exchange for the cash investment, which will allow the Green Bank to continue filling funding gaps for clean energy projects. NY Green Bank currently has a $790 million pipeline of investment opportunities.

NY Green Bank, an 8-year-old division of the New York State Energy Research and Development Authority, has previously been funded by surcharges on ratepayers' electric bills. Through June, it had committed $1.6 billion into residential, commercial, agriculture and industrial infrastructure clean energy projects across the state, Kessler said.

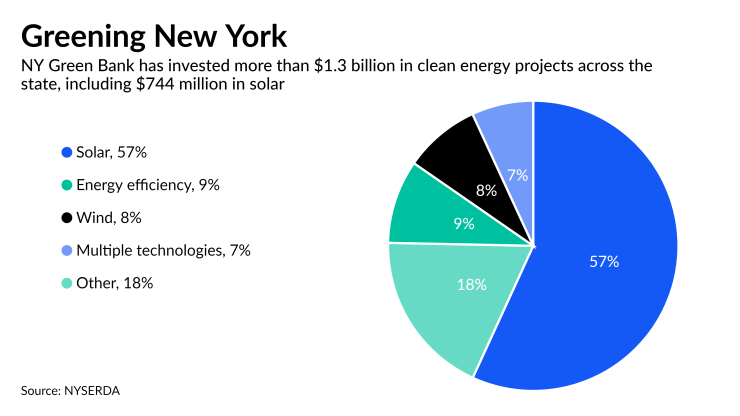

As of March 31, 57% of the Green Bank’s $1.3 billion portfolio was tied to solar energy projects, while 9% involved energy efficiency, and 8% related to wind energy projects, according to a report published in June.

Although the BofA deal is the first private-sector investment in NY Green Bank, the publicly backed entity’s involvement in specific clean energy projects has previously helped commercial banks become more comfortable with making their own investments.

For example, lenders at M&T Bank

The number of green banks has been

Bank of America’s investment in NY Green Bank comes nearly four months after the Charlotte, North Carolina-based megabank

BofA did not immediately respond to a request for comment about the investment.

NY Green Bank is hopeful that it will attract more private-sector investment as banks become more comfortable with green banks’ projects and portfolios, Kessler said.

“I would say stay tuned,” he said. “We will probably be pursuing some form of additional liquidity, perhaps on an annual basis.”