2018 looks to be a good year for U.S. fintech companies, as banks plan to step up their investments.

A study released in December found that 82% of U.S. commercial banks plan to increase fintech investment over the next three years; 86% of bank senior managers surveyed said they intend to boost fintech funding imminently. The research was commissioned by the global fintech provider Fraedom.

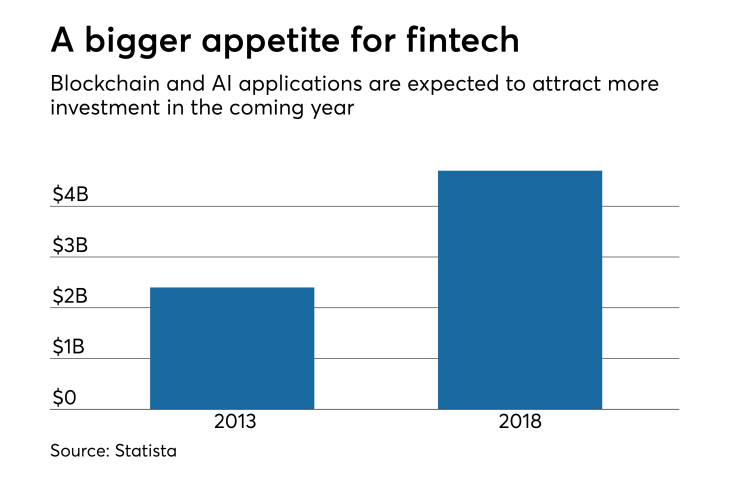

The research firm Statista predicts U.S. fintech companies will receive $4.7 billion from all types of investors in 2018.

Some of the areas of fintech likely to draw investment are the buzzwords of 2017.

“We’re seeing different ways of enabling funding or lending and measuring creditworthiness,” said Jennifer Byrne at Quesnay, a company that connects fintechs with traditional firms. “AI, machine learning and blockchain are top of mind in every conversation we have, whether it’s with investors or corporate executives.”

Here are the fintech markets likely to get some love in the coming year:

Blockchain

“There’s a lot of interest right now in the ecosystem around finding the right use cases for blockchain technology,” said Reetika Grewal, head of payments strategy and solutions at Silicon Valley Bank, and one of the leaders of its fintech accelerator.

“People are willing to put money into them, though there might not be a strong return on investment just yet. Are we going to hit the use case next year? I’m not sure. It’s still a young technology, so it will have continued investment and experimentation and learning from early solutions out there.”

Tyrone Canaday, managing director at the consulting firm Protiviti, predicted the use of blockchain technology for identity and access management will gain momentum in the new year. “There will be more use of blockchain in security because I think it’s needed and a good way to leverage that technology and protocol,” Canaday said.

Up till now, many blockchain pilots have been about gaining back-office efficiencies, such as in clearing securities, Canaday noted. He said he expects the use of blockchain to shift to ways to make money.

Institutional custody for crypto assets is the clearest use case for enterprise blockchain technology, argued Lex Sokolin, global director of fintech strategy at Autonomous Research.

“It’s a well-known problem in the market right now,” he said. “Before we see [cryptocurrency] ETFs, we need to have crypto-custody. Building out traditional finance infrastructure for crypto as an asset class is a very clear theme of 2018. It’s already underway.”

Artificial intelligence

Some venture capitalists have become bearish on artificial intelligence, considering it overhyped and a crowded field.

“We’ve recently passed on a couple of AI companies,” Michael Steinberg, general partner at Reciprocal Ventures, said at a recent conference. “It’s a gigantic opportunity, obviously, but there are also significant challenges for AI firms today.”

One is intense competition. “There was a study done about last quarter’s conference calls where the count of the number of times companies said ‘artificial intelligence’ in their calls was 800, up 25% quarter over quarter,” Steinberg said. “When you’re competing with 800 companies, it’s probably a difficult experience.”

And for AI systems to work well, they need to be trained on data, which is expensive to acquire, he said.

Putting aside such challenges, applying AI to tasks such as fraud monitoring and monitoring large transaction volumes is compelling, Canaday said.

“As we see more data distributed between entities, you’ll need something that will be able to analyze across these transaction sources to make sure you’re monitoring for fraudulent or suspicious activity,” he said.

Regtech

The rise of blockchain technology will mean more transactions will need to be monitored, Canaday said, pushing financial institutions and even some regulators to use regtech tools.

Anti-money-laundering and know-your-customer rules, along with identity verification, will continue to be the hottest areas of regtech, he said. Regulatory reporting by fintechs and banks will be another area of focus in the coming year, he said.

B-to-B payments

While many fintechs focus on serving consumers, “toward the end of this year we started to see more of a shift in investment toward the B-to-B side,” said Grewal. “There’s big money being thrown into the B-to-B space. We’re seeing a lot of new company formation around the B-to-B payment space in a way we haven’t seen before. That’s one trend we’ll see a lot more of next year.”

Businesses need help managing their money and billing efficiently, she said. “There’s a lot of manual processes that people run, so many companies still rely on Excel spreadsheets to run their business,” Grewal said.

Banks could “unlock” $11 billion in new revenue streams from small and midsize businesses by 2020, according to an

Consumer apps

Though fintech apps that help people save, manage their money and invest abound, there are likely to be even more coming out in 2018.

Grewal calls this the next generation of personal finance. “Things like, ‘Am I saving money the right way?’ ” she said. “More holistically, trying to make sure you’re being an advocate for the consumer when it comes to saving money and spending money wisely.”

-

There is seemingly endless research on the attitudes of millennials toward banks, but the major takeaway from all of it is that banks can't expect millennials to want to bank only one way.

March 16 -

Millennials care about more than money. So it's important for recruiting efforts to show what bankers do for their communities.

October 10 -

Just how digital are Millennials?

October 31

Better experiences from fintech apps like Digit and Acorns are turning financial services firms into “ingredients” rather than “destinations,” according to Schwark Satyavolu, general partner at Trinity Ventures.

“So far we’ve tended to think of financial services as, you go to Chase or you go to Citi to get these different kinds of services,” Satyavolu said. “Now, small pieces of that are integrated in other experiences like Digit.”

Fintechs that can provide banking, investing or payments as a piece of their broader offering, as Stripe has done in payments, can do well in this environment, he said.

Grewal also sees a lot of interest in the cross-border commerce space — consumers from China wanting to make purchases in the U.S. and the U.K. and vice versa.

Banktech

Many of the most innovative fintechs have been competing with banks and creating alternative financial brands.

One reason for this “was the fact that the CFPB had a lot of teeth and was able to keep the large national FIs out of certain markets through the threat of potential fines and regulations,” Satyavolu noted.

Now that the Consumer Financial Protection Bureau has been defanged, so to speak, banks can get back into student lending and mortgages without fear of reprisal, he said.

“I think banks will be more aggressive, more risk-taking,” Satyavolu said. “The kinds of products and services they have stayed away from, they’ll be more willing and able to push.”

This should be good news for tech companies that offer technology to banks in these areas.

“You’re going to see companies that serve banks become hot,” Satyavolu said.

Bitcoin wallets

Sokolin envisions bitcoin wallets taking off in the U.S. in 2018.

“Being able to spend your bitcoin or Ethereum investments in the traditional economy, that bridge will be built in 2018, whether it’s in banking, investment or an adjacent industry,” he said.

He pointed out that in the U.K., the neobank Revolut has a prepaid card and a million customers, enabling them to access their cryptocurrency from its app. It’s currently applying for a banking license so it can make loans.

Augmented reality commerce

“We’re going into a world where Amazon, Ikea and every retailer has a mobile app on the iPhone, and every iPhone starting with iPhone X comes with augmented reality capabilities,” Sokolin said. “Amazon wants to have experiences where you check out without swiping the card. They bought Whole Foods for that.”

At some point, Amazon customers will be able to scan their produce through the image recognition on their phone.

“It’s a bit of science fiction land, but I think figuring out the payments mechanism for that paradigm will be an investment opportunity for the future,” Sokolin said.

Bank-fintech partnerships

Along with investment, many observers expect to see more partnerships between banks and fintechs in 2018.

“If you went to conferences a year ago, people were asking, who’s going to win, the fintechs or the banks?” Grewal said. “No one is asking that question anymore. The question is, what’s the right partnership model? We kind of need each other.”

Bank boards and C-level execs are starting to view partnerships with fintechs as vital to their success, allowing them to keep up with the pace of innovation and to better adapt business models to tech advances, Canaday said.

To be prepared for fintech partnerships in 2018, he said, banks have been upgrading their tech infrastructure, moving from client servers to the cloud and revamping their data architectures.

“In 2018 we’ll see some of the leaders in financial services look for the fintech partnerships that will complement their business models, help them access new data sources and enhance the customer experience," he said. "At the end of the day, that’s where the rubber meets the road.”

Editor at Large Penny Crosman welcomes feedback at