Regulators have repeatedly raised red flags about banks carrying too heavy a load of commercial real estate loans, yet the warnings have not altered merger patterns as expected.

Lenders are advised to keep their ratio of CRE loans (excluding credits tied to owner-occupied properties) to total risk-based capital below 300%. Exceeding that threshold is not forbidden, but doing so will draw a sharp eye from federal regulators.

There was some thought that the guidance would encourage banks to pursue M&A deals that lower their CRE concentrations. There have been a few examples of deals lately where the buyer said a deal helped to diversify its portfolio beyond CRE — such as the $434 million agreement in November by

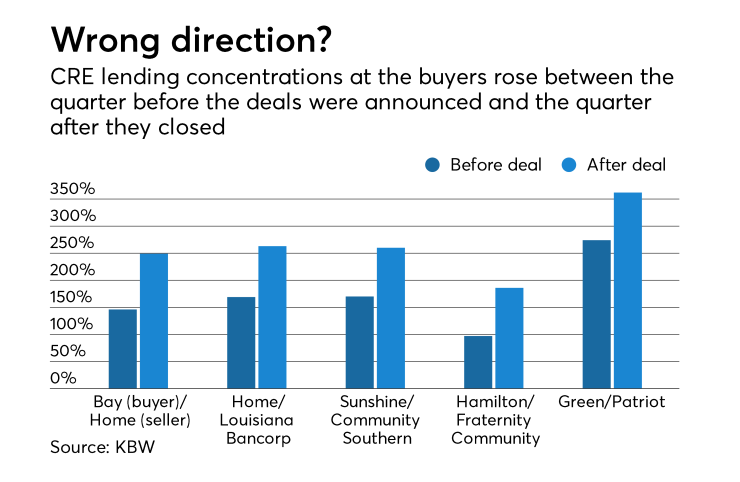

When the investment bank Keefe, Bruyette & Woods examined more than 150 deals completed in 2015 and 2016 that involved banks listed on the New York Stock Exchange and the Nasdaq, it found that concentration levels of 86% of the buyers rose.

Moreover, CRE loans as a percentage of total risk-based capital on average increased from 199% from the quarter before a deal was announced to 217% for the quarter after the deal closed, KBW’s data shows.

There could be several explanations, experts said. For one, banks tend to look for institutions that are similar to themselves, meaning most deals will not drastically change their loan mix. Additionally, the majority of acquirers are well below the 300% threshold, meaning their CRE levels have room to rise.

“I don’t really hear [any bankers] saying they are scared of CRE,” said Greyson Tuck, a director at the legal and consulting firm Gerrish Smith Tuck. “But during the due diligence phase, you will spend the majority of your time on CRE loans because it is usually the largest segment.”

Many buyers are looking for loan growth and can add to their CRE portfolios, said Vincent Hui, who leads the merger and acquisition and risk management practices for the consulting firm Cornerstone Advisors.

“If the buyer is below 200%, then one of the drivers maybe is they are in a low-growth market for CRE and they are looking for expansion in their CRE portfolio,” Hui said. “They have room to grow, at least in that particular metric.”

In fact, most buyers were below the 300% threshold before their deals, according to the KBW data. Only 8% of the deals involved buyers that were at or already over 300% the quarter before their deals were announced.

To be sure, publicly available data has its limits. More heavily concentrated CRE banks are smaller and not publicly traded, said Jonathan Hightower, a partner at the law firm Bryan Cave. Public companies have better access to capital, and that would help them stay below the regulatory threshold, he added.

“I think many of the serial acquirers are well positioned from a concentration standpoint,” Hightower said.

Dennis Hudson III, chairman and CEO of Seacoast Banking Corp. of Florida in Stuart, said that his company’s self-discipline on CRE lending provides a “competitive advantage as a buyer” because it has “room to accommodate something that has a higher ratio, assuming we are comfortable with the portfolio.”

The $4.8 billion-asset Seacoast has worked to maintain caps on its different lending segments to ensure it does not rely too heavily on any one area. Consumer, commercial and industrial and CRE make up roughly a third each of its portfolio. As a result, its CRE to total risk-based capital hovers around 209%. It has bought four banks since October 2014 and has two more transactions pending.

“We look at a number of facets in a deal, and one is CRE concentration,” said Charles Shaffer, the company’s chief financial officer. “It’s about acquiring the right customers in the right markets.”

Though most acquires were willing increase their CRE concentrations, many did so by a relatively modest amount. Of the 137 banks that saw an increase in CRE concentrations after a deal, more than 40 of them went up 10 percentage points or less, according to the KBW data.

A significant jump in concentration could draw the attention of regulators, Hightower said.

“If you are a bank that doesn’t do a lot of CRE lending because of your markets or your business model and you are acquiring a lot of it, regulators will want to understand you have the management capacity to monitor the CRE lending,” Hightower said. “You have to make sure the risk management is all buttoned up.”

Most acquirers are still looking for banks with balance sheets and loan compositions similar to their own, Tuck said. Because of that, it is unlikely that an acquisition would move the needle much either way.

“Typically most bank deals are complementary and not transformative,” Tuck said. “When you look at their target loan portfolio, it will often look like a smaller version of the acquirer. There aren’t many acquirers out there that say, 'Here’s the composition of our balance sheet and let’s buy something completely different.' "