Banks may shed as much as 20 million square feet of office space over the next five years as they shift many back-office functions to high-tech operations centers, frequently in markets with cheaper rents.

The real estate services firm JLL said in a recent report that this mass relocation to less-expensive space could save banks — all of which are trying to reduce overhead any way they can — an estimated $800 million a year in real estate costs.

Banks are outfitting these new operations centers with old technologies, such as videoconferencing and electronic messaging, that they had historically been slow to adopt, as well as more recent advancements, such as distributed ledger, data analytics and cloud-based computing, all of which are helping them automate tasks that employees once handled manually.

Banks also continue to improve their cyberdefenses, which is giving them the confidence to shift some functions to off-site operations centers without fear of compromising customers’ personal information. Indeed, the concern that off-site facilities would not pass regulatory muster is one reason banks had been slow to make the move to less-costly operations centers, said Walter Bialas, the director of research at JLL.

Now, “banks are saying, ‘We don’t necessarily all have to be on the same floor, or even in the same building,’ ” Bialas said.

JPMorgan Chase, which is based in New York,

Such markets as Dallas and Phoenix have a depth of talent and affordability “that are attractive for banks developing new operations centers,” said Christian Beaudoin, senior director of research at JLL.

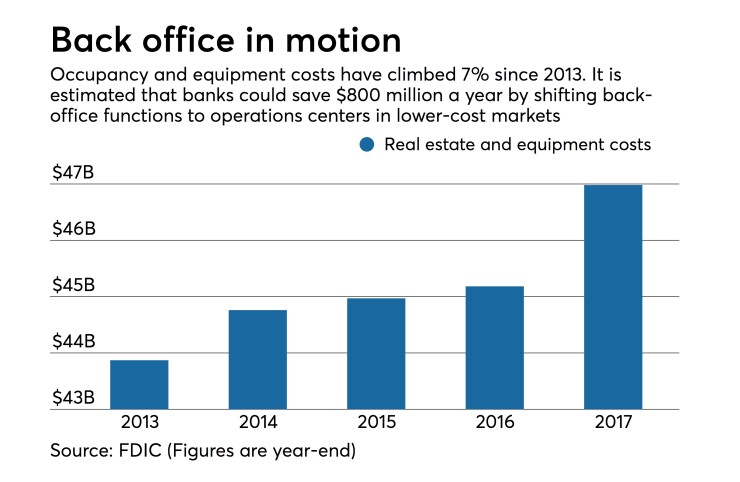

The efficiency initiatives could help banks offset the rising real estate costs. According to Federal Deposit Insurance Corp. data, occupancy and equipment costs climbed 7.3% between Dec. 31, 2013, and Dec. 31, 2017, to $47 billion, even as banks closed thousands of branches and vacated office space. That's largely because overall office-space rent per square foot has been climbing as real estate values have soared in many cities, according to JLL.

These rent increases are coming at the same time banks have been trying to clamp down on expense growth to compensate for weaker-than-expected loan demand and persistent pressure on net interest margins.

While the new back offices generally require costlier talent, they can be staffed with fewer employees, bank executives say.

U.S. Bancorp, like many other banks, has invested hundreds of millions of dollars in tech upgrades in recent quarters. It has, for example, upgraded digital banking sites to respond to customer queries, instead of routing them to a live person at an operations center, Chief Financial Officer Terry Dolan said at a recent investor conference.

“Digital capabilities … provide opportunities with respect to back-office efficiencies,” Dolan said on June 12 at the Morgan Stanley Financials Conference. “Being able to move 25%, 35%, maybe even 50% of the calls out of the call center ends up changing the configuration of your call center” to have more efficient staffing levels.

These operations centers need higher-skilled workers than typical call centers, which explains why about a quarter of all banks’ job postings are now for software engineering and other tech developers, JLL said in the report.

The need for tech skills has meant that banks can’t simply relocate operations centers to the middle of nowhere, just to take advantage of rock-bottom rents. An operations center needs to be located near pools of tech talent, in addition to having access to cheaper buildings, JLL said.

High-cost cities such as San Francisco and Portland, Ore., are blossoming as hubs for financial services operations centers, but so are lower-cost cities, such as Jacksonville, Fla., and Des Moines, Iowa, according to JLL.

“They have large pools of software engineers and technology professionals, and in today’s modern financial services company, those are critical pieces,” Bialas said.

The new model of operations center has meant that some former hubs are losing their cache. The Wilmington, Del., area has long been a hotbed for credit card issuers, but many banks have decided it’s cheaper to move to new operations centers elsewhere than to upgrade legacy centers in Delaware, Beaudoin said.

“Sometimes it’s just easier to move elsewhere,” he said.