-

Once heavy on grey type, Bank of North Carolina's reports are now dotted with colorful graphs, charts and heat maps so that busy senior executives and board members can quickly assess things like loan data and branch profitability and keep better tabs on the integration of acquired banks.

June 17 -

Community banks need a steady flow of prospects. A partnership with a successful retail concept virtually guarantees constant customer traffic.

April 22

Ed Wehmer, the president and chief executive of Wintrust Financial (WTFC), has a message for equity analysts who are you to tell me how to run my bank?

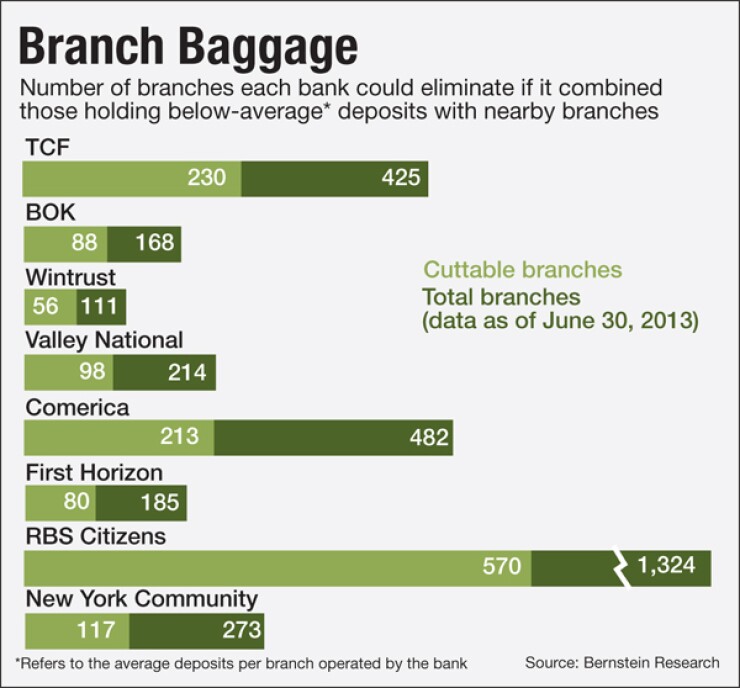

And he's not the only one. At issue is an unusually detailed and blunt research report from Sanford C. Bernstein that recommends regional and midsize banks close hundreds upon hundreds of branches nationwide. It puts a new spin on a lingering, often vague discussion about the future of branches and has clearly struck a nerve.

Wehmer's response was quick and strong, echoing the sentiments of other bankers contacted for this story.

"Quite frankly, I would tell you that a Bernstein analyst out of New York applying a one-size-fits-all approach to all markets would be a foolhardy way for a bank to set strategy," Wehmer says.

The emotional reaction makes sense given the eye-catching numbers in the report.

For example, TCF Financial (TCB) in Minneapolis, BOK Financial (BOKF) in Tulsa, Okla., and

The cost of operating the branches far outweighs the benefits, says Kevin St. Pierre, the lead analyst on the report. When bankers respond to that advice, their responses tend to fall into one of two categories, St. Pierre says "valid/rational" or "defensive/irrational."

A smart reason to keep branches open, St. Pierre says, is the belief that small, cash-based businesses still need a nearby branch. Or, it's understandable if you think that elderly customers want the "security blanket" of being able to visit a branch, he says.

Then there are the knee-jerk responses, St. Pierre says.

These bankers have said "the closures wouldn't save as much money as you estimate," St. Pierre says. They also argue that "the vast majority of deposits still occur at the teller counter [or] the [branches] serve as billboards, increasing our brand awareness."

"Those are pretty expensive billboards," St. Pierre says.

As if on cue, bankers balked. Hard.

TCF regularly analyzes its branch network and tries to identify "opportunities to optimize our footprint," says Mark Goldman, a bank spokesman. The bank in April closed 47 branches in Illinois and Minnesota; it now has 378.

Otherwise, the $18.8 billion-asset TCF is satisfied with its branch model, as it uses retail locations to "achieve significant deposit growth through an efficient cost structure," Goldman says.

Further, Bernstein's approach to closing branches fails to take into account the fact that many TCF branches are located inside supermarkets, which offer lower operating costs than stand-alone branches, he says.

Wintrust's Wehmer argues that the report also overlooks market conditions.

"You have to understand Wintrust," Wehmer says. "You have to understand Chicago. Our premise has always been that 50% of people want this kind of business" to take place in branches, he says.

"Is there a little bit of extra cost in there" to keep some low-performing branches open, Wehmer asks. Yes, but it's the cost of doing business, he says.

"You need to service every community in Chicago, and they're all different and they have different needs," Wehmer says.

Some banks especially community banks may have valid reasons for wanting to keep branches open, but rapid changes in banking technology will force banks to reduce branch counts, says Falk Rieker, head of the global industry business unit for banking at SAP.

"They have to downsize and close branches," Rieker says. "It's simply not profitable anymore. When you can offer most [retail] services online or using mobile, it's hard to justify the existence of branches."

For the Bernstein study, St. Pierre conducted a regression analysis on a branch's personnel, occupancy and equipment costs and determined that the average cost of a single branch is about $1.7 million. St. Pierre then studied each branch in a bank's network and recommended for closure those that either had too few deposits or were located too close to another branch, or a combination of the two.

Some exceptions were made, St. Pierre says. For example, if a branch had a low deposit level, but appeared to show growth potential, he didn't recommend it for closure.

The factors Bernstein used in its report aren't enough to reflect the true value of a bank's branches, says Pat Piper, executive vice president for consumer banking at BOK.

"Our decisions to open, close or relocate branches are ... not tied only to deposits and geography," Piper says. "As consumer behavior evolves, so will our strategy, but branches will always play an important role."

St. Pierre created other rankings and estimates, in addition to the number of branches a company should close. One ranking produced a list of the regional banks that could chop expenses the fastest. The leader is Fifth Third Bancorp (FITB) in Cincinnati, which could reduce noninterest expenses by 24.4% by closing the branches St. Pierre recommends.

The bigger banks' defensiveness, and their often carefully crafted public statements, reflect the sensitivity of the matter, especially given the potential harm to their more intangible brand values.

"Our banking centers remain the most visible brand identifier in our communities, and are a key part of our strategy in terms of customer convenience and sales opportunities," says Stephanie Honan, a spokeswoman for the $127 billion-asset Fifth Third.

"As consumer needs and expectations are changing, we are committed to serving our customers how, when and where they want to be served and believe branches will continue to play an integral role."

Honan declined to specifically respond to the Bernstein report.

Most superregional banks acknowledge privately they should close branches, Rieker says. The chief information officer of a top-20 U.S. bank recently told Rieker that his biggest challenge is how to rethink branch staffing.

Others say it's a matter of degree and what's practical.

Valley National, which Bernstein says should close 46% of its 214-branch network, regularly conducts a profitability analysis of its branches, says spokesman Marc Piro. A large majority of them remain profitable, he says.

The $16.3 billion-asset Valley is also adding more technology to its branches, including interactive video teller machines and enhanced ATMs, which is expected to lower costs, he says.

"While we might close a few branches moving forward, we certainly would not close anywhere near the 98 recommended in this report," Piro says.