U.S. auto lenders may be tempted to breathe easy as Congress prepares to

But lenders would be well advised to keep up their guard, since states — particularly blue ones — are taking steps of their own to crack down on what they see as abusive lending practices.

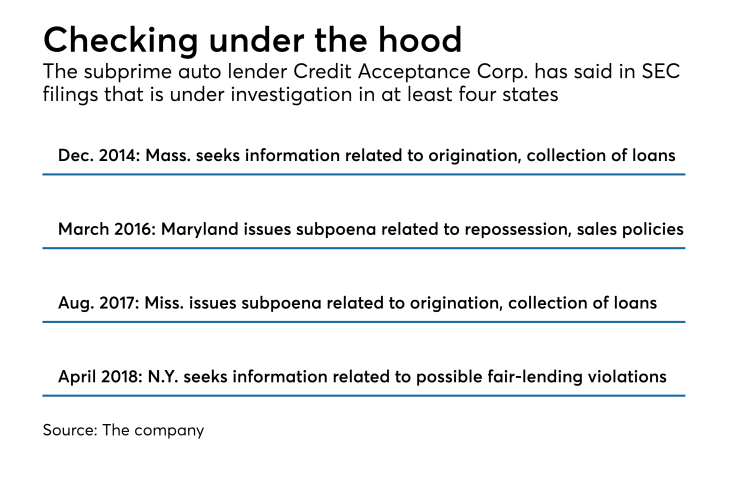

On Thursday, Credit Acceptance Corp., a subprime auto lender based in Southfield, Mich., disclosed in its quarterly earnings report that New York officials are looking into whether it discriminated against certain borrowers. Also under review is the question of whether the firm provided inaccurate information in the course of a supervisory examination.

The investigation of Credit Acceptance by the New York State Department of Financial Services comes on the heels of demands for information from the company by authorities in Massachusetts, Maryland and Mississippi.

The Trump administration’s efforts to

But for some lenders, the latter trend may prove to be more consequential than the former.

During a conference call with analysts on Friday, Douglas Busk, a senior vice president at Credit Acceptance, did not comment on the deregulatory push in Washington. But he did suggest that there has been a shift in state capitals toward tougher regulation. He said that during the last four years, Credit Acceptance has disclosed at least seven state and federal government probes in its securities filings.

“In the 24 years I was with the company before that, I don’t think we had any. So clearly something’s changed in the regulatory environment. We’re under a lot of scrutiny. We have been for quite a while now,” Busk said.

Subprime auto lenders have been facing stepped-up regulatory pressure for several years following a post-recession boom during which credit standards weakened. For example, Santander Consumer Holdings USA, a Dallas-based lender that is largely owned by the Spanish banking giant,

Today, with federal scrutiny seemingly on the wane, the question is whether state attorneys general, particularly those who are Democrats, will further ratchet up their enforcement efforts.

“Some have threatened to do that — it’s unclear if they’ll be effective, though,” said Moshe Orenbuch, an analyst at Credit Suisse.

Lawyers who represent financial institutions have been issuing general warnings in recent months about the threat of closer scrutiny by state officials.

“It may not be the case that every state is going to make consumer financial law enforcement a top priority. But at least the majority of the states with Democrats as attorneys general have shown a willingness to push on this issue,” Stephanie Robinson, an attorney at Mayer Brown, said during a conference call last month.

The U.S. House of Representatives is expected to vote this week to repeal 5-year-old regulatory guidance that was part of the CFPB effort to crack down on auto lending practices that often resulted in minorities paying higher prices. The measure has already been approved by the Senate, and President Trump is expected to sign it.

The lobbying push to repeal the Obama-era auto lending guidance was led by the National Automobile Dealers Association. Last week the trade group warned its members that they still face the risk of litigation over alleged fair-lending violations.

“That’s why it’s so important to have an internal culture of compliance,” David Regan, executive vice president of public affairs at the National Automobile Dealers Association, said during a call with reporters.

While state officials remain a thorn in the auto industry’s side, consumer groups that have previously alleged fair violations may have less leverage than they did in the past.

The National Consumer Law Center filed class-action suits in the 2000s accusing auto lenders of discrimination. The industry eventually agreed to pay about $100 million to settle the claims, and also agreed to temporarily cap the size of discretionary dealer markups that were at issue in the suits. Those caps have since expired.

Stuart Rossman, director of litigation at the NCLC, said it would be harder today for the consumer advocacy organization to bring the same sort of lawsuits. He noted that numerous state motor vehicle departments used to collect information on the race of drivers, which could be used to perform relevant statistical analyses, but the states have generally since stopped recording that data.