WASHINGTON — With rock-bottom interest rates expected to begin rising soon, regulators and industry representatives are increasingly concerned about institutions' ability to weather a boomerang effect on their funding costs.

The abnormally low rates have allowed banks to expand their balance sheets, but fueled worries that some institutions with heavy use of short-term funds may be caught flat-footed when interest rates go up.

"It's becoming a larger and larger threat as every day goes by," said Donald J. Musso, the president and chief executive of the consulting firm FinPro Inc.

Federal regulators are expected to address the issue in a joint release as early as today, and the Federal Deposit Insurance Corp. is planning a conference devoted to interest rate risk management for Jan. 29.

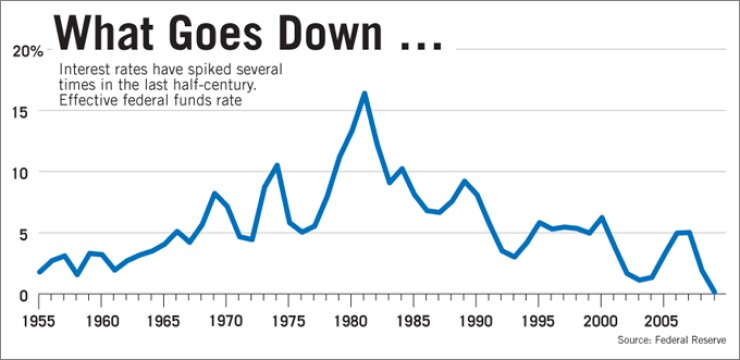

Fallout from sharply rising interest rates helped cause the failures of hundreds of savings and loans in the late '70s and '80s, when rates climbed to as high as 20%. At that time, thrifts primarily held long-term assets — 30-year, fixed rate mortgages — which elevated risk because many were funded with short-term liabilities.

"If you're paying 20% for deposits and you're making 10% on your loans, you can't really make that up on volume," said Sanford Brown, a managing partner at the law firm Bracewell & Giuliani LLP and a former official at the Office of the Comptroller of the Currency.

"The challenge is going to be for those banks that are particularly liability-side-sensitive, where their deposits are going to reprice more quickly than their assets."

While observers said systemwide problems from interest rate risk are not expected this time around, some institutions may have trouble.

"There is some legitimate worry about what rising interest rates would do to the balance sheets of some of the banks," said John Douglas, a partner at Davis Polk & Wardwell and a former general counsel at the FDIC. "It was certainly the basis for the crisis of the early '80s. The rising interest rates really decimated the thrift industry."

Institutions that have emphasized short-term liabilities while holding assets with long-term yields may need to consider balance-sheet changes, according to some observers.

"Over the last 12 months in particular, a lot of banks' balance sheets have seen a worsening of their interest rate position," Musso said. "I would not call it material. It's certainly not like it was back in the late '80s '90s.

"Everybody has been going intermediate and longer-term on the asset side. So you can see the natural course of events would be increasing interest rate risk. Now, we're a fork in the road: What are we going to do to stop it from getting any worse than it currently is?"

Rates hit historic lows in late 2008 as policymakers employed an assortment of tools to prop up the spiraling economy. The Federal Reserve Board's key short-term interest rate has hovered around zero for well over a year, and the central bank announced a decision last month to keep the rate between zero and 0.25% for an "extended period."

But most watchers are bracing for an end to the ride.

"There is a growing expectation that interest rates are not going to stay at this level forever," Douglas said.

FDIC officials have sounded the alarm over the last few months. In a Dec. 17 report in the agency's Supervisory Insights publication, officials warned that some institutions, in the process of chasing earnings during the low-rate period, may have taken on substantially more risk.

The report noted an increased use of assets with extended maturities. Whereas such assets made up just 24% of the industry's portfolio in 2006, that number was near 40% in June 2009. Meanwhile, noncore funding, which the FDIC regards as less stable and vulnerable to interest rate changes, remains popular with institutions with longer-term assets. Smaller institutions are also increasing their use of long-term mortgages as they hold fewer construction and development loans, the report said.

"Historically, the primary hedge against IRR for most financial institutions was a stable deposit base over which banks had significant pricing power," the report said. "The shift in the asset mix increases the interest rate exposure of many institutions, especially those with less than $10 billion in total assets."

Though much of the crisis has resulted from bad loans, and policymakers have focused on improving credit quality, some observers said interest rate risk may have been overlooked as another factor threatening institutions.

"I've certainly been worrying for the past year that people were focusing on credit risk and not the other thing that was really the cause of the bank problems in the '80s, which was interest rate risk," said Wayne Abernathy, the executive director of financial institutions policy for the American Bankers Association.

The last policy on interest rate risk from the federal regulators was a 1996 guidance that provided institutions with principles for sound interest rate risk management. But the agencies decided at that time to hold off on prescribing a standard measure for interest rate risk. Few details about the coming release are known, but it will likely be an update to that guidance.

"We've learned a lot more over the last 14 years," said a source at one of the agencies. "Everybody has concentrated on market risk and liquidity risk, and interest rate risk hasn't received a lot of attention. … But interest rate risk hasn't gone away, because it never goes away."

The FDIC appears to be considering interest rate risk already in enforcement actions.

A Nov. 12 order against the $211 million-asset Washita State Bank in Burns Flat, Okla., cited the institution for, among other things, "operating with an excessive level of interest rate risk exposure" and using "ineffective" tools for measuring interest rate risk." The agency made similar claims against the $720 million-asset Frontier State Bank in Oklahoma City. (Frontier is challenging the FDIC order in administrative court.)

Still, several observers say the heightened risk may be limited to isolated cases.

"Obviously, there will be some pockets of banks that aren't prepared. But the bankers I talk to have been through this before and are seasoned," said Dan Bass, the managing director in the Houston office of Carson Medlin Co. "The interest rate environment is Banking 101. If people are going to get nailed on this, they shouldn't be in banking. You just don't get locked into a fixed, long-term loan with people worried about inflation."

Musso said that, while there will be "outliers," the industry is in much better position to deal with a changing rate environment than during the crisis of the 1980s. He said his firm has begun helping clients consider changes in their deposit product selection and pricing to prepare for increasing rates.

"As an industry, I think we're doing a much better job of managing our overall interest rate risk," he said.