-

Fannie Mae and Freddie Mac are not properly using a web portal developed to collect and screen appraisal information in order to minimize losses, according to an audit released Thursday.

February 6 -

The government-sponsored enterprise is keeping a running list of appraisers that it views as shady and is warning banks and mortgage lenders to be careful about doing business with them.

January 27

Mortgage lenders are facing a potential threat to their business that has nothing to do with new regulations or the uneven economic recovery: a persistent shortage of home appraisers.

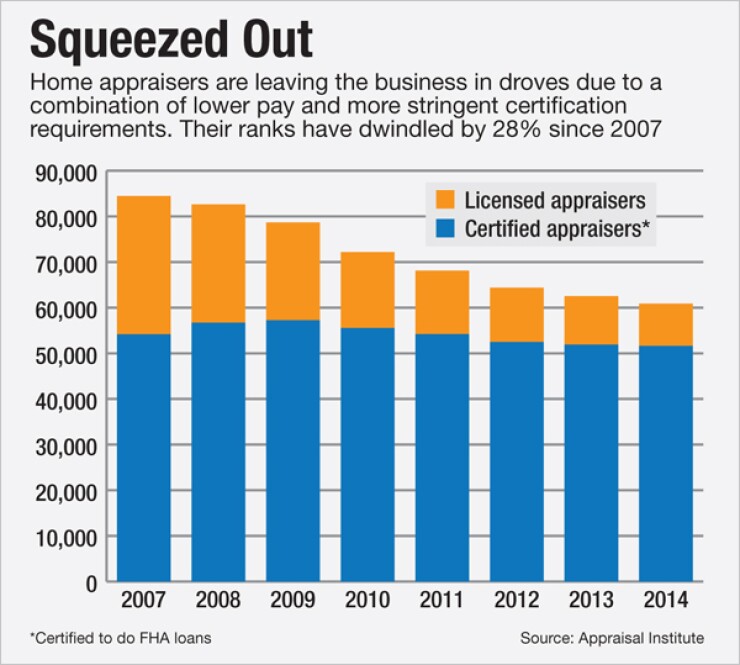

Since the height of the housing boom in 2007, the number of individuals certified or licensed to do home appraisals has declined by 23,000, or 28%, according to the Appraisal Institute.

It's not a crisis at least not yet but with older appraisers retiring and fewer and fewer college graduates entering the profession, some industry observers say that, in five to 10 years, there won't be enough appraisers to handle the volume of home sales. For lenders, that could mean higher appraisal fees and long delays in closing loans at a time when technology could be speeding up the process.

"In five years the banking industry will not have many appraisers left to do their mortgages," said Rick Hiton, the owner of the Chicago appraisal firm Rick Hiton & Associates.

Age is perhaps the biggest reason the industry is facing a talent shortage; many existing appraisers are between 50 and 55 and looking to retire within the next decade. But experts say many younger appraisers are being driven from the industry by a combination of lower pay and heavier workloads, while more stringent certification requirements that took effect in January have raised the bar for becoming an appraiser.

It used to be that an appraiser could enter the profession with just an associate degree, but now a bachelor's degree is mandatory. New appraisers must also serve at least 2,500 hours as an apprentice and starting in 2017 appraisers will be required to undergo mandatory background checks.

"Now it can take seven years before someone can do an appraisal on their own," said Greg Schroeder, the president of Comergence, a Mission Viejo, Calif., company that vets appraisers and mortgage originators. "Regulation has created very onerous time and educational requirements for appraisers and it's killing an industry that is already dying because of age."

Mortgage lenders, servicers, and real estate investors rely on appraisers to justify the value of a home and the size of a home loan. Appraisals

At this point, the appraiser shortage isn't affecting home sales much because overall volume is low. The turnaround time on most appraisals these days is about a week compared to 10 days during the refinancing booms of recent years though appraisals can are taking longer in rural areas, where there are fewer appraisers.

"Appraisers are busy, some are declining the work and lenders are asking for more capacity and staff," said Brandon Boudreau, the chief operating officer at Metro-West Appraisals, a national appraisal firm based in Detroit.

Industry experts suggest that these bottlenecks will only get worse as mortgage volume picks up and the number of appraisers continues to shrink. Schroeder estimates that as many as 30% of the nation's roughly 61,000 certified and licensed residential appraisers are no longer in the business but just haven't surrendered their licenses. Another 20% to 30% are "grumbling about retiring, so the actual number of working appraisers could be cut in half," he said.

Many appraisers blame the Home Valuation Code of Conduct, which took effect in 2009, for thinning their ranks. The HVCC, which came about as a result of negotiations between then New York State Attorney General Andrew Cuomo, the Federal Housing Finance Agency, Freddie Mac and Fannie Mae, sought to prevent commissioned loan officers and mortgage brokers from bullying appraisers into inflating valuations.

Banks responded by eliminating their costly in-house appraisal departments and instead hiring third-party appraisal management companies. Because these firms get a cut of the appraisal fee, individual appraisers that may have once collected $400 to $500 per appraisal have seen their fees slashed to anywhere from $225 to $350.

"The banks saved millions of dollars a year but appraisal fees never went up," said Bill King, a senior vice president of valuation solutions at Platinum Data Solutions, an Aliso Viejo, Calif.-based firm that provides collateral valuation technology. "No one thought through these actions."

A provision of the Dodd-Frank Act requires that lenders

"I have to make sure in a bad month that the appraiser can earn a living and have grocery money, while the company basically does not earn anything," said Hiton, who employs 12 appraisers.

Advances in technology could further reduce the need for appraisers, some observers say.

In January,

For now, though, appraisers are not allowed to use the software because they are the "boots on the ground" updating property data, a Fannie spokesman said.

Tim McCarthy, the chief appraiser at his own Chicago appraisal firm, TJ McCarthy & Associates, agrees that technology can't replace appraisers though he does believe that it can help them do their jobs better. It's puzzling to him that Fannie has made its tool available to lenders, but not appraisers out in the field.

"Can you think of any other industry that withholds the best tools available for the professional, and only uses the tool after the job was completed to see if they did it correctly?" he said.