-

Weak community banks will have to give in and start selling in greater numbers next year, two executives of acquisitive banks predict.

November 30

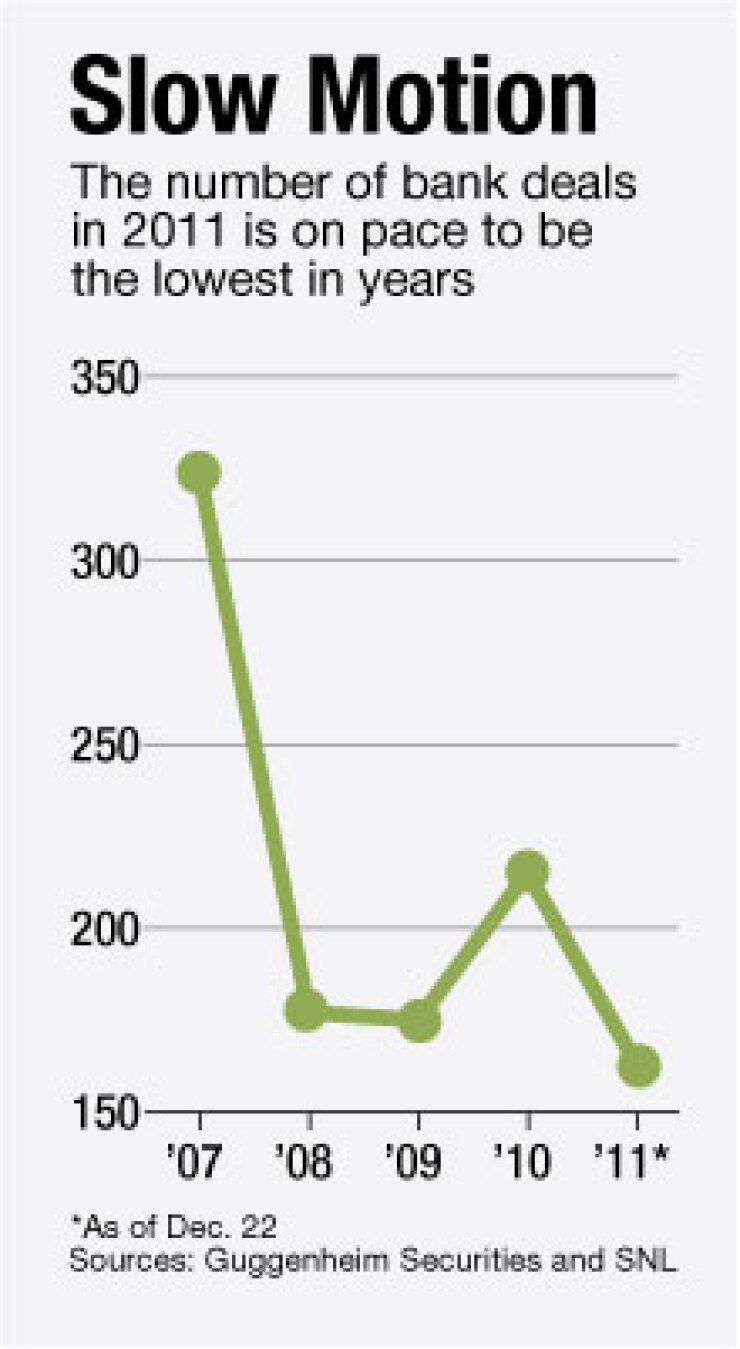

Barring a late flurry of deals — and we mean late — 2011 may end up being the most tepid year for bank M&A in at least two decades.

There were 163 bank and thrift acquisitions announced through Wednesday, which puts this year on pace for the fewest number of banks to change hands since 1990, according to data from Guggenheim Securities LLC and SNL Financial.

Jeff Davis, a Guggenheim analyst, recently forecast 170 deals by yearend, or fewer than the two previous lows in recent history: 175 in 2009 and 177 in 2008.

Data on the Federal Reserve Board's website, which goes back another decade, says the next lowest figure after those was 190 in 1980.

A year ago, Davis and other market watchers were predicting that a mini-rebound in bank mergers in 2010 would accelerate this year. What happened?

There may have been more reasons to avoid deals than there were, well, actual deals. Plunging stocks, falling revenue, narrowing margins, widening bid/ask spreads, frustratingly low interest rates, accounting rule changes and soaring regulatory fees were some of the many.

There were also the Dodd-Frank Act, the European debt crisis, political gridlock in Washington, elevated unemployment, a spotty housing market, and on and on and on.

And do not forget how banks with the nerve to actually do big deals — from

What all that comes down to is that if banks are not making money or worth money then they cannot spend money buying other banks.

"Activity in 2011, while not at a standstill, was a virtual bust in our view as few deals in excess of $100 million of deal value occurred," Davis wrote in a research note on Monday.

He was only slightly more upbeat in an interview, saying the sheer volume of small banks with profit problems should create some momentum in the small end of the M&A market in 2012.

"I think we'll see a gradual pickup as the year progresses," Davis says. "Where we really ought to see it is in the companies of $1 billion in assets and below."

About 58% of the country's 7,400 banks fit that description, according to regulatory data.

Major consolidation — if and when it comes — may look more like ripples in a lake than waves in an ocean, he predicts. There will be fewer headline-grabbing deals between regional giants than there were in the two merger waves of the 1990s that produced Bank of America Corp. and JPMorgan Chase & Co.

There are a lot fewer midsize banks with the potential to become those types of super banks these days, and regulators and investors would scoff at many of those who tried.

Davis and others expect a new class of super-community banks to emerge — institutions with a few billion of assets at most that strike serial low-risk, under-the-radar deals for institutions with just a handful of branches.

A few candidates for super-community banking status have announced deals for small banks in Texas, Washington and South Carolina in recent weeks. They include