Is this the beginning of the long-awaited comeback in commercial lending?

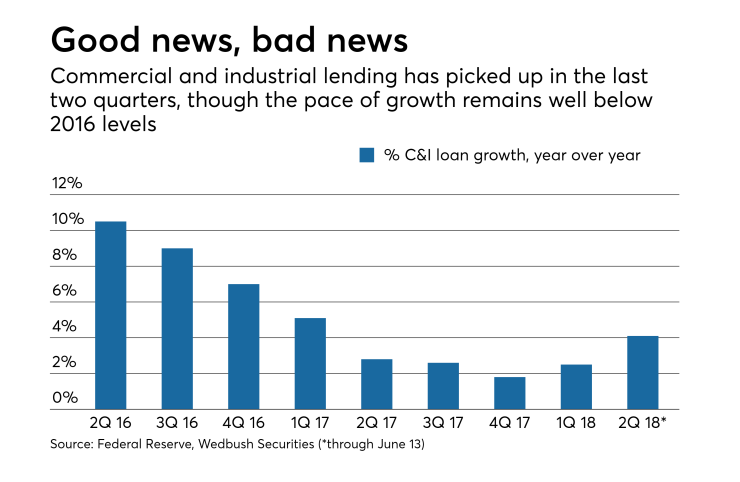

Though complete second-quarter numbers aren’t in yet from the Federal Reserve, and banks don't start announcing their quarterly financial results for another week, a Wedbush Securities analysis of the Fed's weekly lending data found that commercial and industrial loans were on pace to increase 4% in the three-month period when compared with a year earlier.

Assuming the numbers hold, it would be the first time in two years that quarterly C&I growth had outpaced the prior year’s level — raising hopes among bankers, investors and analysts that loan demand is once again on the upswing.

“We are cautiously optimistic that the expected loan growth momentum in [the second quarter] continues into the back half of the year,” Peter Winter, a Wedbush analyst, said in a recent research note to clients.

Of course, at 4%, commercial loan growth remains well below the 10% growth banks reported in the same quarter two years ago, and some analysts say they are concerned that a surge in loan paydowns could offset the stronger demand.

Nonetheless, C&I lending is expected to be a highlight of second-quarter earnings when banks begin reporting results next week.

According to Wedbush, business lending has been particularly strong at the 25 biggest banks. As of mid-June, commercial loan originations at these banks were on pace to climb 11% since the end of the first quarter, driven by an increase in capital investments and strong demand for merger-and-acquisition financing, Winter said.

During an investor conference in June, U.S. Bancorp Chief Financial Officer Terry Dolan pointed to several leading indicators of loan demand, including a recent rise in activity in the company’s commercial payment division.

Still, Dolan struck a cautious tone when discussing the Minneapolis company’s results. In the quarter that ended March 31, commercial loans were flat from the prior quarter, but up 4% from a year earlier.

“We’re seeing some early signs, but we still need it to show up in the numbers,” Dolan said.

Christopher York, an analyst with JMP Securities, was equally cautious when discussing expectations for second-quarter results.

While some West Coast banks, such as Silicon Valley Bank, have boosted commercial lending by targeting technology and private equity firms, others that lend to less-high-flying industries are unlikely to see a meaningful increase in loan volume until businesses start to take fuller advantage of the recent cut to the corporate tax rate and invest in growth.

“We may not see loan growth overwhelm here in the second quarter,” York said.

Big banks, including JPMorgan Chase, Citigroup and Wells Fargo, will kick off the quarterly earnings season on July 13, and many regional banks will report results the following week.

Apart from discussion about commercial lending trends, expect analysts to pepper bank executives with questions about the impact the Trump administration’s protectionist trade policies could have on lending and how recent revisions to the Dodd-Frank Act — particularly the provision that raises the threshold for determining if a bank is systemically important to $250 billion — might affect their thinking on acquisitions.

Bank executives are also expected to face questions on deposit costs, following the Fed’s move in mid-June to raise interest rates by 25 basis points for the seventh time in three years.

Price competition has begun to intensify in a meaningful way across the industry, according to industry analysts. Commercial borrowers continue to pressure banks for better rates on their excess cash. More recently, banks have also begun offering consumers higher rates on CDs.

In Los Angeles, for instance, the number of CD specials — the rates that banks typically advertise in their branch windows — increased by 53% as of the end of June compared with three months earlier, according to a recent client note from Hovde Group. Promotions are up in other cities, as well, such as Boston and New York.

“It’s very, very competitive,” York said.