Some banks are hungry for artificial intelligence technology, and fintech entrepreneurs are counting on demand to soar — as are their venture capital backers.

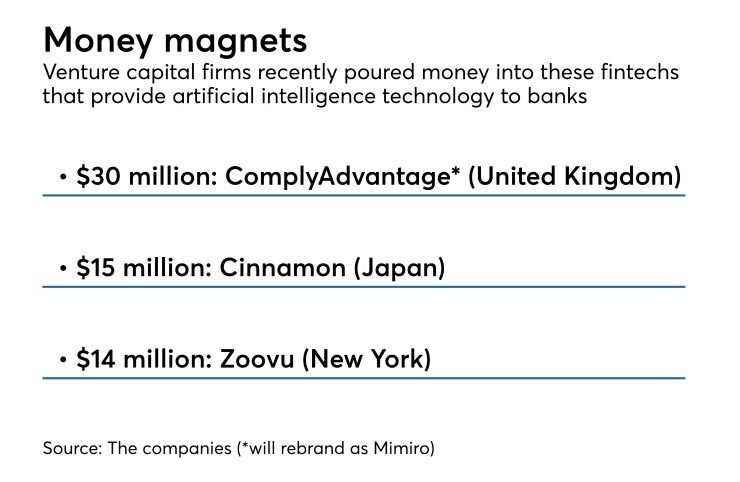

Three AI-focused fintechs — ComplyAdvantage, Cinnamon and Zoovu — have recently raised millions of venture dollars to fuel their expansions into new cities and market their automated risk management, data-scanning and customer service products to more banks in coming months.

Though AI is still evolving and raises many technological, labor and policy questions, there seems to be a fertile market for it. Fifty-two percent of

“AI is going to be transformative to our business over the next 10 years,” said Christopher Maher, the CEO of OceanFirst Financial, a $7.5 billion-asset bank in Toms River, N.J. “I think you’ll see more of this kind of [venture capital] funding activity [for] AI fintechs as a result.”

The following is a roundup of the three fintechs that raised money from VC firms recently and what they say they can do for banks:

Crime fighting, compliance

ComplyAdvantage, which is in the process of rebranding as Mimiro, calls itself the world’s only AI-driven database on consumers who pose a financial crime risk.

The London company in January announced a $30 million funding round to propel it into new markets worldwide and to finance improvements in its machine-learning platform. Its product helps banks, retailers and insurance companies detect financial criminals.

ComplyAdvantage CEO and founder Charles Delingpole said the company already works with some major global banks and anticipates increased demand from institutions in the U.S., where it already has an office. Santander Bank is the only bank partnership the company has made public, a spokesman said.

ComplyAdvantage’s platform has established a database of what Delingpole calls high-risk consumers, who could have potential links to terrorist groups or histories of financial crimes. Banks for years manually built such databases, he said.

“The old way of doing things doesn’t work,” Delingpole said. “We’re constantly improving our process. … The algorithm will be much better over time.”

Smart scanner

Cinnamon AI, based in Japan, announced in January its entry into the U.S. along with $15 million from a Series B equity funding round.

Cinnamon’s primary offering is called Flex Scanner, a document reader the company said is capable of extracting key information from various business documents and converting it into “database-ready” files.

The information is derived from documents such as financial statements, insurance claims, invoices or receipts, to name a few.

Flex Scanner uses natural-language-processing algorithms to read a document’s data fields, whether that information is handwritten or typed. The company claims it is 99.2% accurate in handwriting recognition.

Cinnamon Chief Operating Officer Yoshiaki Ieda said the company began exploring U.S. expansion in the middle of last year and found that banks and insurance companies were clamoring for such a service that helped “eliminate repetitive tasks.”

Investment in AI that performs rote activities could pay dividends, freeing employees to focus on more meaningful tasks, bankers have said.

Cinnamon has opened an office in San Mateo, Calif.

“What we’ve seen in the Japanese market is similar to what we’re seeing in the U.S.,” Ieda said. “That’s why it’s the right timing for us to come to the U.S.”

Modern sales assistance

Zoovu, the only U.S.-based company of the trio, earlier this month announced $14 million in Series B funding to increase investment in AI and behavioral analytics for its digital sales assistant program.

The New York company also plans to use the new funding to expand into the Asia-Pacific region.

Zoovu was not immediately available to comment on its funding round.

While Zoovu works primarily with retailers such as Amazon and Canon, the company has also trained its digital assistants to be well-versed in consumer banking inquiries.

The digital assistant can help bank customers find more information about additional services, such as credit cards and mortgage applications.

That could put Zoovu in a better position to partner more with banks, which seem hesitant to adopt AI for customer-facing virtual assistants despite the popularity of smart speakers like Amazon’s Alexa or bots such as Bank of America’s erica.

Only 5% of respondents in the American Banker survey had extensively deployed AI-powered virtual assistants.

Peter Longo, head of Axiom Bank’s mobile efforts, said AI-powered virtual assistants should become more prevalent as Amazon, Apple and Google smart speakers bring the technology into the mainstream.

“I think that's something that a lot of people weren't thinking about a year or two ago,” said Longo, whose Maitland, Fla., bank has $631 million in assets.

Longo added that he would like to see more AI-focused fintechs specializing in customer analytics.

Banks are increasingly handling more customer data and would like to manage it better to “properly engage” consumers, he said.

“I think the AI-related fintech companies help with both sides of that spectrum,” Longo said. “One would be to help with customer engagement, understanding when and how to interact with customers. But they can also help from an operational efficiency standpoint and create better processes” in that area.