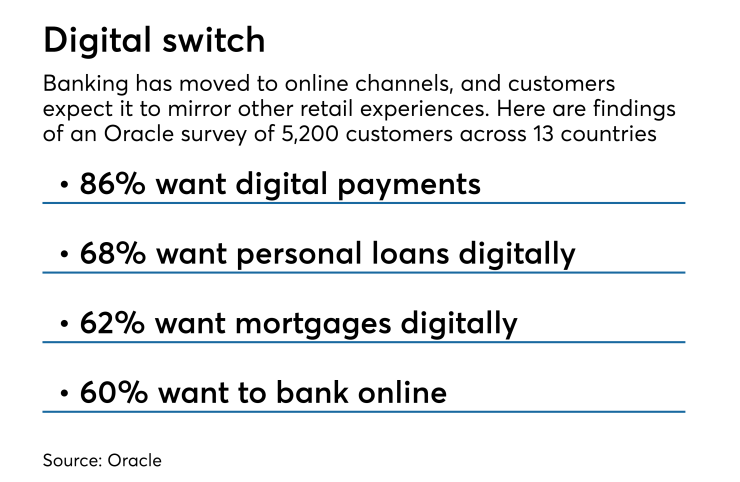

One of the dominant themes at the recent Oracle Industry Connect conference was that banking customers are not in a state of transition to digital anymore — they are all digital now.

That should be reason enough for every bank to get motivated and create better digital experiences for customers, said Ron Suber, a former president of the online lender Prosper Marketplace.

But whether an institution is drawing up plans on how to respond to big tech firms entering the banking market, or engaged in an effort to overhaul legacy systems, Suber said, the guiding emotion shouldn’t be fear. Instead, he said, bankers should embrace a “golden age of fintech.”

“You’re either as scared as you ever were, or you are as excited as you ever were,” he said.

Indeed, top tech executives at KeyCorp displayed a renewed spirit after the Cleveland company announced it was investing in entirely

“We have to think about, if we were born today, how would we design the branch?” said Vipin Gupta, chief information officer at Key Community Bank Technology. “It doesn’t mean we wouldn’t have them, but how would they be different?” (Key Community Bank is the business unit that encompasses KeyCorp's consumer banking, mortgage banking, private banking, investment services, business banking and commercial banking.)

Key’s goal is to use digital to enable self-service when appropriate, while gearing the branch towards serving customers with issues best suited for a one-on-one request.

“We’re looking at every client interaction from the outside in and asking: Why do they come to the branches?” Gupta said. “We want to give the option of self-service" when appropriate, "but digital is incomplete without the human touch.”

Technology companies delving into financial services that aren’t hindered by legacy systems and processes can act on customer data to deliver more customized, relevant experiences, Suber said. This includes not only fintech startups, but big tech companies like Google and Amazon who are “absolutely coming for banks” he said.

“The most valuable asset in the world right now … is not oil, not gold, but data,” he said.

To determine which actions are more likely to be done in a branch versus a digital channel, Gupta said, Key leans heavily on analytics to gauge customers’ preferences. Over the last half decade or so, Key has made

“You can’t deliver a digital experience not powered by analytics,” said Amy Brady, the bank's chief information officer. “The journey is never over and we are constantly monitoring data to deliver better experiences to clients and give them choices in how they interact with us.”

Transforming the digital experience for retail clients isn't the only action item for banks; many are also looking at improving the commercial client digital experience. It could be said that’s an area that has

“We move about $4 trillion each day around the world,” said Amit Verma, global product manager for treasury and trade solutions at Citi. “My client base is treasurers, CFOs and others in the finance world and they’re used to watching movies on their mobile device, making P-to-P payments digitally," he said. "When they show up to work they want a similar experience. Banks have been relatively lazy in this area … and CFOs are demanding better technology.”

For example, a company doing business in many different countries may typically have to open up new accounts for each country where it does business, Verma said.

“They get treated like a new customer each time; they have to fill out 10 different forms. It’s a terrible client experience,” Verma said. For that reason, Citi is looking at solutions such as offering virtual accounts, which can make and retrieve payments on behalf of one physical account.

Banks can also leverage application programming interfaces to better serve commercial clients, said Judd Holroyde, head of global product management at Wells Fargo. This means instead of having to connect “with seven different places” within a company to enable a payment, the firm can use APIs to make a payment directly to the beneficiary. The bank is also looking at using blockchain technology to help enable quicker cross-border payments for clients, he said.

So while banks can’t replace all their legacy technology in one fell swoop, they can take advantage of technology like APIs and blockchain to offer immediate improvements while working to improve the overall enterprise.

“To change everything at the same time is unreasonable, if not unrealistic, but we can be more agile and do it in a kind of transitional way,” he said.