Prominent bank investor Larry Seidman is urging Flushing Financial Corp. in Uniondale, New York, to sell itself to a larger bank focused on the Asian American market.

The $9.1 billion-asset Flushing, parent to Flushing Bank, has built a large book of business among Asian American businesses and consumers in the New York metropolitan area. In a presentation it published July 29, along with its second-quarter financial results, Flushing reported deposits to Asian American customers totaling $1.3 billion, along with loans of $745.5 million.

Adding to its Asian American client base is central to Flushing's success, President and CEO John Buran said last month on a conference call with analysts discussing the company's second-quarter financial results. "This market, with its dense population and a high number of small businesses, continues to be an important opportunity for us and one that we believe will drive our success moving forward," Buran said on the July 30 call.

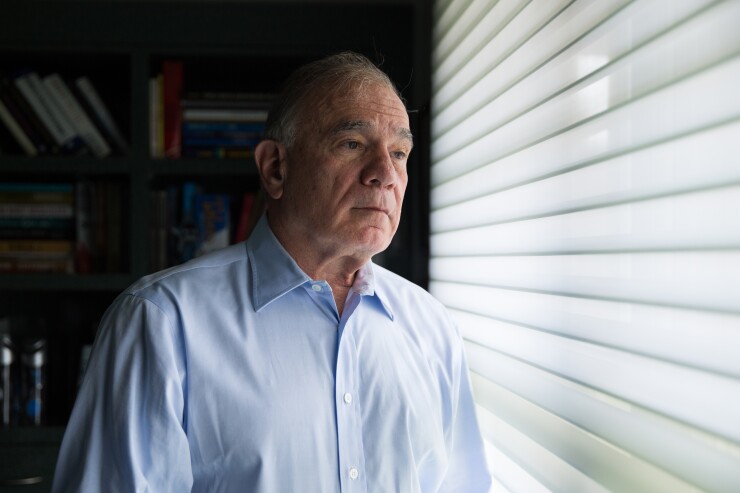

Flushing estimated its Asian American deposits amount to about 3% of the total in the region and 19% of the bank's $6.9 billion in total deposits. Seidman said Friday in an interview that "the only way shareholders can make a return on their investment is for the bank to be sold." Flushing's performance "has been horrible the past two years," Seidman said. A veteran bank investor, Seidman said he recently laid out his concerns in a letter to the company. "I'm a concerned shareholder. I expressed my view. That's what I do," Seidman said.

Seidman did not name any potential partners for Flushing.

Flushing reported net income totaling $5.3 million for the quarter ended June. 30. The total was up more than 40% sequentially, but down about 40% from the same three-month period in 2023. While credit quality remained solid — Flushing reported net recoveries for the quarter ending June 30 — the $6.8 billion loan portfolio was essentially flat with the June 30, 2023, level. At the same time, securities, which totaled $1.6 billion, were up 30% from March 31 and more than 70% from a year ago. Seidman singled out the securities increase for particular criticism. "Are they a securities firm or a bank?" Seidman asked.

Buran declined to comment on Seidman's letter. Speaking on the July 30 conference call, Buran said Flushing's performance has been impacted by high interest rates, tepid loan demand and what he termed "aggressive deposit pricing" by larger competitors.

Flushing's second-quarter results prompted at least one analyst, Piper Sandler's Mark Fitzgibbon, to reduce his rating, from overweight to neutral. "We believe that [Flushing] should trade below peers given our expectation for continued sub-peer profitability levels," Fitzgibbon wrote July 30 in a research note.