The American Bankers Association has stepped up its opposition to the Current Expected Credit Loss standard.

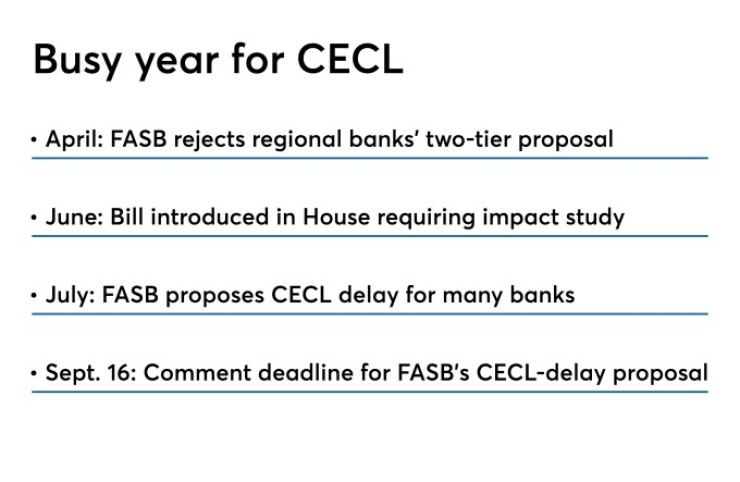

Already on record favoring an indefinite, across-the-board delay of the new standard for recording loan losses to allow time for a qualitative impact study, the association filed a

Through Monday afternoon, 72 individuals and groups had submitted comment letters.

FASB had been seeking comment on a proposal to

Large publicly traded banks are scheduled to convert to CECL in January.

The ABA’s letter repeated claims that CECL is “procyclical” and would lead banks to stockpile loan-loss reserves during a downturn, depleting capital and reducing lending.

“If accounting then makes loss reserves overstated during the downturn, it further exacerbates the procyclicality,” Michael Gullette, the association’s senior vice president, tax and accounting, wrote in the comment letter.

By contrast, the Independent Community Bankers of America filed a letter Monday supporting the FASB proposal.

“Extending the [CECL] model out to 2023 for small community banks will provide these institutions with the additional time needed to understand the disclosures required in the financial statements and refine critical component inputs into their loss estimate forecasting,” wrote James Kendrick, the ICBA's first vice president, accounting and capital policy.

Adding to his fears about CECL's effect on lending, Gullette raised concerns that audit firms aren’t ready for the new standard. He cited recent proposed changes to auditing standards that

“No audit should be performed until there is a generally accepted understanding of the key issues and how such issues should be addressed,” Gullette wrote. “With such little time to digest auditing standards that are meant to challenge management bias in accounting estimates, CECL represents a change that greatly expands the potential for management bias in its estimates.”

The ABA paired its Sept. 13 comment letter to FASB with one it sent

“Starting the auditing process at this point is setting up banks and/or auditing firms for failure,” Gullette wrote the AICPA. He dispatched his letter in response to the AICPA’s call for comments on its pending proposed statement of auditing standards.

Robert Dohrer, the accountant group’s chief auditor, said Monday his group “received the comment letter and will address the comments in the ABA letter that run to the Audit Evidence Exposure Draft.”

The ABA's letters came less than a week after FASB board member Hal Schroeder, one of CECL’s most vocal proponents, told an audience of more than 1,000 accountants attending AICPA’s National Conference on Banks and Savings Institutions that, while he favored additional study of CECL, he

To counter the ABA’s procyclicality claims, Schroeder said he believed "concerns about CECL’s impact on lending are misplaced."

A FASB spokesperson declined to comment on the ABA’s letters.

Approved in 2016, CECL requires lenders to predict and record a loan's lifetime credit losses at the time it is booked.