Early in the second half of 2019, many banks find themselves staring down a different set of uncertainties than they did a year ago or even early this year.

Now the guessing game is about how far the Federal Reserve might cut rates and how to react. On the one hand, lower rates could tighten margins after a long period of expansion and trim interest income. On the other hand, they might spur more mortgage production and de-escalate pricey competition for deposits.

Regional banks have especially crucial decisions ahead as they try to compete with megabanks spending billions on new technology, while attempting to fend off immense investor pressure to rein in costs.

Bruce Van Saun, chairman and CEO of Citizens Financial Group, put himself squarely in the camp of bank executives defending the long view.

"We’re not trying to cost cut our way to glory,” Van Saun said in an interview Friday after his bank reported second-quarter results. “I want to keep looking for the next opportunity where we can find that revenue growth and differentiate ourselves. A healthy bank is growing its revenue stream, it’s adding customers, and that provides the ability to invest in the next thing.”

Van Saun outlined some strategic priorities over the next year or two, part of an ongoing efficiency initiative called Tapping Our Potential. In keeping with his comments about staying growth-minded, he emphasized things that would enhance revenue.

For instance, payments at the point of sale are one area where he thinks the $162.7 billion-asset Citizens can improve. He also wants to beef up digital offerings for commercial customers, especially those in the small-business to lower-middle-market range. And separately from the efficiency program, Van Saun also says he would be happy if the Providence, R.I., company could do a couple of small nonbank deals each year.

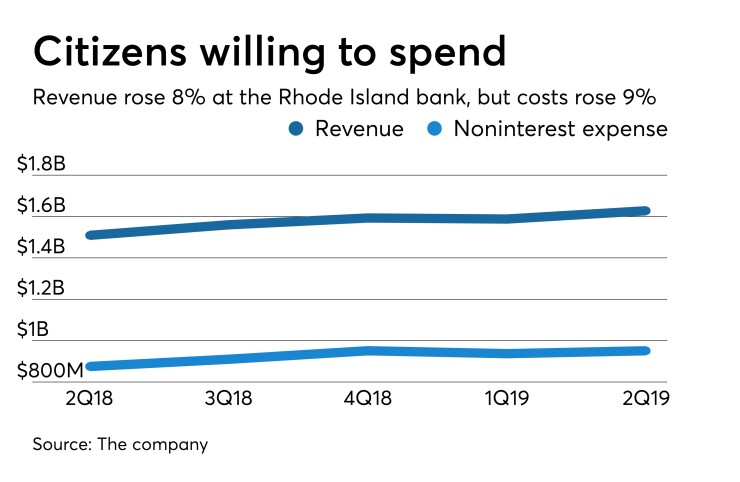

Again, the company has shown a willingness to spend on those high-tech efforts and other initiatives. Expenses rose 9% year over year to $951 million in the second quarter, including a 12% increase in employee salaries and benefits to $507 million.

That slightly outpaced total revenues, which increased 8% to $1.6 billion. Net interest income rose 4% to $1.2 billion. At 3.21%, the net interest margin was flat.

Overall, net income rose 7% year $453 million. Earnings per share came in at 96 cents.

Growth across a variety of fee businesses helped offset the flat loan margins; noninterest income increased 19% to $462 million. Capital markets fees rose 19% to $57 million, trust and investment services fees rose 23% to $53 million, and mortgage banking revenue rose 130% to $62 million.

Citizens has already benefited from lower mortgage rates in the second quarter, as more customers applied for new home loans or refinanced. Van Saun said Citizens has a healthy mortgage production pipeline early into the third quarter and should be well positioned for continued growth in mortgage banking revenue.

Acquisitions have also been a key to Citizens’ fee-income strategy. In the past 18 months, Citizens has

“But it’s not a huge shopping list,” he said. “It’s got to be the right firm that brings those capabilities or has a culture that we think is going to plug into our culture. ... If we find two a year that fit like that, I’d be really happy.”

Deposits increased 7% to $123.1 billion. Deposits at Citizens Access, its online bank launched last year, totaled $5.4 billion at the end of the second quarter, up from $4.6 billion at the end of the first.

Declining interest rates should help to bring deposits costs in line, too. Van Saun said that Citizens had already begun to reprice some of its deposit products downward in the second quarter. He pointed out that deposits grew at Citizens Access even as it adjusted rates and said he is not worried that customers will switch to other banks if it lowers deposit rates further.

On the credit side, total loans and leases grew 4% to $117.8 billion. Commercial loans and leases rose 6% to $57.9 billion, while consumer loans rose 3% to $59.9 billion.

Van Saun said that Citizens has been walking away from commercial lending deals it does not like for one reason or another. He said that competition has been “pretty intense” and that it's coming from large and small banks alike, as well as nonbank lenders. Leveraged lending and commercial real estate are two areas he’s keeping an eye on, he added.

“It’s always good to hold your discipline through any market environment,” he said. “I think this is a tricky market environment and we’re prepared to sacrifice a little loan growth to hold that discipline.”