Officially, new restrictions on paying shareholder dividends amid the pandemic only apply to 33 large banks.

But industry analysts are now anticipating that the Federal Reserve Board’s recently imposed requirements —

“Generally there’s trickle-down regulation,” said Brian Kleinhanzl, an analyst at Keefe, Bruyette & Woods. He noted that the suspension of share buybacks that was first announced by eight big banks on March 15 has since spread to regional banks and even smaller institutions.

Even if the Fed does not explicitly apply the new dividend restrictions to banks with less than $100 billion of assets, Kleinhanzl expects those companies to comprehend the central bank’s message. “I think it’s a subtle nudge,” he said.

If more banks are eventually forced to cut their quarterly payouts to shareholders, it will be due to the toll the coronavirus recession is taking on bank profits. Many banks significantly boosted provisions for loan losses in the first and

Moreover, regional banks tend to be more dependent than the biggest banks on interest generated from loans, a component of earnings that is suffering amid the pandemic as a result of low interest rates.

Midsize banks are expected to feel the earnings pain even more acutely than their larger peers because they don’t have large capital markets businesses to help offset declines in interest income, Scott Siefers, an analyst at Piper Sandler, said in an interview.

“We should see some bifurcation in performance,” he said.

So far, Wells Fargo is the only U.S. bank to announce plans to reduce its dividend in the third quarter. But KBW is forecasting that the $59 billion-asset CIT Group, which is not among the nearly three-dozen large banks recently stress-tested by the Fed, may also have to cut its dividend.

Estimated dividends to be paid by New York-based CIT Group in the second quarter amount to 141% of the firm’s average net income over the four previous quarters, according to a KBW calculation.That’s well in excess of the 100% bar established by the Fed for banks that were stress-tested.

If the Fed’s restrictions remain in effect for the fourth quarter of 2020, dividends paid to shareholders at four other regional banks may also have to be cut, according to KBW analysts. That group includes Citizens Financial Group in Providence, R.I., Huntington Bancshares in Columbus, Ohio, and KeyCorp in Cleveland, all of which were stress-tested by the Fed, and Dallas-based Comerica, which was not.

The $177 billion-asset Citizens, the $113.8 billion-asset Huntington and the $155 billion-asset Key have all vowed to maintain their dividends in the third quarter, but they haven’t commented on what may happen beyond that point.

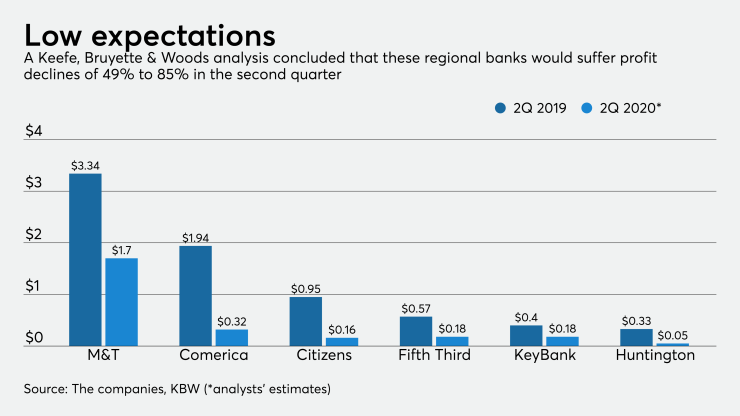

KBW analysts projected that per share at large regional banks would fall by 74% year over year in the second quarter. Declines of more than 80% are expected at Citizens, the $76.3 billion-asset Comerica and Huntington.

Profits at big banks are expected to hold up better, by and large. KBW projected that earnings at nine large banks would fall by about 25% compared with the second quarter of 2019. One outlier is the $1.9 trillion-asset Wells Fargo, where Kleinhanzl is projecting a 98% decline in earnings per share.

Wells Fargo CEO Charlie Scharf said this week that he expects the bank’s allowance for credit losses to grow by a substantially larger amount in the second quarter than it did in the first three months of 2020, when the allowance increased by 18%, to nearly $11.3 billion, from a quarter earlier.

Across the banking industry, second-quarter earnings will be hurt by larger provisions, as lenders brace for a coming wave of defaults by consumers and businesses. KBW analysts project that reserve builds will peak in the second quarter, while Piper Sandler analysts anticipate that median bank provisions will decline by 10.5% in comparison with the first quarter.

The mortgage business is expected to provide one bright spot for banks, since volumes have been boosted by low interest rates, and profit margins have been soaring.

Analysts at Autonomous Research wrote in a recent research note that the gain on sale on mortgages, which represents the difference between the rate paid by the borrower and the rate paid for loans on the secondary market, could reach an all-time high in the second quarter.