Want unlimited access to top ideas and insights?

Last year could have been a reputational disaster for Truist Financial. When the COVID-19 pandemic struck in early 2020, the company was just starting to blend the franchises of BB&T and SunTrust into one after their coupling in 2019.

Mergers often reveal organizational weaknesses, and the pandemic brought major new challenges for all businesses. So much so that most U.S. industries suffered a decline in their reputation over the past year, according to RepTrak, a Boston-based reputation research company.

But Truist successfully managed a slew of potential disruptions. Organization and leadership emerged as key strengths, helping drive up its reputation score in a meaningful way among both customers and noncustomers, based on the results of the annual American Banker/RepTrak Survey of Bank Reputations.

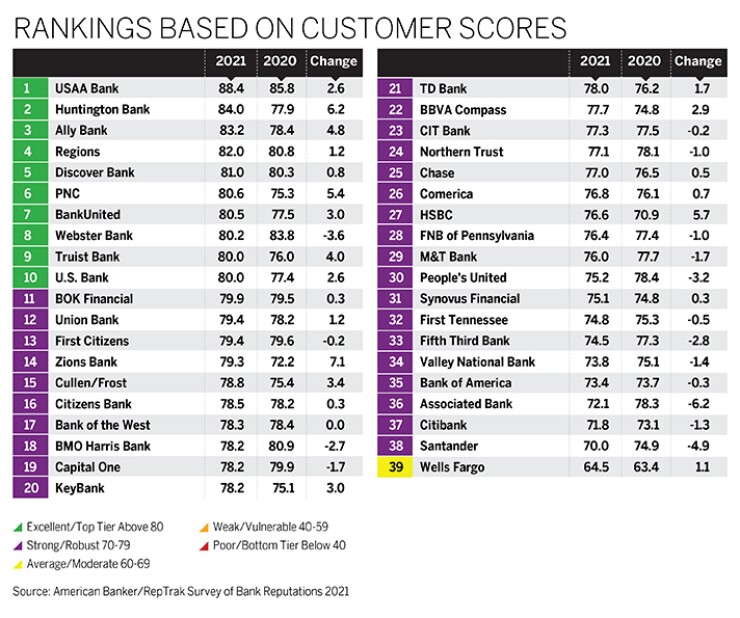

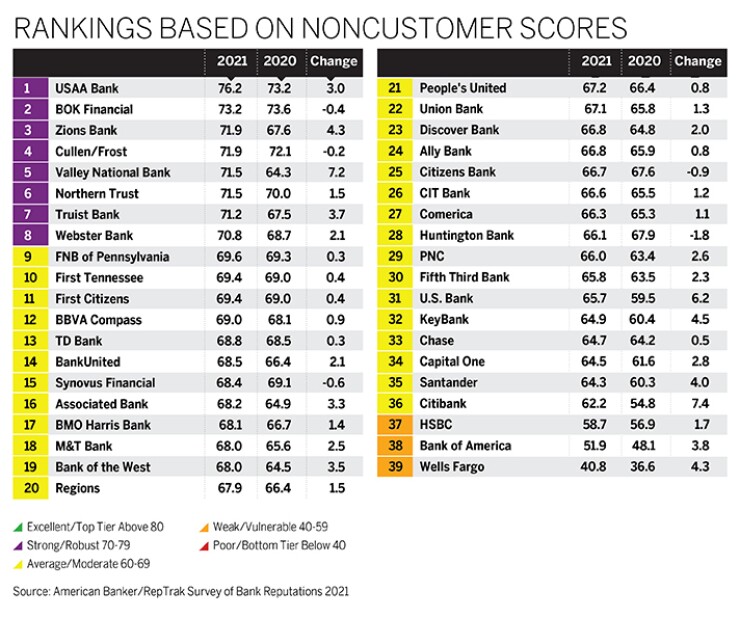

The banking industry overall not only retained the reputational strides made in the first half of 2020 amid the onset of the pandemic, but also continued to build on that, according to the survey, which measures consumer perceptions of 40 of the country’s largest banks. Truist was among the biggest gainers. Its reputation among customers moved into “excellent” territory, one of 10 banks now scoring at that level, up from five banks last year.

Truist executives attribute the performance to an intentional effort. Throughout the merger, the company, now with $522 billion of assets and based in Charlotte, North Carolina, has focused on creating a “delightful migration experience” for its customers, said Dontá Wilson, its chief digital and client experience officer.

The first steps included creating a client integration and insights team that took all customer interactions into account, whether digital or in the branch, Wilson said. The team examined every change that would affect customers, identified potential pain points and collaborated with others across the company to devise solutions.

“We mapped out over a thousand different treatment plans,” Wilson said.

The team then tested various scenarios with actual customers, solicited feedback and made modifications where necessary. The work included figuring out a way to avoid changes to customer account numbers, one of the most fraught aspects of any merger.

Truist also is planning a digital-first migration, Wilson said. Many post-merger conversions take place in a big bang over a single weekend. Truist is taking a phased approach.

Before changing signs on its branches and converting its core systems, it is rolling out a new mobile experience for customers. This allows Truist to gather feedback and fine-tune its processes while removing some of the risk from the rest of the conversion, Wilson said. If any systems do go down, customers will still have mobile access.

The focus on customers starts with Truist Chairman and Chief Executive Kelly King, Wilson said. King — who enjoys a strong reputation himself, according to RepTrak — has been a vocal champion of a culture where customer care is paramount, consistently reinforcing the message in meetings and earnings calls, he said.

“It’s not just words on paper,” Wilson said. “It’s lived every day.”

Still rising, but more slowly than last year

After a year of COVID-19 lockdowns and mask mandates, the reputation of many industries suffered. Retailing, for instance, fell from its No. 1 spot in 2020 down to No. 8 this year, with a score of 70.8 out of a possible 100, according to RepTrak. The sector’s score last year was 75.6.

Banks were among the few sectors that made gains, alongside diversified financials and pharmaceuticals/biotech/life sciences. The latter enjoyed a bounce as vaccines helped curb the pandemic in the first half of 2021.

In the Survey of Bank Reputations this spring, the banking industry as a whole scored a 70.3, which is up just enough to be rated as “strong.” It also cracked into the top 10 among the 16 industries that RepTrak rates.

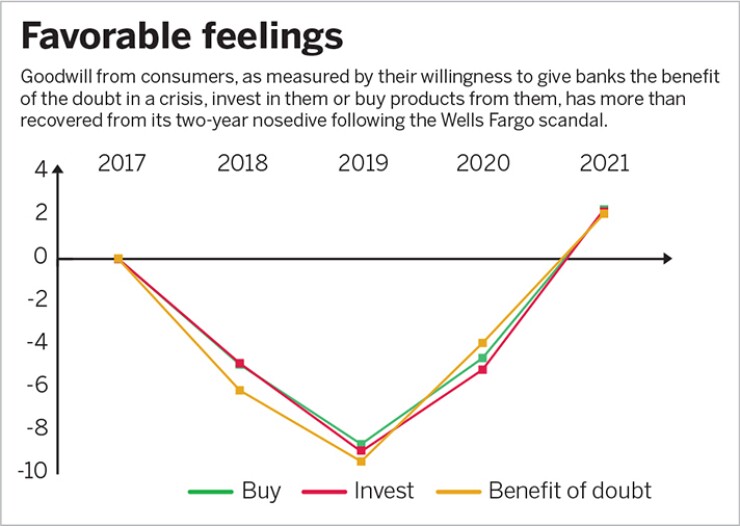

The higher a reputation score is, the more willing people are to do business with a company, invest in it and give it the benefit of the doubt in a crisis, based on RepTrak’s research. And in the case of banks this year, goodwill got an even higher boost than the reputation score itself, which is unusual, said Sven Klingemann, a director at RepTrak (formerly called the Reputation Institute).

The benefit extended to consumer perceptions of risks that traditionally weigh on bank reputations, ranging from data breaches to deceptive sales practices. Both customers and noncustomers gave those things less weight this year than in past years.

The shift in perspective might be due to actions banks took to help financially struggling consumers during the pandemic, Klingemann said.

Nonetheless, the banking industry’s 1.6-point overall reputation gain in 2021 was smaller than last year’s 5.4-point gain, and the survey findings offer some insight about how and where banks can continue to improve.

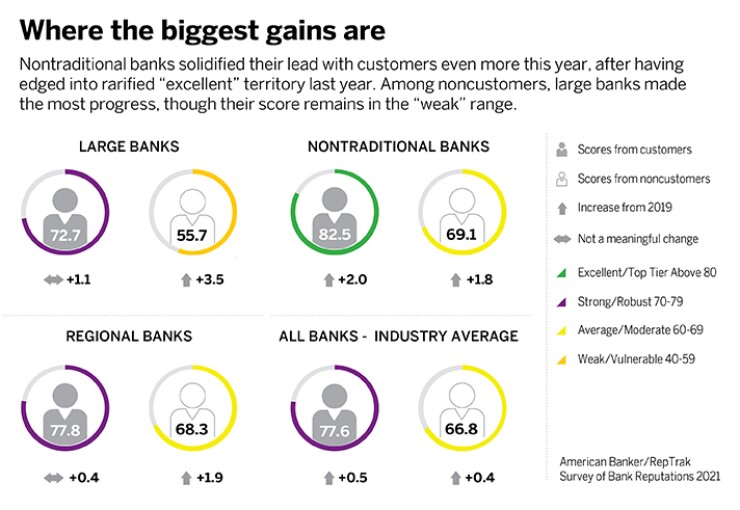

The need to do better is particularly acute for large banks, which made progress, but continue to lag regional and nontraditional banks among both customers and noncustomers.

“There’s not a lot of ‘I love you’ in there,” Klingemann said of the sentiment toward the large banks.

Areas of weakness include governance, which RepTrak defines as being open, ethical and transparent. This has grown in importance for large banks, accounting for more than a fifth of their reputation scores among both customers and noncustomers in the 2021 survey.

Governance also is a top reputation driver for regional and nontraditional banks.

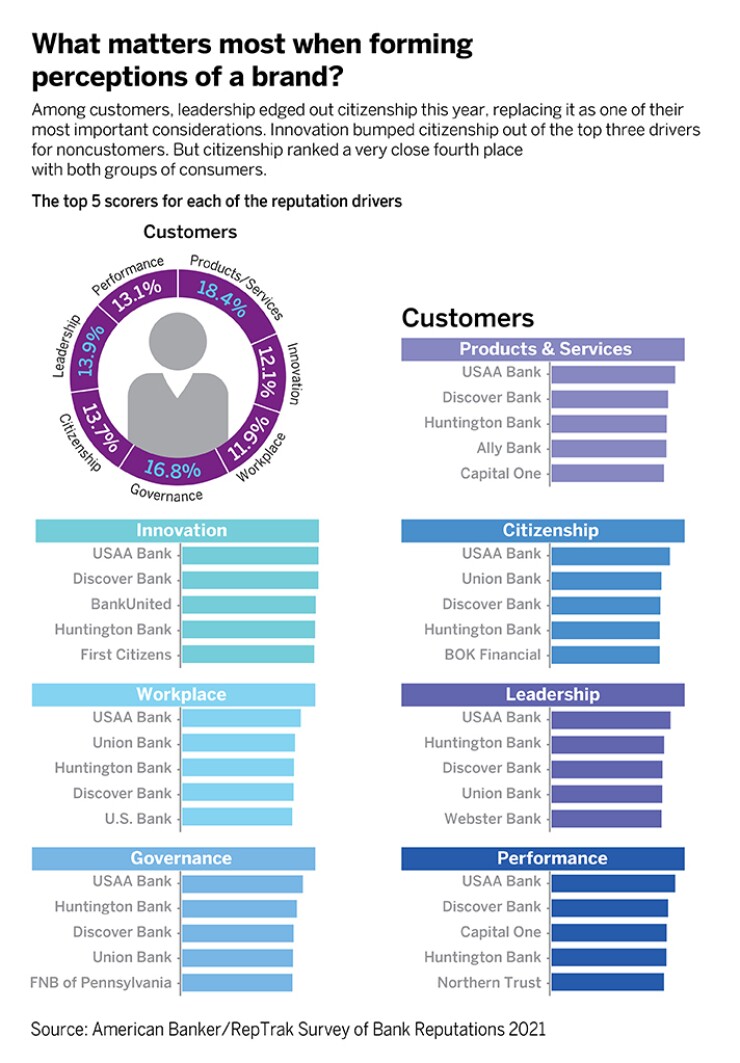

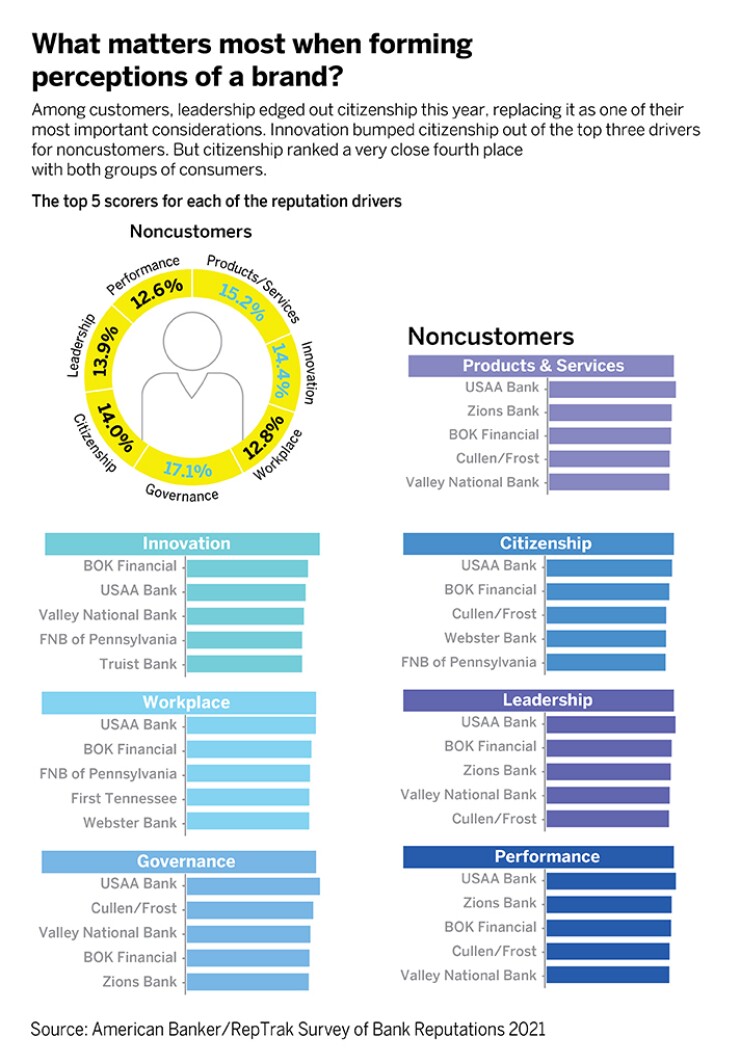

Besides governance, the survey takes into account six other reputation factors, including innovation, citizenship and executive leadership. Each year there tend to be shifts in which factors are the biggest drivers of bank reputations, and this year the factors that mattered most to customers and noncustomers were products and services, followed by governance.

For customers, leadership rounded out the top three, and for noncustomers, it was innovation.

Framing the conversation

The survey also measured consumer perceptions of the pandemic response from banks, which proved to be a highlight. Banks came through with loans from the Small Business Administration’s Paycheck Protection Program, and generally helped customers and employees alike navigate the financial hardships of COVID-19.

Discover had something of a head start. The $110 billion-asset bank operated by the credit card giant modeled some of its pandemic relief measures after what it typically rolls out for a local disaster, only they were offered nationwide, said Roger Hochschild, Discover’s president and CEO. The bank earned an “excellent” reputation score among customers for the second year in a row, one of only four to do so in back-to-back years.

The measures that Discover implemented included skip-a-payment plans, waived fees for tapping into certificates of deposit and emergency credit line increases, said Hochschild, who applauded regulators for quickly approving new programs. “It was a good moment for the financial services industry in terms of how quickly we were able to react,” he said.

As they helped customers, banks were concerned about their own fortunes. They set aside extra money for bad loans and prepared for a rocky year. But as the pandemic wore on, bad loans failed to materialize in large numbers and bank profits held up.

Nearly three-quarters of all banks insured by the Federal Deposit Insurance Corp. reported a year-over-year increase in net income in the first quarter of 2021. The average return on assets was 1.38% for the first quarter, up a percentage point from the same period a year ago and up 28 basis points from the final quarter of 2020, according to the FDIC.

But rising income brings its own reputational risks, particularly during a period of crisis. It’s important to present the information in a way that is less likely to be perceived negatively, Klingemann said.

Consumers care about how much a bank earns, but even more so about what its profits allow it to do, he said. So focusing on what banks stand for, how they are navigating the post-COVID environment and what they are doing to contribute positively to society matters.

Discover focused on getting details out about its numerous relief efforts, including the creation of a $5 million grant program to support Black-owned restaurants, which were disproportionately harmed by the pandemic. “2020 was a unique time in terms of what I would say was a call to action around social awareness,” Hochschild said.

Discover also unveiled plans in March to establish a call center in Chatham, Illinois, a majority-Black neighborhood on the South Side of Chicago. At full capacity, the center is expected to employ nearly 1,000 people, including customer care representatives starting at $17.25 per hour.

“That’s something we did because we felt that every company should be doing its part to bring opportunity to those neighborhoods,” Hochschild said. “Frequently, they are Black and Brown neighborhoods that have been underserved and have not seen the same types of opportunities that other areas have.”

What’s providing outsize impact

For many banks over the last year, CEOs like King and Hochschild emerged as key spokespeople confronting the twin challenges of the pandemic and the movement for racial justice. As a result, the reputation of the CEO came to weigh more heavily in perceptions of bank reputations as a whole, according to RepTrak.

With the higher profile of CEOs in overall communications, more customers came to know who their bank’s leader is. According to RepTrak, 30% of customers said they were familiar with their bank’s CEO this year, up from 25% in 2020 and 15% in 2019.

For noncustomers, familiarity stayed roughly the same this year as it had been last year, at around 15%. But even so, the noncustomers who were familiar with specific bank CEOs tended to give them higher ratings than they had received in the previous year.

Large-bank CEOs improved the most — 11.7 points — raising their collective reputation score from “weak” to “average.” Regional bank CEOs were the only ones to earn a “strong” reputation score from noncustomers.

Read more insight from the Survey of Bank Reputations:

Stepping up: How the pandemic response boosted bank reputations (2020 survey) A lesson in crisis communications and how it gave regional banks an edge over bigger rivals (2020 survey)

Regional banks enjoyed a similar edge in their COVID-related communications, even though a year into the pandemic, attention spans waned. Perhaps it became more of a struggle to get noticed by bank customers because they were less inclined to worry about what their bank was doing in a crisis that many believed to be winding down.

Among regional bank customers, 41% said they were aware of their bank’s COVID communications and actions in 2021, down from 44% in 2020. But that was much higher than the 23% recorded for customers of nontraditional banks and the 15% recorded for those at large banks this year.

The messages that did break through the noise landed with more impact, Klingemann said. All types of banks scored an “excellent” reputation among customers who actually recalled their bank’s COVID communications.

“We hear you less. But when we hear you, we rate you better than how we used to on how you responded to the crisis,” Klingemann said, summing up the consumer perception, which held true for both customers and noncustomers.

For Discover, communication was as much about reaching out to customers as it was making sure customers could reach the bank when they had problems, Hochschild said. It hired thousands of call-center reps during the pandemic, he said, noting that the bank operates solely online.

Hochschild suggested that Discover’s call-center experience and bandwidth may have been an advantage over traditional banks, which closed branches during the pandemic and had to staff up call centers to handle the surge in inquiries from customers who would normally have gone to branches.

“Customers were able to get through to us, and I think frequently it was a situation where they were calling multiple providers,” Hochschild said. As a result, customers could compare their experiences.

Looking ahead, RepTrak’s Klingemann urged caution for traditional banks, saying they might want to pause before they undertake another round of branch closings. The pandemic kicked a lot of financial transactions to online and mobile channels. But as COVID-19 ebbs, a significant chunk of customers said in the survey that they plan to resume their usual branch usage, particularly at regional banks. Just over 50% of regional bank customers said they are more likely to use in-person services in the future, compared with around 40% for large banks, according to RepTrak.

Where to focus now

While reputation scores offer a glimpse into what worked in the past, they also shine a light on what banks can do going forward to polish their reputations.

RepTrak divides reputational drivers into three broad baskets: areas of strength that companies can build on; neutral factors that can be lifted into positive territory; and weaknesses where companies have an opportunity to get better.

Among the strengths for all banks are products and services. Banks are getting credit for standing behind high-quality products that meet customer needs.

However, banks in general are seen as weak when it comes to innovation, in particular being first to market with desirable new products and services.

Innovation is increasingly important to bank reputations, though. “Customers are looking for a partner that is continually upping their game in terms of the value that is provided,” said Hochschild.

Discover consistently ranks in the top five for innovation in the annual survey.

Truist also is hoping to make an impression when it comes to innovation. The bank plans this year to open a 100,000-square-foot innovation and technology center, Wilson said, adding that the center is purposely located at Truist’s headquarters.

“We want it to be part of the core DNA of who Truist is,” he said.

Nontraditional banks, meanwhile, have the most work to do in the workplace category, which measures perceptions of how well employees are treated. The pandemic was a stress test of sorts for the mantra, shared by many companies today, that taking better care of employees results in employees taking better care of customers.

Discover, however, stood out from other nontraditional banks and saw an increase in its workplace score, according to the survey. Like many other companies, Discover hurriedly set up employees to work from home in March 2020. At the same time, it ramped up efforts at connectivity and engagement, said Hochschild, noting that he wrote weekly letters to all employees and made random calls to individual employees on a regular basis.

The company also devoted more attention to employee well-being and mental health, for example, by encouraging people to use their paid time off, Hochschild said.

“We learned some lessons during the crisis that we want to make permanent,” he said.

Survey methodology

Company selection:

- Companies drawn from the Federal Reserve's list of large commercial banks, with final selections by American Banker based on total assets and deposits.

- Only those with significant retail brands were considered.

Ratings:

- Ratings were collected via online questionnaire in April 2021.

- At least 100 customers and 100 noncustomers rated each company, with more than 13,000 respondents overall.

- Each respondent was very or somewhat familiar with the companies they rated.