-

The payments network will now allow merchants to offer discounts to customers who use specific cards, as new CEO Charles Scharf rethinks how Visa does business.

February 22 -

Any new state laws on the issue would likely strengthen the bargaining power of Visa and MasterCard in negotiations with retailers over swipe fees.

February 7 -

The rise of the prepaid card is sure to be one of the Durbin Amendment's biggest legacies. It also suggests any savings merchants derive from the law will be short-lived.

November 8

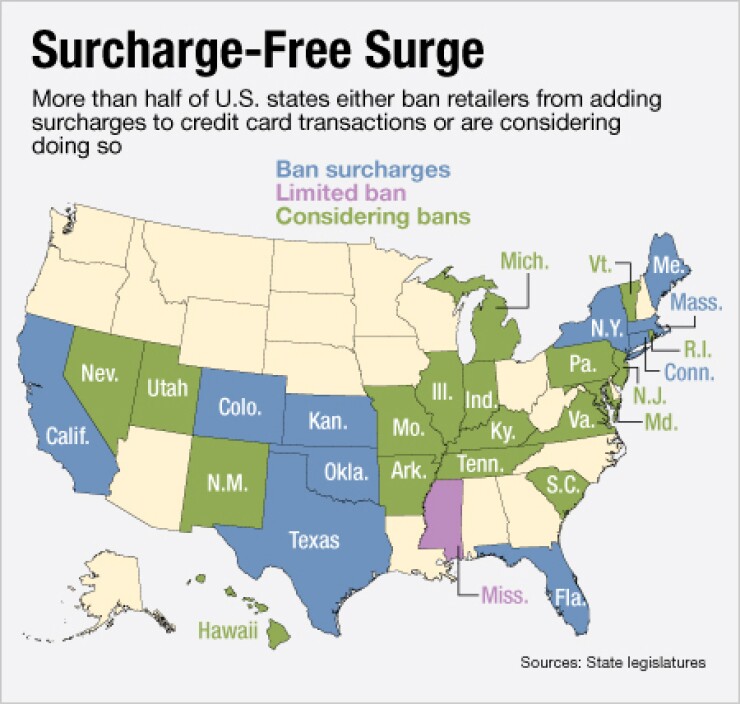

Eighteen states are now considering legislation that would bar retailers from imposing surcharges when consumers use their credit cards.

The state-level proposals come in the wake of new rules that allow would merchants - for the first time ever - to impose surcharges on MasterCard (MA) and Visa (NYSE:V) purchases that could help them recoup the swipe fees they pay to the card networks.

Prior to the rule change, 10 states had already imposed bans on credit card surcharges, which limited the potential impact of the new rules.

Proposals to outlaw the fees are pending Arkansas, Hawaii, Illinois, Indiana, Kentucky, Maryland, Michigan, Missouri, Nevada, New Jersey, New Mexico, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Vermont and West Virginia. (American Banker previously reported that nine states were considering surcharge bans.)

Few, if any, merchants have yet to add surcharges to card transactions because most fear that doing so would spark a customer backlash, sending business to their competitors. Indeed, the proposals to ban surcharging are being touted by their backers as consumer-protection measures.

Still, merchants fiercely oppose the bills because, if passed, their options for recovering income lost to interchange would be limited.

"This is simply a way to hide the fact that Visa and MasterCard charge exorbitantly high prices," David Vite, president of the Illinois Retail Merchants Association, told American Banker in February. "We think it's unnecessary. We think it's an overreach."

Banning surcharging would also remove a key bit of leverage banks would have in price negotiations with the two card networks.

Of the 18 states that are now considering legislation to ban surcharging, the issue has progressed furthest in Utah, where a bill has been sent to Republican Gov. Gary Herbert. The bill is currently under review by the governor's office, according to a spokesman.

In New Jersey, a bill has passed the state Senate, but the state Assembly has yet to vote on the measure.

One state not on the list, Mississippi, enacted a very limited ban on credit card surcharges last week. The new law applies only to transactions made with credit cards issued by the state government.

And lawmakers in one state that was previously mulling a ban on credit-card surcharges, Washington, have opted not to.

The proposal in Washington state was amended merely to require that retailers provide notice to their customers when they impose surcharges. Such disclosures are already required under the MasterCard and Visa rules.

Meanwhile, legislation to relax an existing ban on credit card surcharges has been introduced in Maine, one of the 10 states that currently prohibit surcharging. The other nine states are California, Colorado, Connecticut, Florida, Kansas, Massachusetts, New York, Oklahoma and Texas.

The new MasterCard and Visa rules to allow credit card surcharges are part of the proposed settlement of a class-action lawsuit filed by merchants against the two card networks.

The settlement deal is being opposed by many large merchants and their trade groups, largely because it allows the two companies to continue setting credit card swipe fee prices.