-

Income volatility is a persistent problem for millions of U.S. households. Banks and fintech companies are trying to help consumers cope — but the industry can do more.

April 24 -

Student-run branches at five California high schools create a wide "ripple effect" in communities that often don't trust banks.

April 24 -

How can banks improve performance while dealing with low interest rates and high regulatory expenses? One effective strategy is to bulk up, as shown by our annual ranking of the top 200 banks with less than $2 billion of assets.

April 26 -

The bank uses machine learning to customize content in real time on its website for every user, based on their behavior during their session.

April 26

-

Monetary policy was intended to act as an accelerant for an economy in recession, and did in fact accomplish that goal early on; however, its benefits have waned, if not reversed, over time.

April 24M&T Bank -

We asked microfinance organizations around the country about the challenges they face, what they wish banks would do differently, and even what they are reading. Here are some of their responses.

April 24 -

The Office of the Comptroller of the Currency’s proposal to require fintech charter applicants to draft and comply with a financial inclusion plan appears to have more teeth than similar Community Reinvestment Act requirements for banks.

April 3 - Finance and investment-related court cases

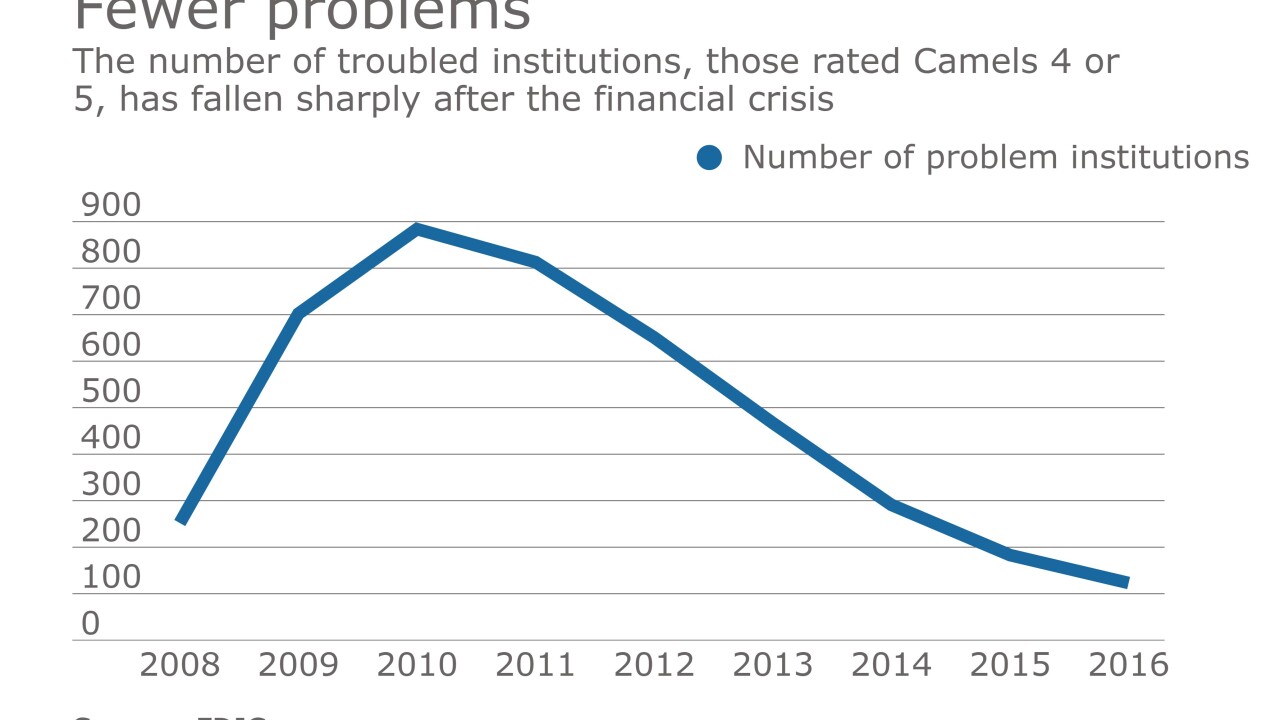

A bank took the unusual step of suing the FDIC over its Camels rating of 4 in a case that could set an important precedent for the industry.

March 20 -

Data and analytics tools can help banks detect financial patterns that may indicate that human trafficking is occurring.

March 29 -

The credit bureaus will change the way they include information about tax liens and civil judgments in credit reports. This could spur lenders' use of alternative credit data.

March 30 -

Upgrade, an online lender started by former Lending Club CEO Renaud Laplanche, will tout credit monitoring and education features to stand out in a crowded field.

April 6