-

The temptation for banks these days is to digitize as much as possible, but that generally results in spending a lot and doing nothing really well. Picking one of these three business models can help banks choose technology best suited to add value and thus get the most bang for their buck.

February 21

-

With U.S. Bancorp's leadership transition underway, the big question is whether it will deliver faster earnings growth — the one shareholder demand that has proven elusive.

February 21 -

Fearful banks hesitate on core conversions they need. But what's more risky? Keeping legacy technology? Or finally replacing it?

February 21 -

The way we buy today is already different than just a few years ago. In a decade, it will be totally transformed. Here is what every company must do to stay relevant and competitive in the coming decade of unprecedented disruption.

February 21 Spigit

Spigit -

A deal between Ford Motor Credit and a San Francisco-based startup will give car buyers the option of customizing their own loan terms.

January 24 -

The embattled company's new incentive pay plan appears to resemble those used by other banks, which suggests that regulators are unlikely to demand big changes throughout the sector.

January 17 -

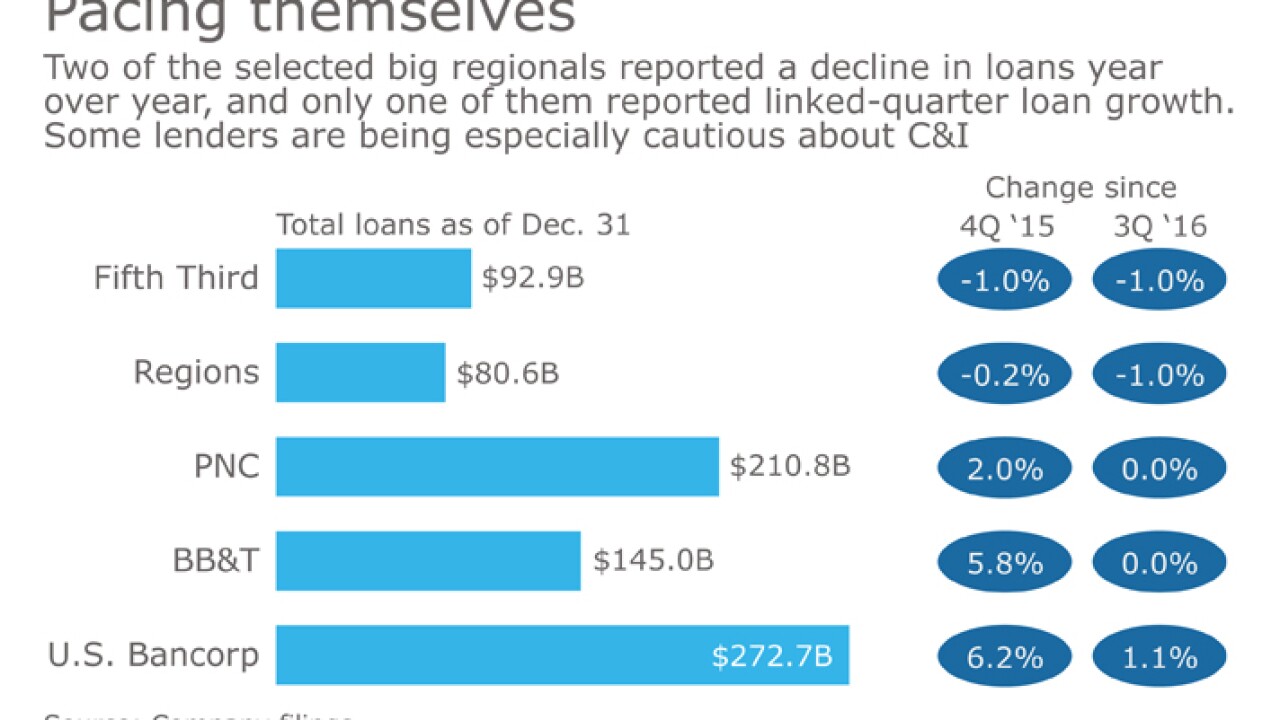

Fifth Third and other regionals have ditched what they deem to be high-risk commercial loans in hopes of strengthening credit quality over the long term.

January 24 -

The upcoming launch of Zelle gives Chase, B of A, Wells Fargo and other large banks an opportunity to correct their past mistakes.

January 27 -

Banks are becoming more comfortable with robotic process automation and could use it overhaul everything from the payroll functions to advising customers.

January 23