-

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

Two trends — competition from challenger banks and the emergence of real-time payments — threaten to eat away at the fees banks collect on overdrafts and bounced checks.

January 6 -

Banks need to stake out a presence on platforms that have nothing to do with banking.

January 2 -

Bank portfolios are chock full of loans to industries — think agriculture, tourism, real estate and energy — that could be particularly hard hit by warming temperatures. Some large banks are engaging in "scenario analysis" to mitigate the risk.

January 2 -

One bank is tracking the habits of its 4.4 million customers, giving them discounts on services if they visit the gym or get a flu shot. Other companies may soon follow suit.

January 1 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

The technology does not yet exist, but in the not-too-distant future it could fundamentally transform how many organizations do business.

January 3 -

LendStreet is looking to break the circle of debt that often arises when struggling borrowers try to consolidate what they owe.

January 3 -

Before the financial crisis, federal and state regulators unabashedly pitched their charters to banks as the better choice. That's happening again, despite warnings that such jousting might result in lax oversight.

January 6 -

Automating the loan application process is a potentially game-changing development that could put more car shoppers in control of which bank or credit union finances their purchase.

January 7 -

Technology is often cited as the leg up large banks have in winning over customers, but regionals are worried about the “billions and billions” bigger rivals can pour into ubiquitous ad campaigns.

November 27 -

MyBucks and its New Finance Bank subsidiary have opened 4,200 digital banking accounts and provided 72 loans at a Malawi branch said to be the first of its kind in a refugee camp.

November 21 -

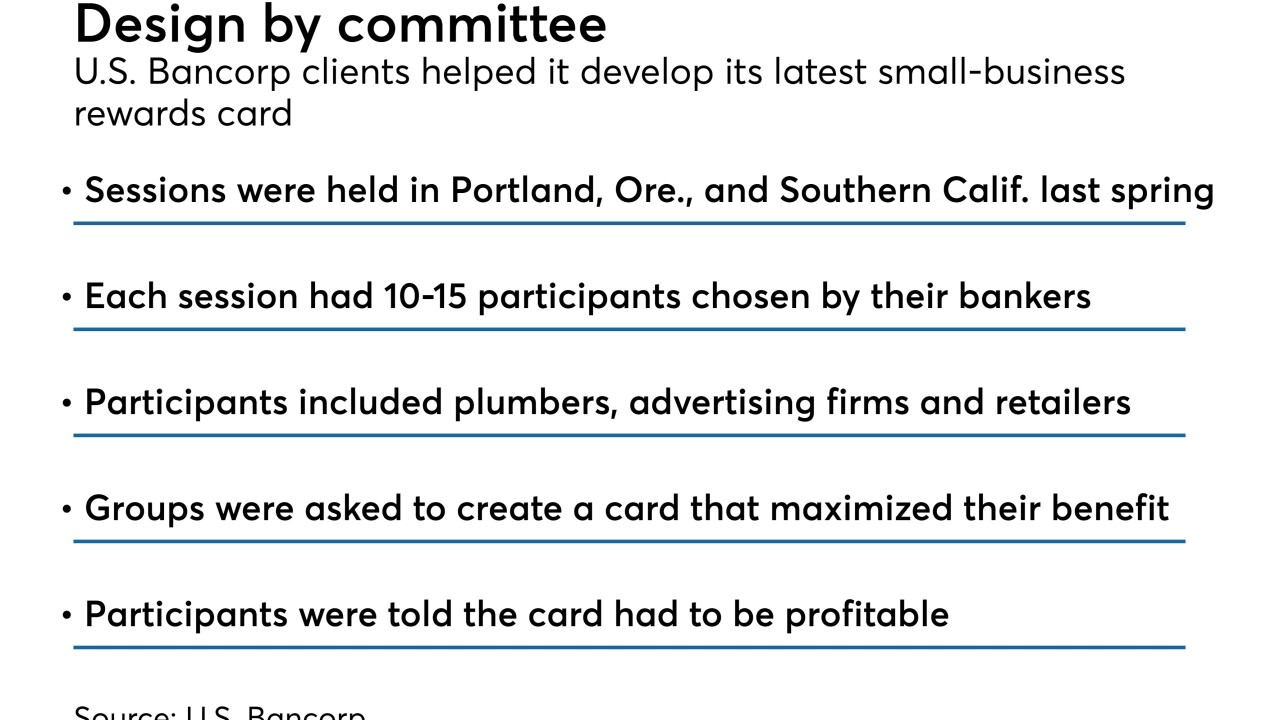

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

Whatever the central bank decides, it is sure to ruffle a lot of feathers in the industry.

December 4 -

Familiar recriminations and calls for legislation from lawmakers followed the massive hack of the Starwood hotel chain, but will Capitol Hill actually do anything?

December 7