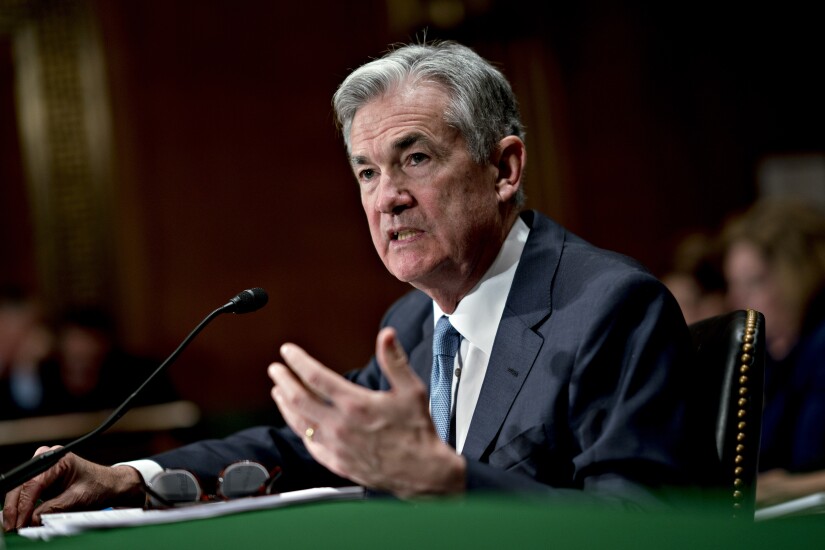

The 119th Congress will get its first crack at Federal Reserve Chair Jerome Powell this week.

Powell will appear in front of the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday to deliver his first semi-annual monetary policy report of 2025.

Along with a discussion of Fed's recent interest rate moves — including three cuts at the last three Federal Open Market Committee meetings of last year followed by a pause last month — Powell is expected to face a barrage of questions from lawmakers about the state of the economy and policymaking under the new administration.

Since Donald Trump won a second term in the Oval Office, Powell has repeatedly been asked how tariffs, tax cuts and other economic agenda items might impact monetary policy, and each time the Fed chair has said it was too early to speculate, without knowing the exact scope of the policies.

Trump has since levied new tariffs of 10% against Chinese goods and 25% tariff on imported steel while threatening a 25% increase in the duties charged on Canadian and Mexican imports. With the administration's playbook coming into clearer focus, it will be harder for Powell to demure.

Powell is also likely to face questions about the Treasury Department's ambitions to shrink the national debt and a host of questions about regulation and supervision.

In particular, legislators are likely to be curious about the future of pending rule changes, including the Basel III endgame capital rules and long-term debt requirements for large regional banks. Though the Fed has pledged to hold off on rulemaking until Trump fills key bank regulatory vacancies, including the Fed's vice chair for supervision.

Other matters of interest likely will include supervisory practices that have contributed to account closures at commercial banks, as well as the regulation of so-called stablecoins.