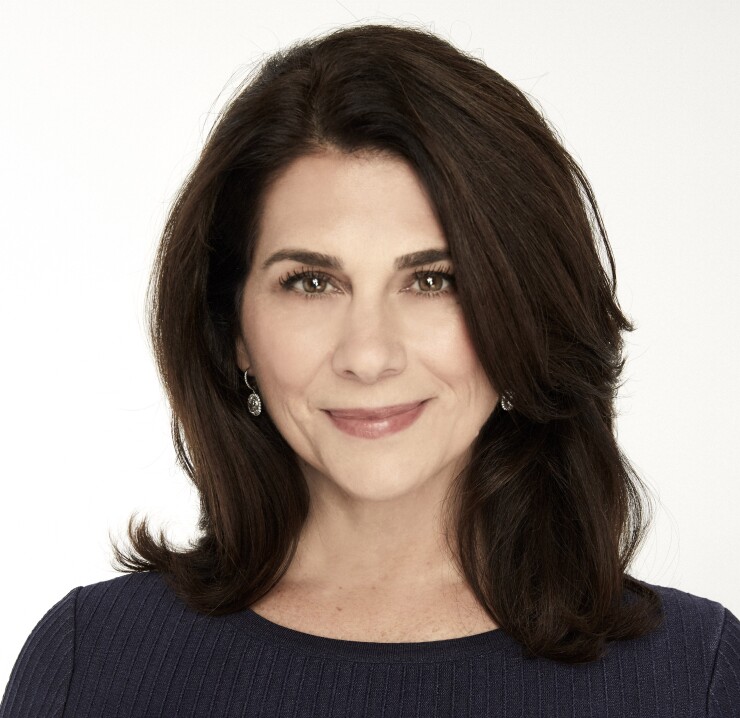

The 23 CEOs on this list run banks and credit unions. But no matter the size of their institution, these women shape business strategy, gender and diversity initiatives, culture and community. The list, starting with Citigroup CEO Jane Fraser at #1, is ranked according to asset size.

Women in banking CEOs