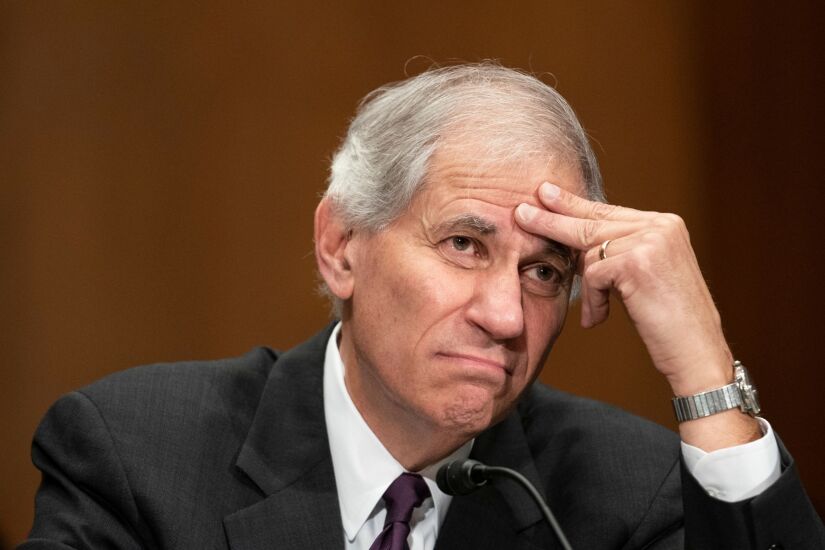

WASHINGTON — Martin Gruenberg's pending departure from the Federal Deposit Insurance Corp. will leave a large opening at the helm of bank regulation in Washington.

Gruenberg announced Monday that he

He lost the support of

Filling the top job at the FDIC will be a tough job for Brown and the White House, with few legislative days left to confirm a new chair before the 2024 presidential election. Republicans have been unusually successful in killing the nominations of the Biden administration's picks for top bank regulation posts, notably Saule Omarova and Mehrsa Baradaran at the Office of the Comptroller of the Currency.

The best case scenario for the Biden administration is someone who could get confirmed quickly, ideally along bipartisan lines, so that Gruenberg doesn't sit in a lame duck position until the election, as well as adding someone who could help the Biden administration fulfill a progressive financial policy agenda.

The list of candidates who could potentially do both is short.

Here's some of the top regulators, former regulators and other policymakers who could be tapped by the White House to fill Gruenberg's spot.