Last year proved a difficult one, even for the best performing larger community banks.

Banks with between $2 billion and $10 billion of assets reported a decline in net income, a drop in core deposits and a higher cost of funds. This held true even for the top-performing banks in this asset category.

Every year, American Banker ranks the top-performing banks across four asset categories using an analysis from the consulting firm

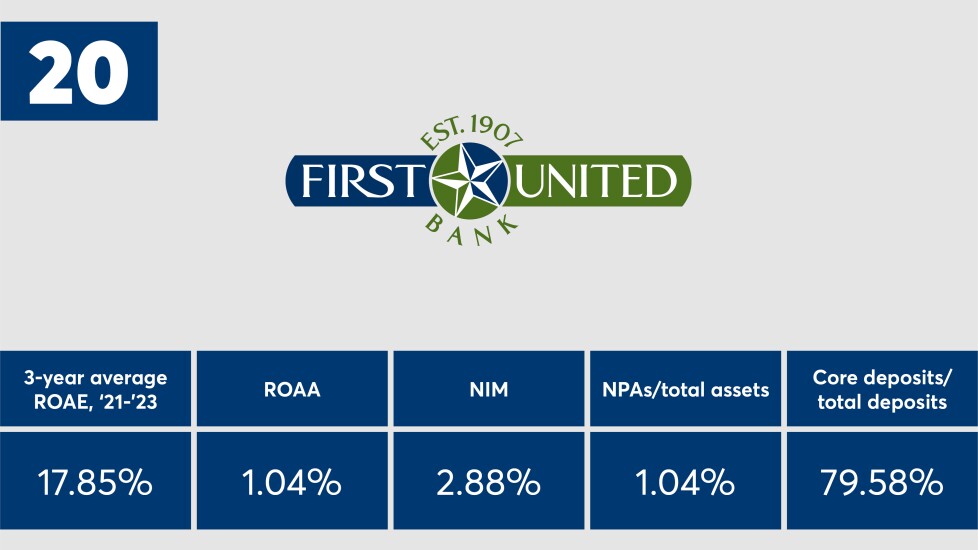

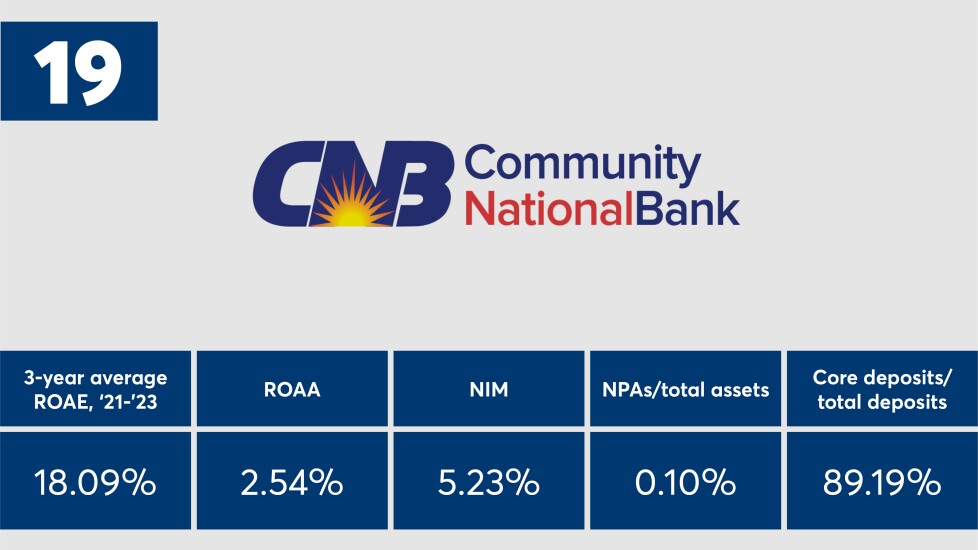

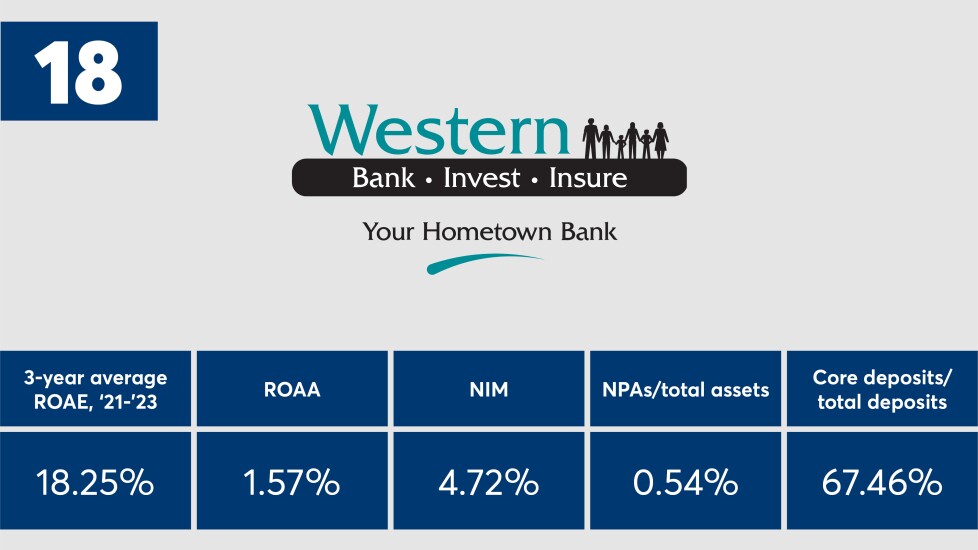

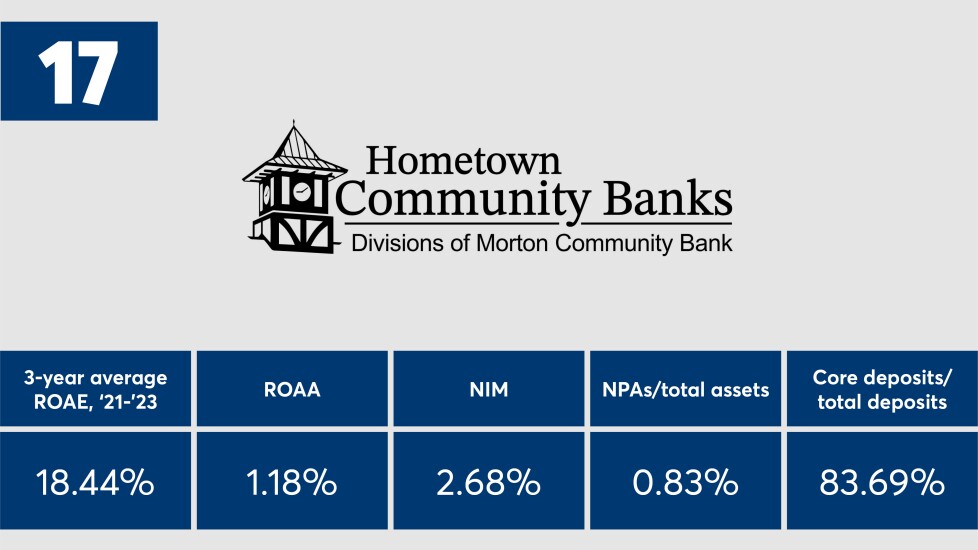

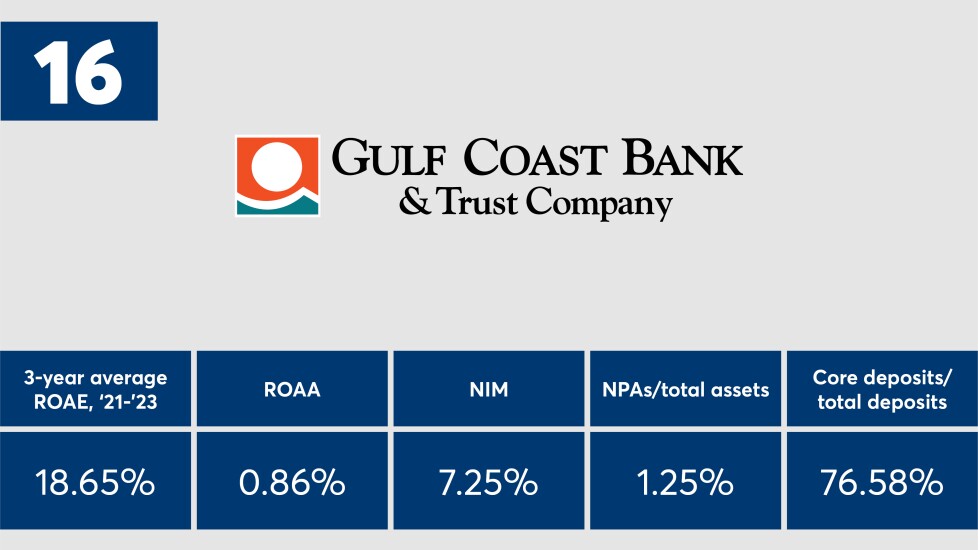

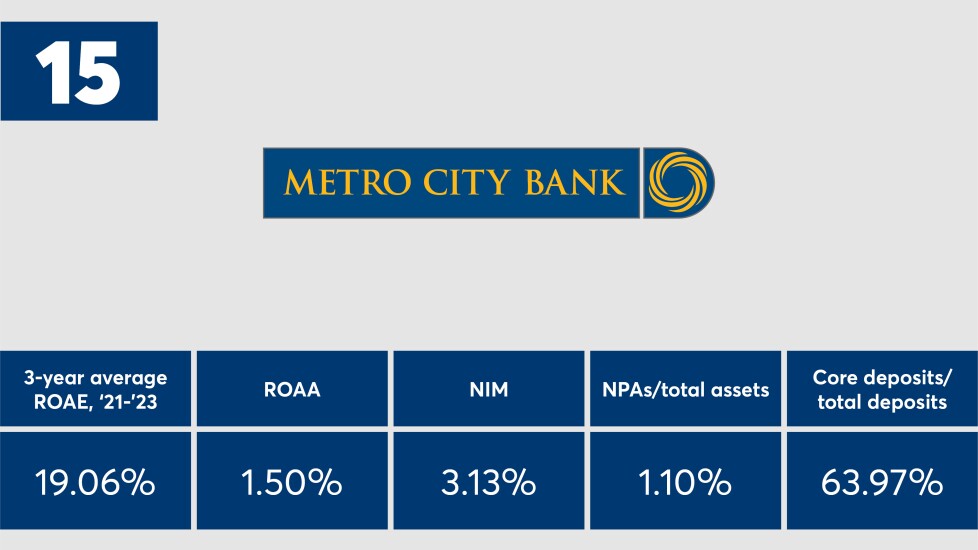

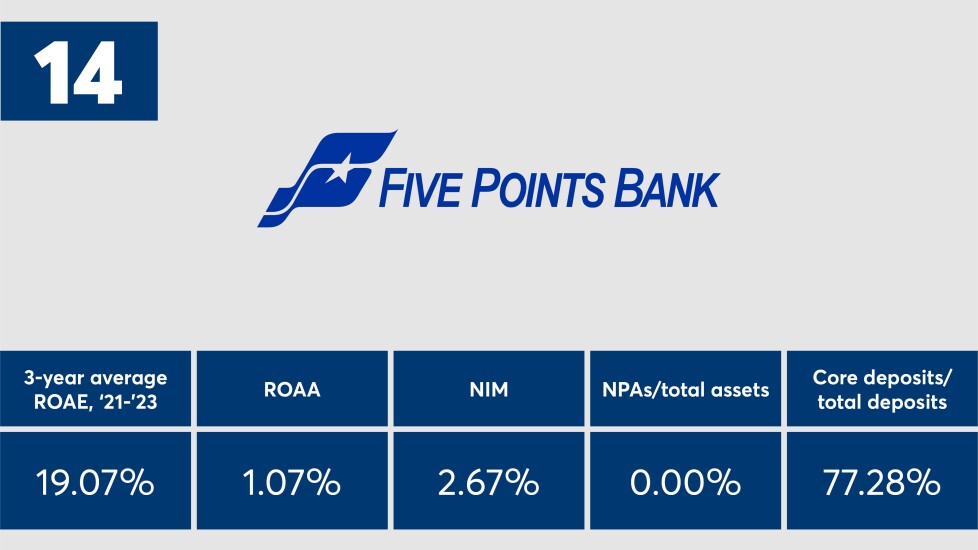

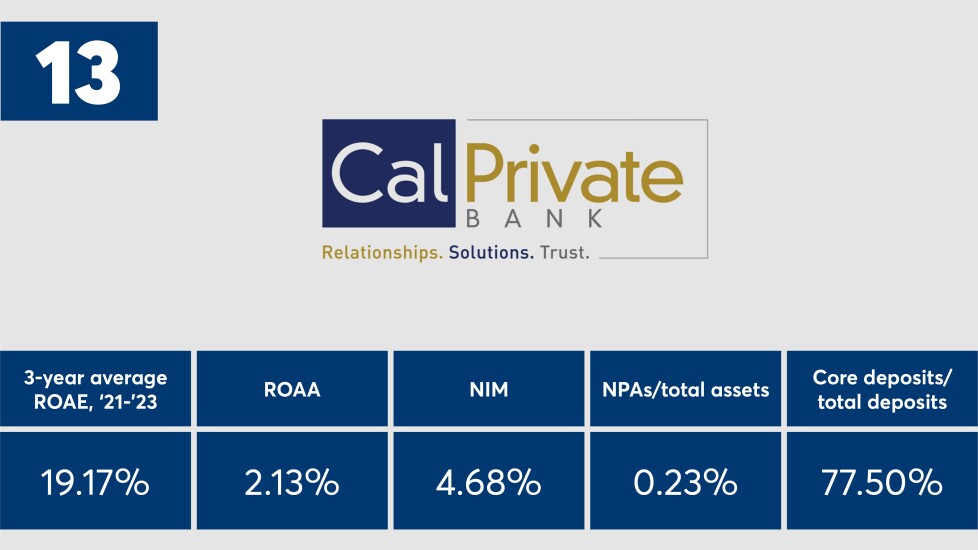

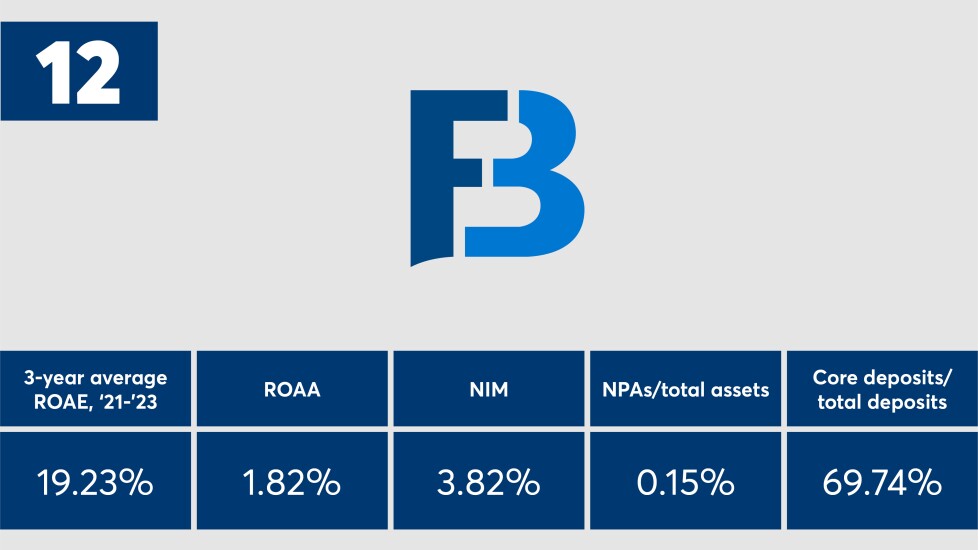

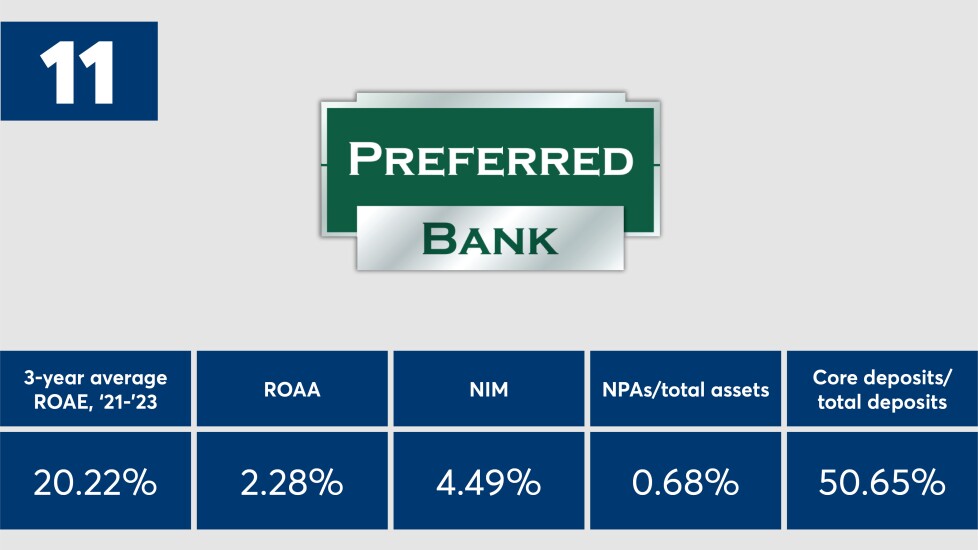

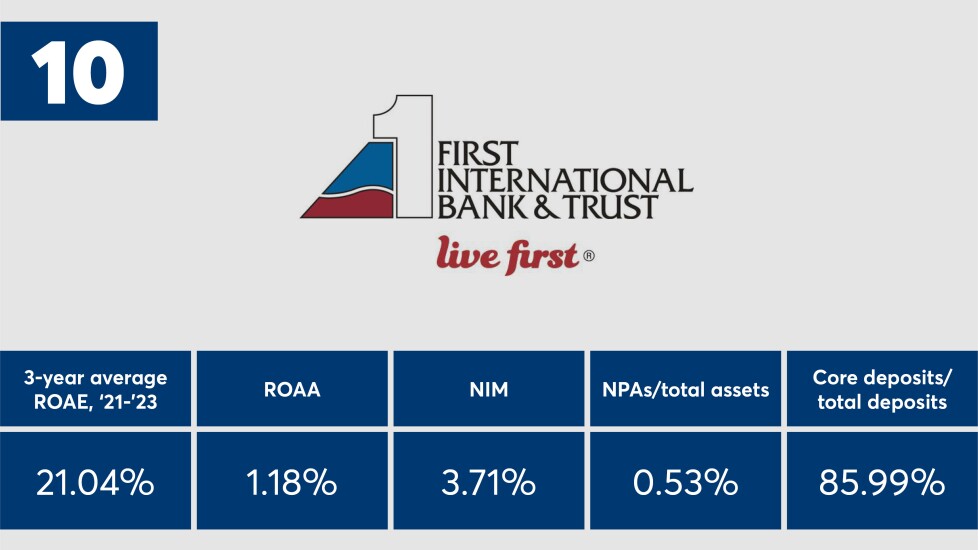

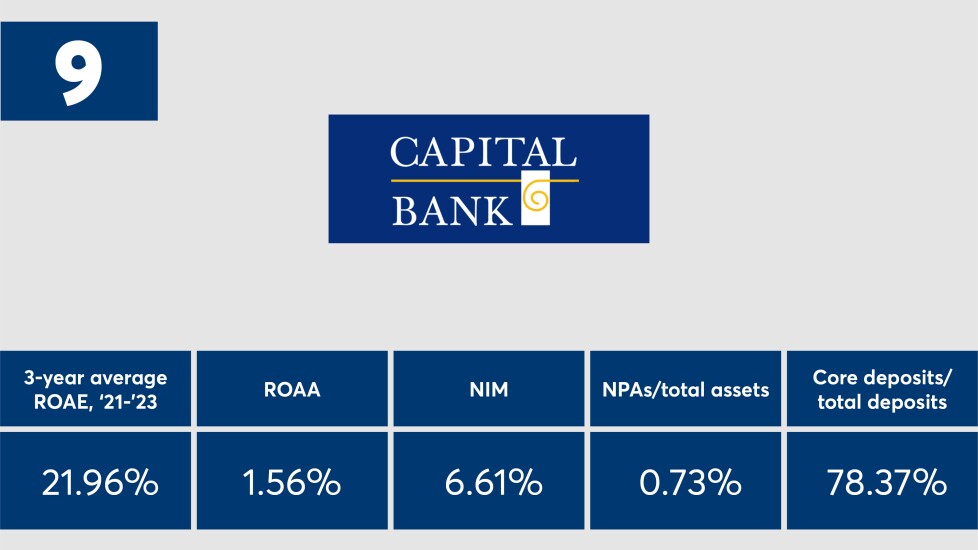

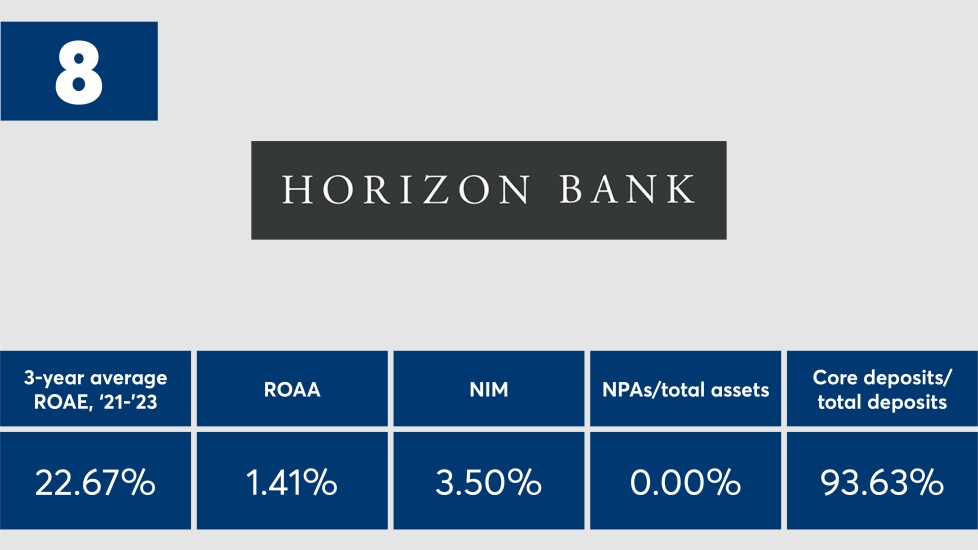

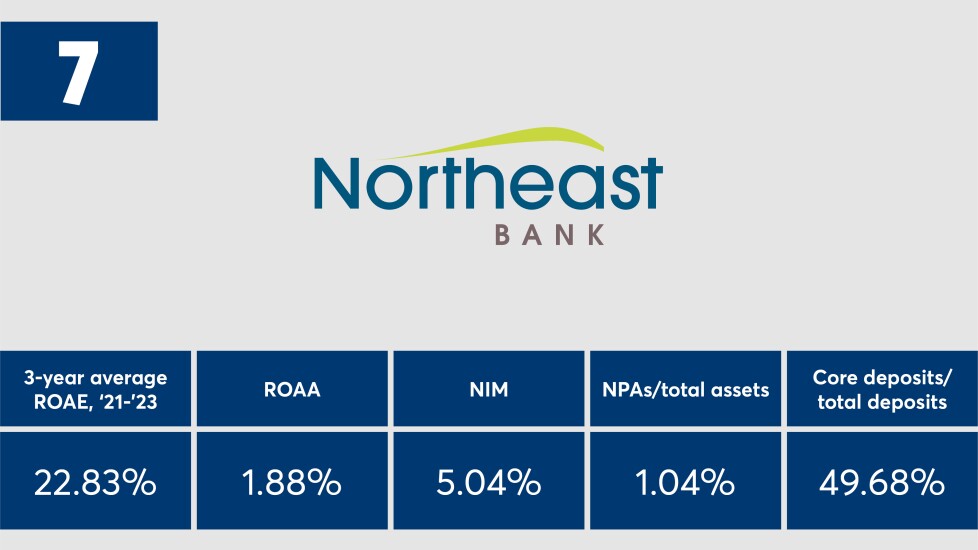

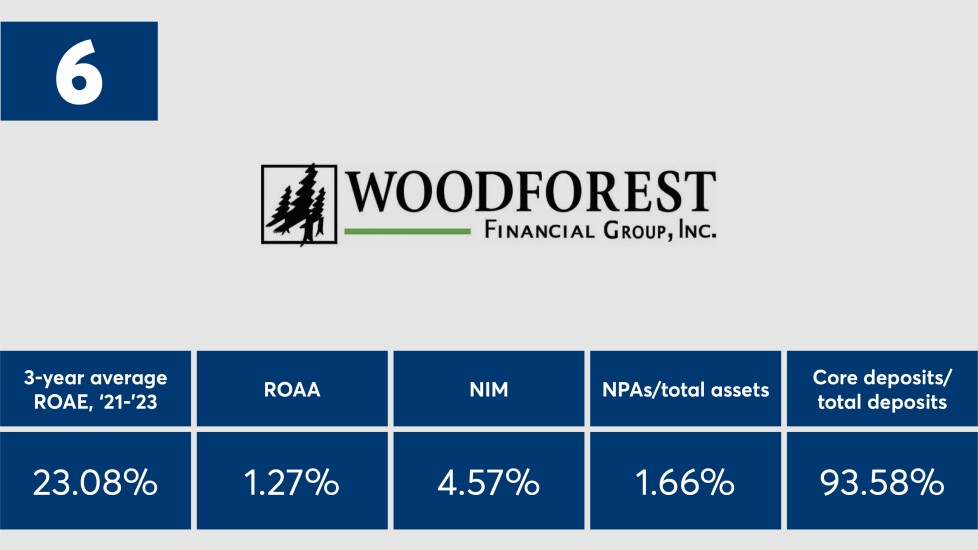

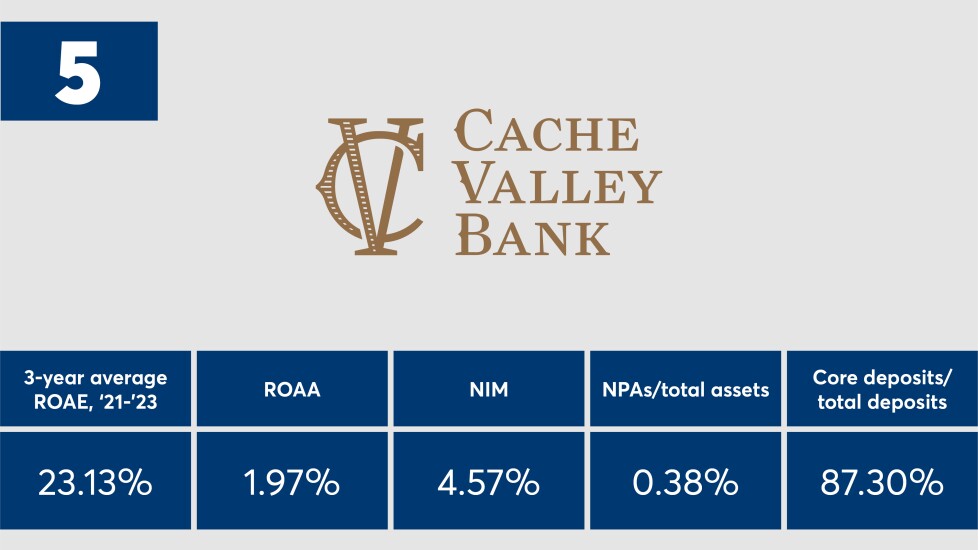

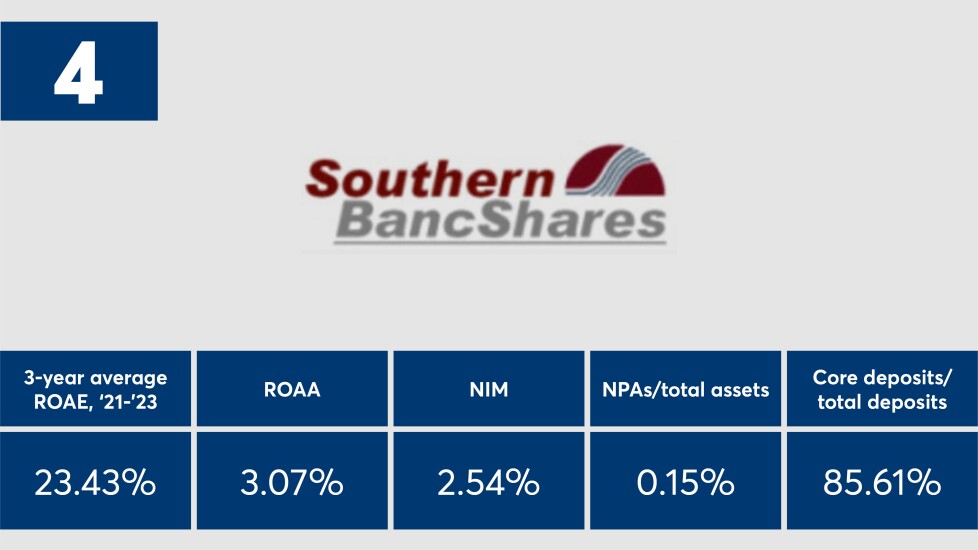

For this year's list of banks with between $2 billion and $10 billion of assets, State Bank of Texas in Irving was the top-performing bank, jumping eight spots from its ranking in 2023. The institution had a three-year average ROAE of 26.22%. The median of this metric for the top 20 institutions was 20.63%, while the median for all banks of this size was 11.51%. Overall, five of the 20 top-performing banks were based in Texas.

For just 2023, the top banks posted a median ROAE of just under 20% while all banks recorded a median ROAE of roughly 10%. These returns were down from year-end 2022, when the median for the top banks was 21.79% and the median for this entire group was 12.54%. This pattern held true across a variety of financial metrics.

However, one area the top-performing banks managed to do better compared with last year was efficiency. This year, the median efficiency ratio for the 20 banks was 47.51%, a slight decrease from 47.91% for 2023's ranking. However, the entire asset class posted a worsening median efficiency ratio.

To view the results of the top 100 publicly traded banks under $2 billion of assets,

Please read on for additional information on the top-performing banks with between $2 billion and $10 billion of assets. For additional coverage of this asset class,