Western Alliance in Phoenix is the top performing large bank for the second year in a row.

Although the $71 billion-asset

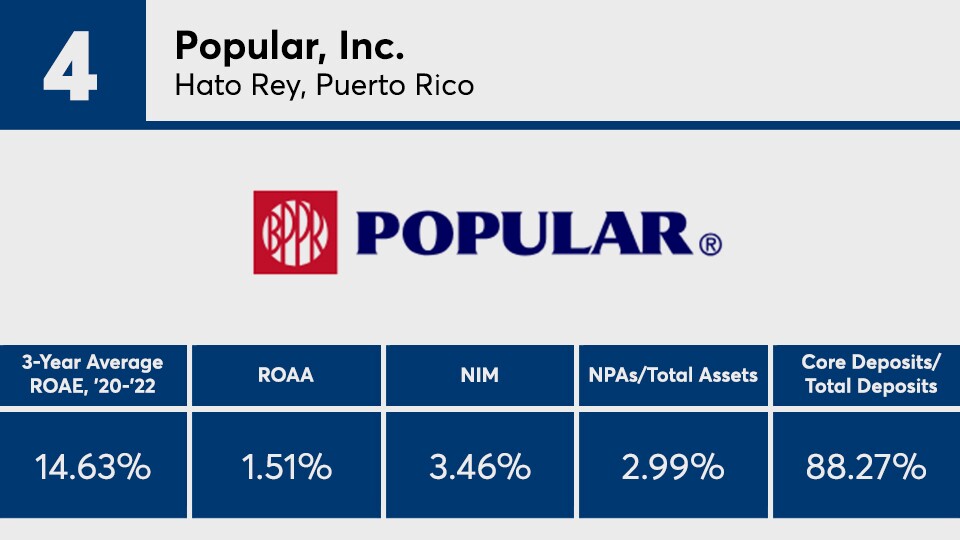

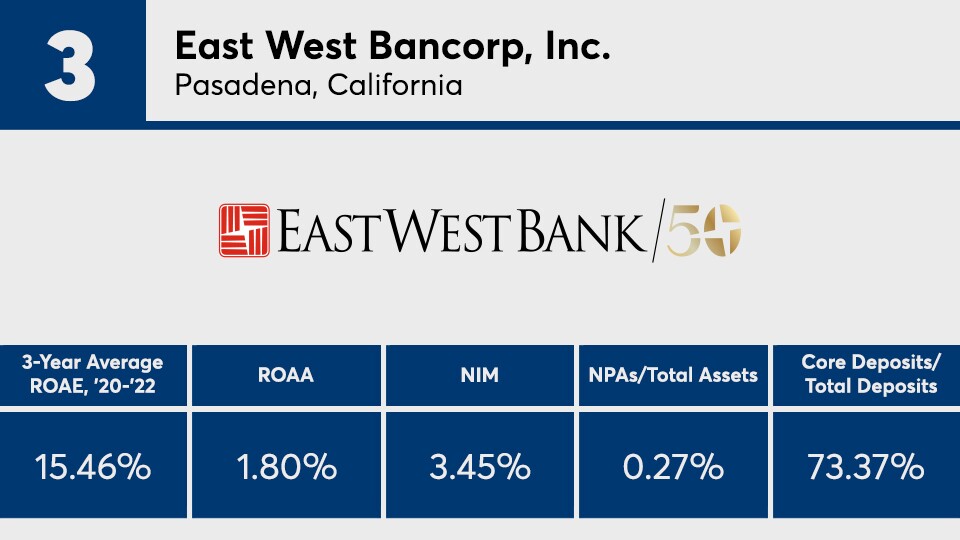

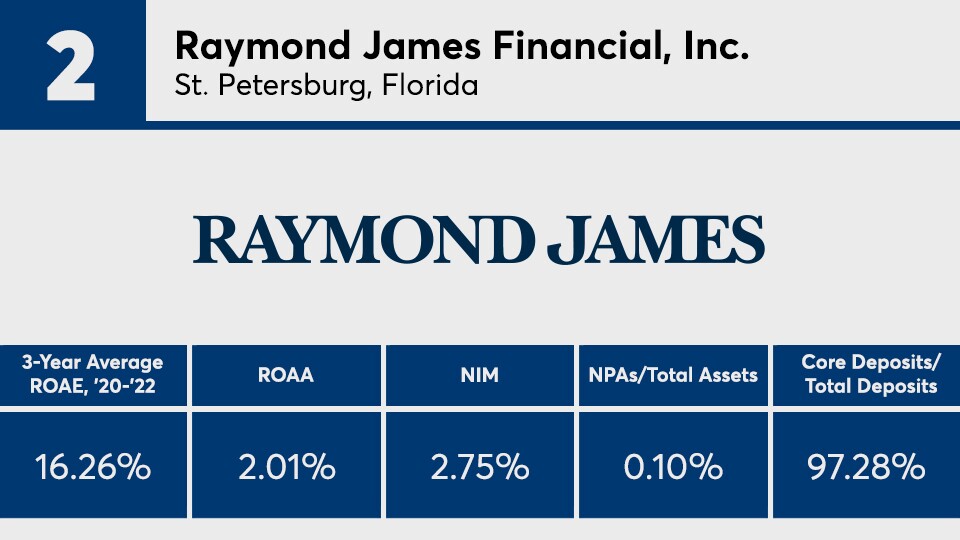

From 2020 to 2022, Western Alliance's average ROAE was 19.70%. That put it above second-place Raymond James Financial in St. Petersburg, Florida, which posted a three-year average ROAE of 16.26%, and third-place East West Bancorp in Pasadena, California, which recorded a three-year average ROAE of 15.46%.

Overall, the top 10 large banks posted better results than their peers in a number of key categories. This group had a higher median net interest margin at 3.21%, which topped the median NIM of 3.02% for the entire group. The top 10 had a median return on average assets of 1.32%, compared with 1.03% for all banks with at least $50 billion of assets. And the top performers had a three-year average ROAE of 13.36%, which was higher than the 10.43% the group recorded.

Here is an overview of the top 10 institutions from this year's list of banks with at least $50 billion of assets. For additional coverage, please visit