“Glum” is one of the first words that Promontory Interfinancial Network, a deposit placement provider based in Arlington, Va., used to describe bankers’ attitudes about the future of the U.S. economy in its most recent Bank Executive Business Outlook Survey.

The quarterly survey, conducted from April 2-12, was distributed by email to bank CEOs, presidents and chief financial officers across the United States. It asked them about a wide range of items including economic outlook, loan demand, deposit competition and funding costs as well as topical issues, such as the potential impact of the BB&T-SunTrust merger deal announced in February. The 453 respondents skewed slightly toward community banks with assets of less than $1 billion,

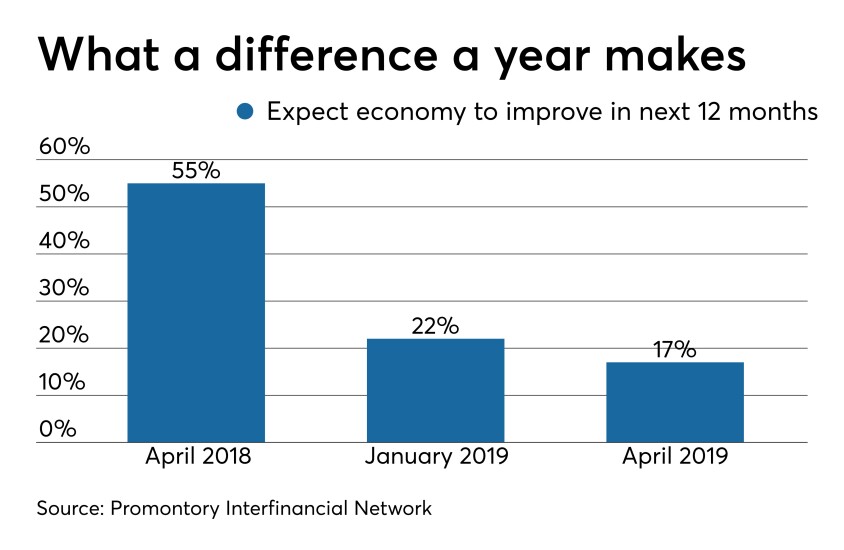

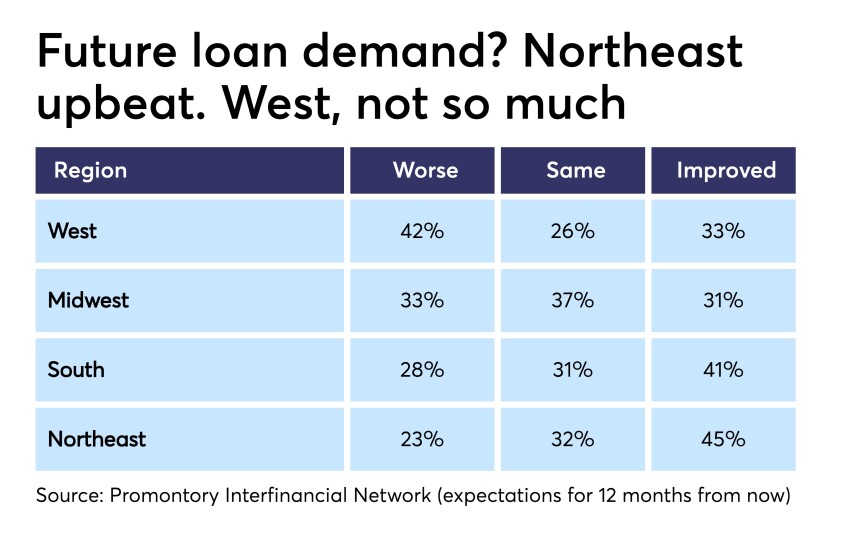

The picture was pretty clear: Bankers are less bullish about economic conditions than they were a year ago. Last year, more than half of the bankers surveyed said that economic conditions for their bank would improve in the next 12 months. This year, fewer than 20% made such a prediction. Expectations for loan demand have cooled, too, while commercial real estate lending is emerging as a trouble spot. Bankers in the West and Midwest seemed more downbeat than their peers in other regions.

Two of the study’s gauges of banker attitudes, including its Bank Confidence Index, seemed to rise slightly. But even if attitudes have bottomed out, soft demand for loans and other factors could keep the 100-point indexes below 50 “for the foreseeable future,” report said. The indices have been below 50 for five consecutive quarters.

Meanwhile, though bankers seemed concerned about the more formidable competitor the combined BB&T-SunTrust could become, they were relatively optimistic about consolidation, the acceleration of technology investments and other changes the megadeal could bring. They also embraced the possibilities presented by the expansion of marijuana services businesses in some parts of the country.

Here are our five big takeaways from the results and the accompanying data.