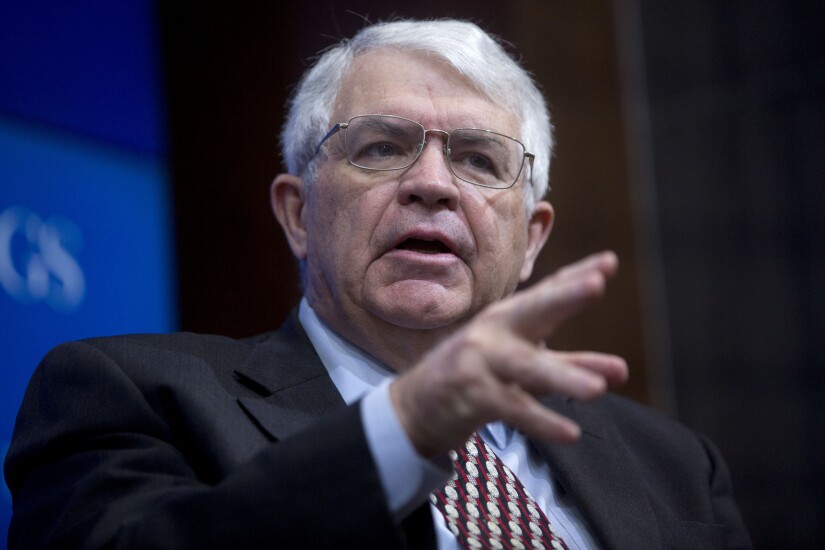

WASHINGTON — President Trump's pick of Federal Reserve Board Gov. Jerome Powell as the next head of the central bank is likely to cause bankers to breathe a sigh of relief.

In many ways, Powell represents the best of all worlds among the

Analysts say Powell is a shrewd choice. Though Trump had lately talked up the possibility of reappointing Yellen because he approves of the Fed's low interest rate policy, he has also criticized her in the past for attempting to help his presidential opponent, former Secretary of State Hillary Clinton. Powell is likely to continue Yellen's monetary policy while satisfying demands from Republicans that Trump appoint one of their own.

Moreover, Powell has a long history of working well with new Fed Vice Chair for Supervision Randal Quarles, which suggests the central bank would approach any changes to the Dodd-Frank Act in a united manner. Moreover, unlike some other candidates for the Fed job, Powell has spelled out his views on bank regulation, having served as head of the central bank's banking committee after former Fed Gov. Daniel Tarullo left in April.

Now that Powell has received the nod from Trump to head the Fed, here’s what banks can expect: