In this month's roundup of top banking news: New York Community Bancorp works through internal strife, JPMorgan Chase accuses TransUnion and others of data theft, KPMG comes under fire and more.

Western Alliance's survival saga

But that all changed during the banking crisis of March 2023, when the Phoenix-based regional bank's survival appeared to be in question for several nail-biting days.

Western Alliance's asset mix and characteristics were fundamentally different from those of Silicon Valley Bank and others that collapsed last spring. But some investors were worried that the $70 billion-asset bank's higher-than-average exposure to Bay Area technology firms put it dangerously close to succumbing to the same fate as SVB. Those fears invited market contagion.

PNC CEO: 'Regulation is uneven' between OCC, other agencies

"Regulatory arbitrage" is leading to banks across the country being held to different standards, Demchak said at a March 5 event hosted by Brookings about last year's bank collapses. He said that institutions can "charter shop" to find softer regulators, like the Federal Deposit Insurance Corp. and the Federal Reserve Bank of San Francisco, the respective supervisors of the failed First Republic Bank and Silicon Valley Bank.

"My primary lesson learned was that regulation is uneven," Demchak said. "It astounded me what First Republic and Silicon Valley were able to do. … Regulators didn't do their job. … Bluntly, if that was an OCC bank, that never would have happened."

Racist emails becoming focal point in redlining settlements

In another separate redlining case against Trident Mortgage, the Justice Department described how loan officers, assistants and other employees received and distributed emails containing racial slurs and content that used racial tropes and terms. The communications sent on work emails included a photo showing a senior loan officer posing with colleagues in front of a Confederate flag, and pejorative content related to real estate and appraisals and content targeting people living in majority-minority neighborhoods. Trident, which is owned by Warren Buffet's Berkshire Hathaway, settled the DOJ's complaint in 2022 for $24 million.

Since the Justice Department launched its Combatting Redlining Initiative in late 2021, racist emails have received more attention from both the DOJ and the Consumer Financial Protection Bureau in an effort to show racial bias has permeated a company's culture.

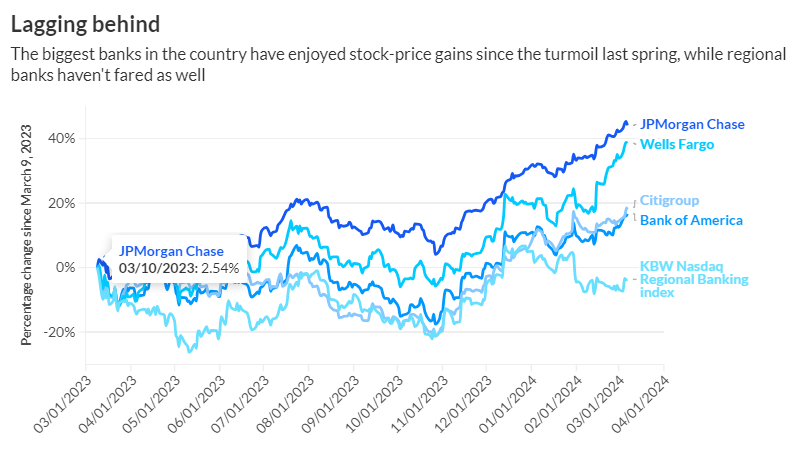

A year after SVB went down, regional banks are not out of the woods

But the

"There's a general concern … that we're in a credit cycle," said Chris Marinac, an analyst at Janney Montgomery Scott, pointing to investor worries that "every bank is going to have some type of problem as we move into the rest of 2024 and 2025."

KPMG faces fresh questions over audits after New York Community turmoil

KPMG has built up a large business auditing U.S. banks and had long audited Long Island-based New York Community. The bank's stock is down nearly 70% this year after a

The latter disclosure seemingly conflicts with an audit KPMG performed in 2022, when KPMG said the bank's internal controls were effective.

JPMorgan Chase accuses TransUnion, others of stealing 'trade secrets'

In the lawsuit the New York bank filed against Chicago-based TransUnion last week in Delaware Federal District Court, it said Argus Information & Advisory Services collected the bank's credit card data while under contract as a data aggregator for the

"While Argus did not have access to any of our customers' personally identifiable information, this data is valuable and competitively sensitive," said Seth Wheeler, Chase's chief data and analytics officer. "Argus used Chase's data for its own commercial gain, and it's time this pattern of behavior stops once and for all."

Virginia banks merging in $47 million deal

The $1.4 billion-asset

"Combining our companies will help ensure that we continue to be part of the fabric of the communities we serve," Scott Harvard, president and CEO of First National, said in a release announcing the deal. "We are incredibly excited about this opportunity to expand our Richmond metro presence."

NYCB's new risk team fails to calm investors, ratings firms

The company said early on March 1 that it has filled gaps in its executive ranks by hiring a new chief risk officer and a head auditor. The appointments are part of the bank's efforts

The hirings of George Buchanan as chief risk officer and Colleen McCullum as chief audit executive fill two vacancies that had been a

New York Community lands $1B capital infusion led by Mnuchin, Otting

Otting, the former Comptroller of the Currency, will become the bank's CEO, while Mnuchin, the former Treasury secretary, will join its board, the company said on March 6. Mnuchin's investment firm, Liberty Strategic Capital, is leading the deal by pumping in $450 million, while the investment firm Hudson Bay will invest $250 million, and Reverence Capital will provide $200 million.

Alessandro "Sandro" DiNello, the former CEO of Flagstar Bancorp, who was

'They're fixing a broken bank': NYCB starts to outline a way forward

Two weeks

The plan was included in New York Community's annual report, which was released Thursday after being