— Where are the opportunities to sustain, or even grow, origination volume amid tight housing supply and tepid refinance demand?

— Can loan product diversity and competitive pricing overcome the affordability challenges brought on by rising interest rates, home prices and uncertainty in the broader economy?

— Given the relentless upheaval, is it even worth it to stay in business?

As recently as October, many economists were optimistic that the

Even with December's swoon, the economy doesn’t have the same signs of fundamental weakness it did a decade ago. Similarly, mortgage originations project to decelerate, but not face total devastation.

"We're still seeing above-trend GDP growth that is likely to slow as the impact of last year's tax cuts wears off with higher interest rates," Calvin Schnure, the National Association of Real Estate Investment Trusts' senior vice president of research and economic analysis, said in an interview.

As of the third quarter in 2018, the amount of total

Origination forecasts show a dip to $1.61 trillion in 2019 from $1.63 trillion in 2018, according to Fannie Mae. While a $20 billion decline is small from a percentage point standpoint, it's nevertheless a large enough sum to drive further consolidation among industry firms.

Here's a look at the economic fundamentals that will be key drivers in the mortgage origination and housing market in 2019.

Moving rates

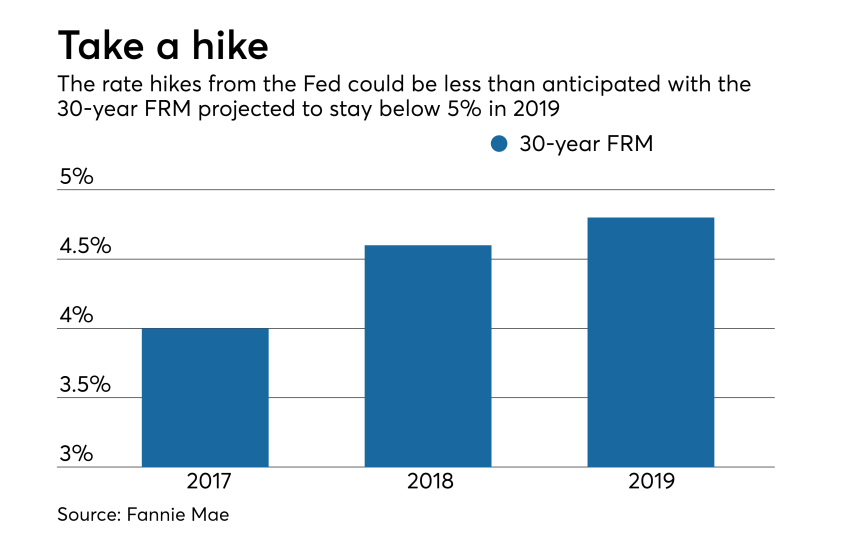

"We've seen periodic worries that they'd be moving much higher — both short-term with the Fed continuing to remove the stimulus they put in previously and also with the long-term. Earlier in the year, the inflation rates had moved above the Fed's target but for the past six months the core personal consumptions expenditures deflator has been running at about 1.5%," said Schnure. "That means the Fed doesn't need to be aggressive. The current market pricing suggests about 50% chance of just one more increase next year. That's a pretty benign interest rate outlook."

Fannie Mae projects 30-year fixed-rate mortgages to go to 4.8% after finishing 2018 at 4.6% and 2017 at 4%. The housing market slowed down over the past year behind the overarching rate climb.

Stunting price growth

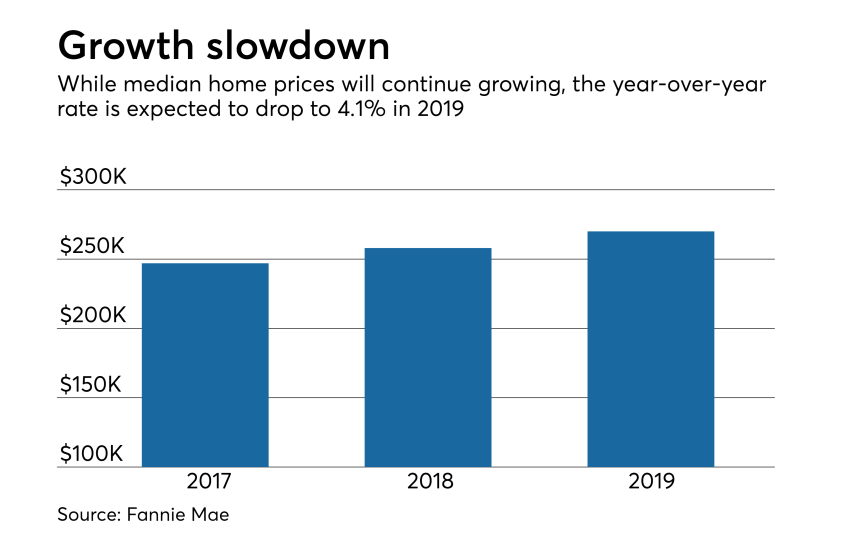

"The interest rates are keeping demand in check, but it's not going to push it down. I don't see the real downside risks people are worried about," Schnure said.

In an exhibit of checks and balances, as mortgage rates see an increase,

Starting fresh

The market still operates at a severe deficit, despite

With the high demand, any remnant fears of a revived housing bubble popping should be quelled. In addition, improved credit quality went a long way in keeping history from repeating itself.

"A decade ago people were worried, because not only were there mortgages with weak underwriting, but a lot of the borrowers were quite stretched. Underwriting standards have still been reasonably good," Schnure explained.

Strong labor

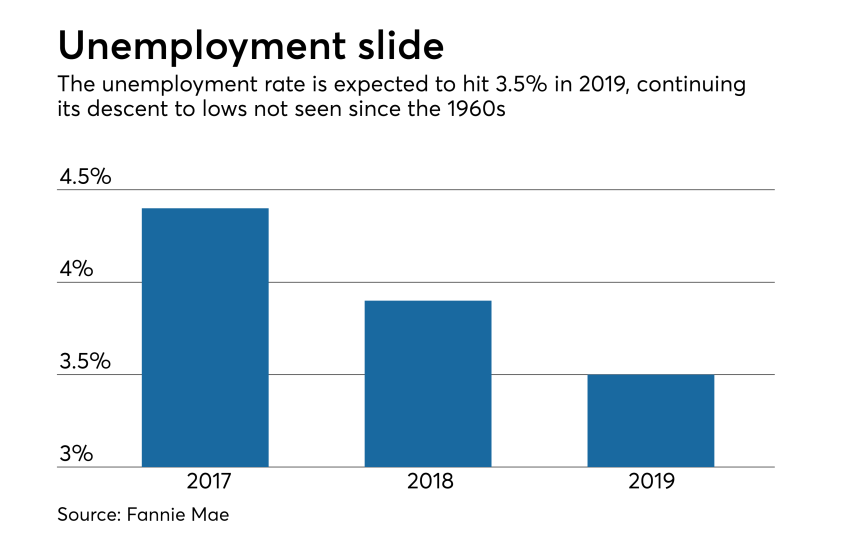

"We're seeing a solid job market and quite good job growth, which is translating to wages," Schnure said. "You're seeing household income growth that keeps those borrowers able to service their mortgages. This is a market where you can continue to make loans without looking over your shoulder too much."

In 2019, the unemployment rate is expected to plummet to lows that the country hasn't seen since the 1960s.