With more options for which provider to use for their banking needs than ever before—from retail banks and credit unions to challenger and online-only banks—consumers can afford to be discriminating about the banking experience they want. The key for banks that are looking to attract and retain those customers is understanding why they choose to bank with one financial institution rather than another.

That's the question American Banker set out to answer when it teamed up with the creative experience agency Monigle on research to better understand how clients viewed the performance of their financial institutions when it comes to the customer experience.

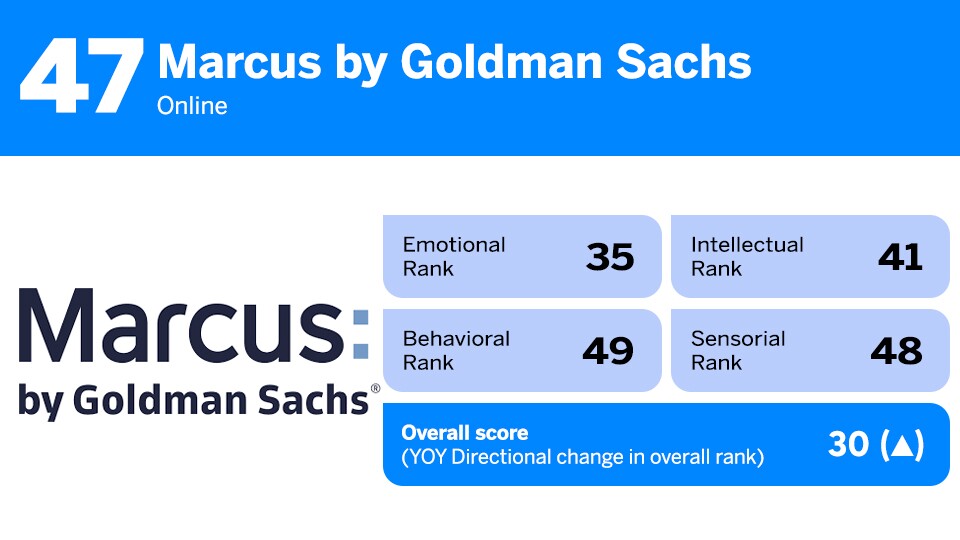

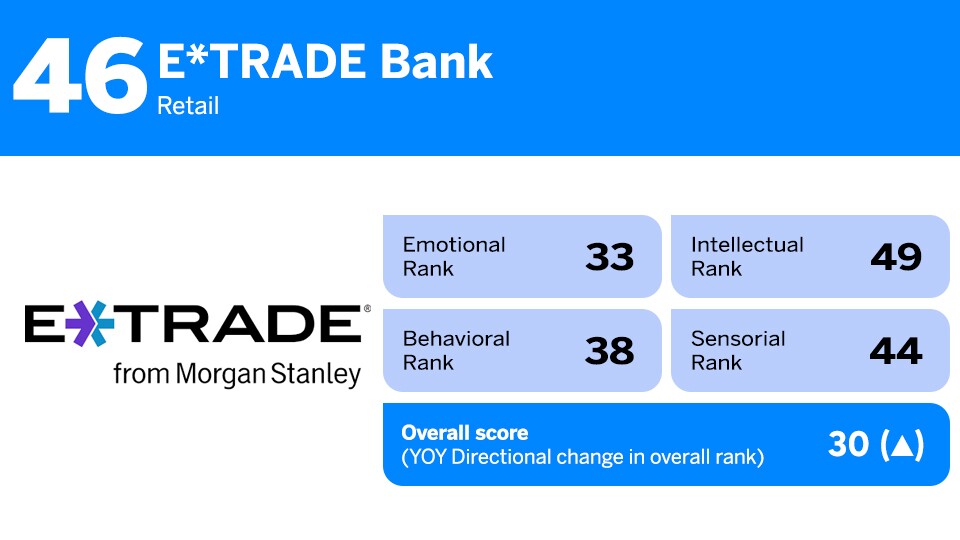

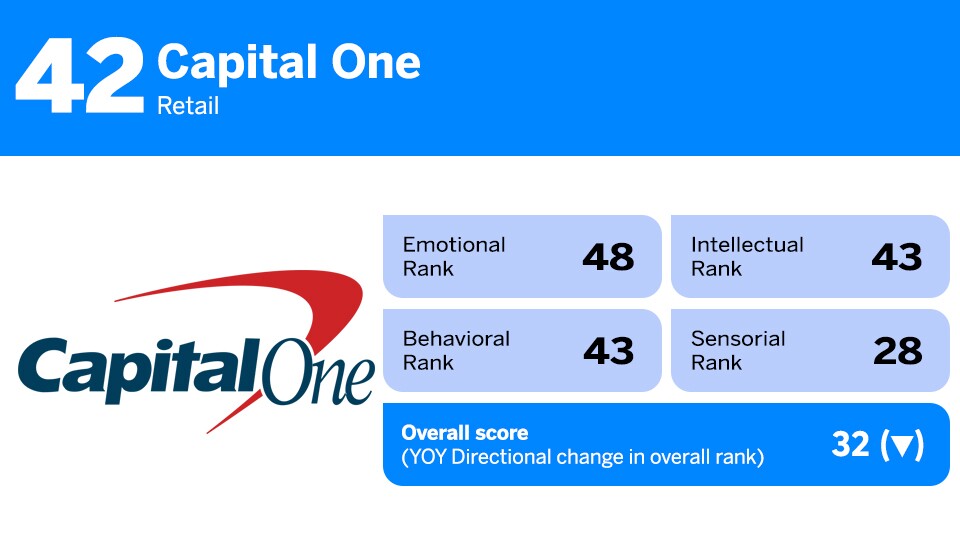

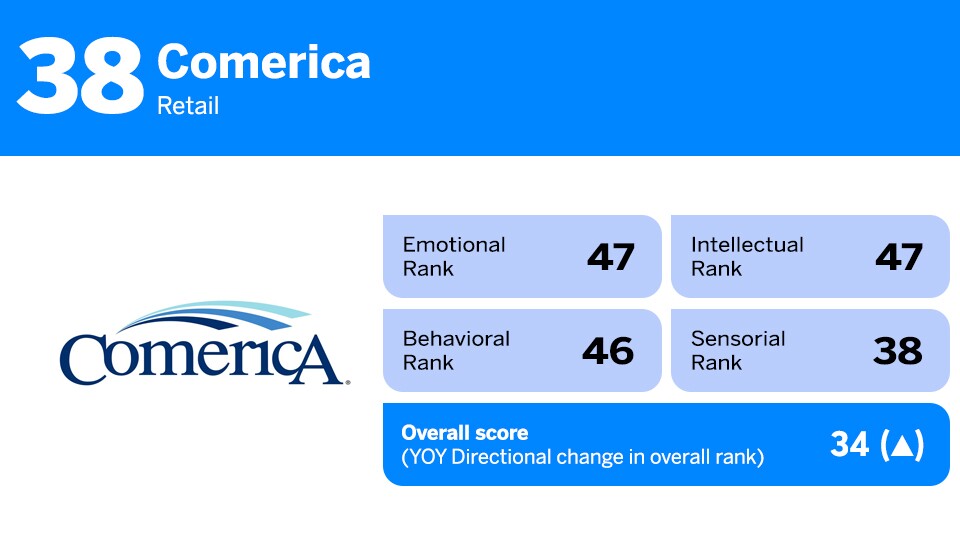

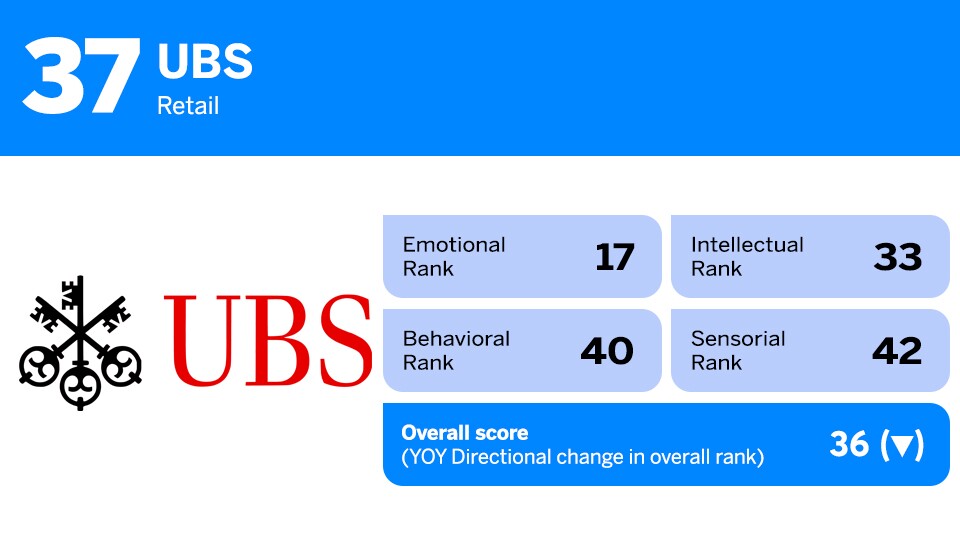

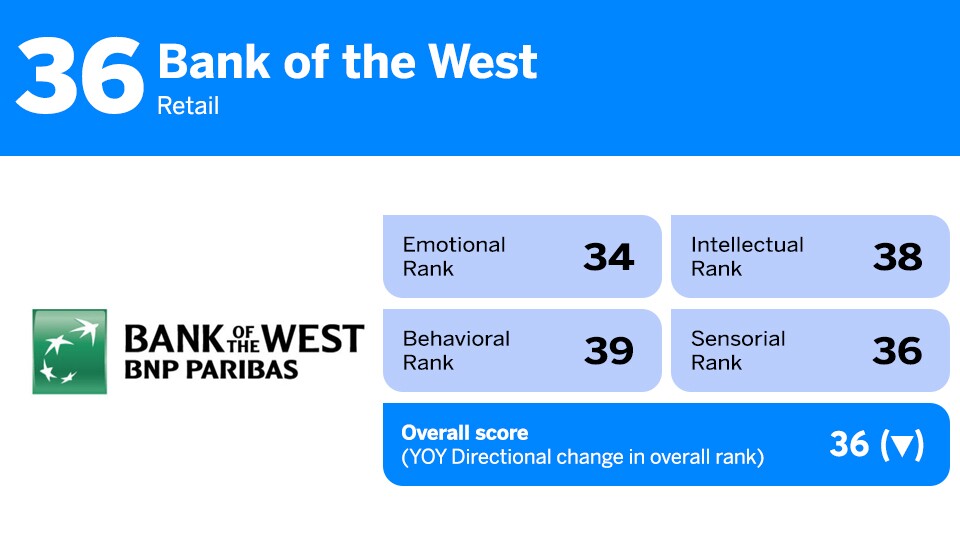

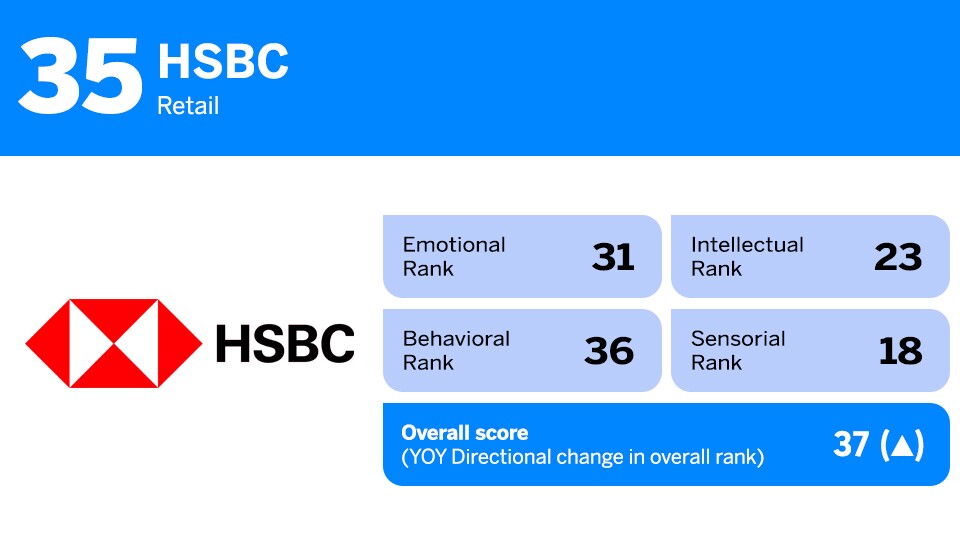

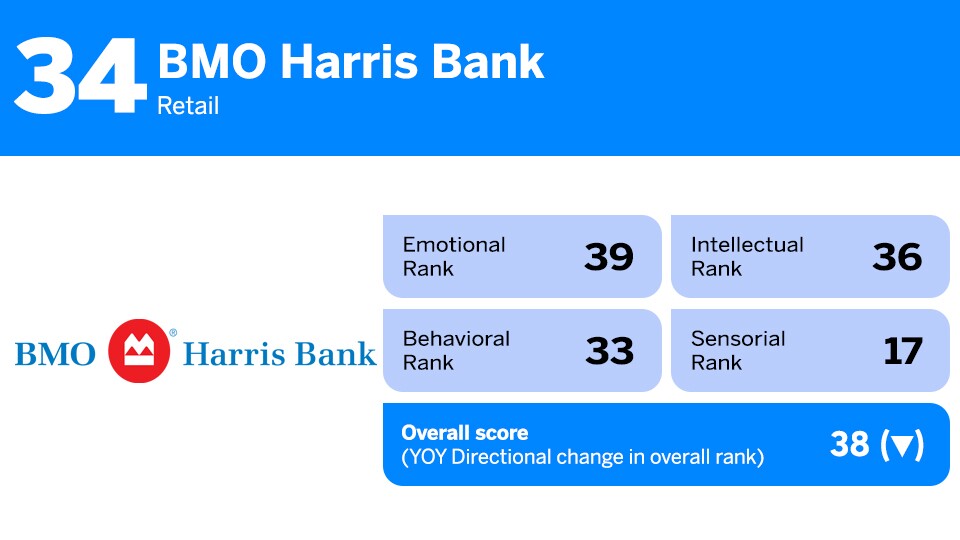

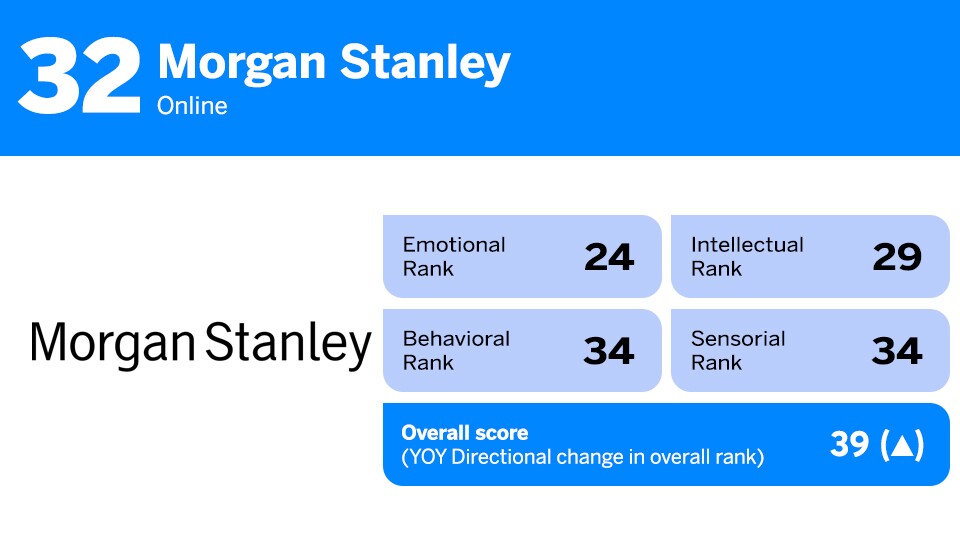

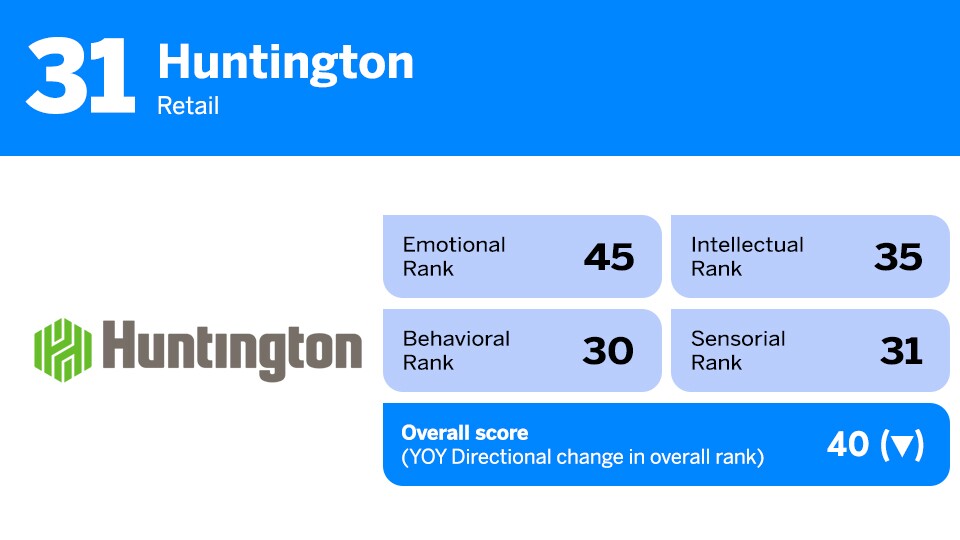

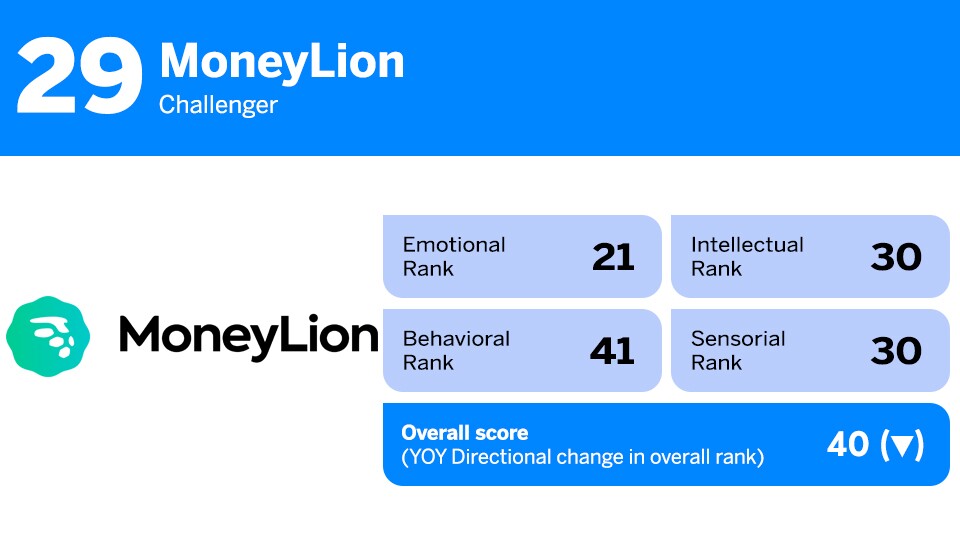

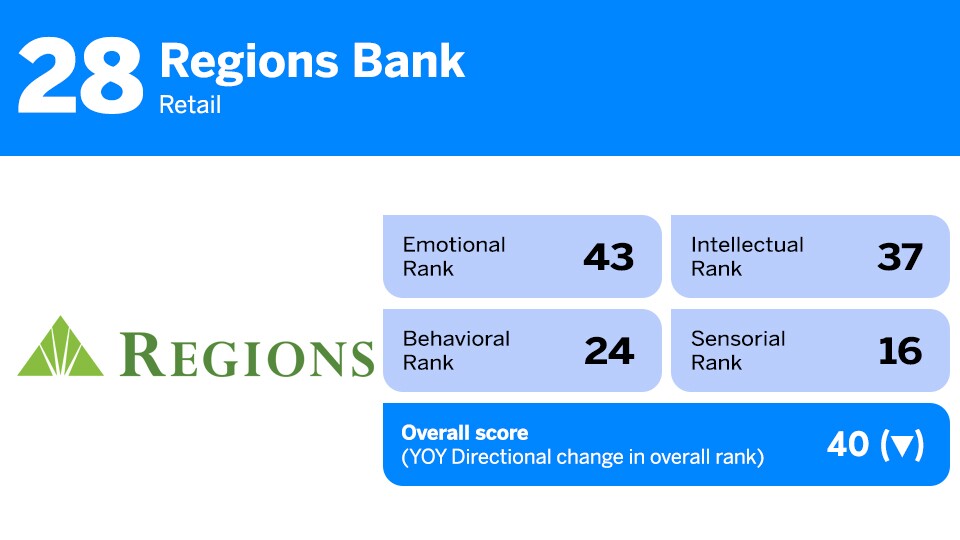

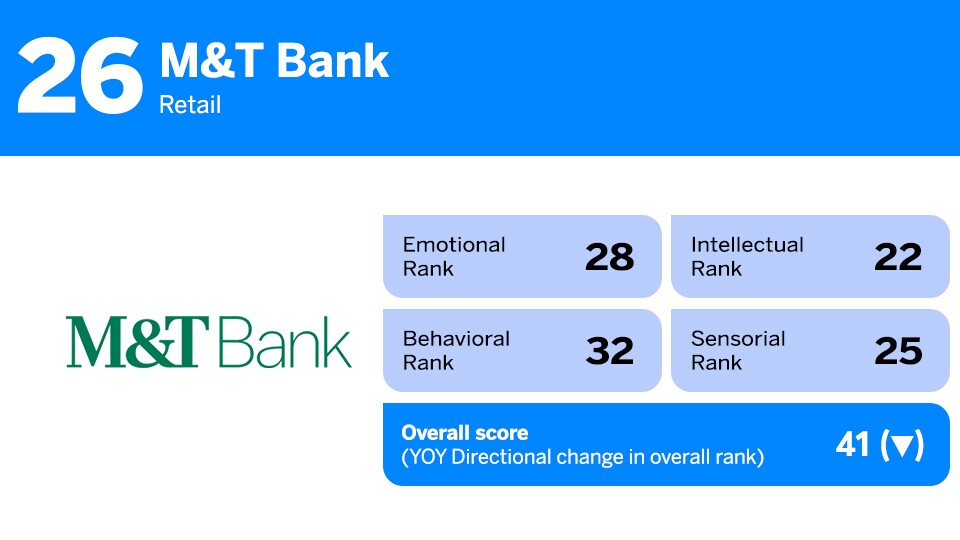

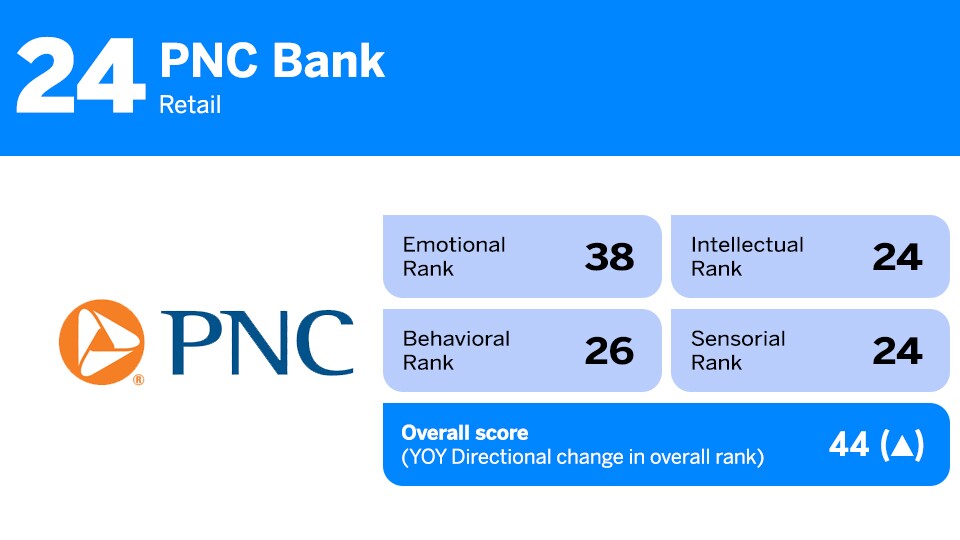

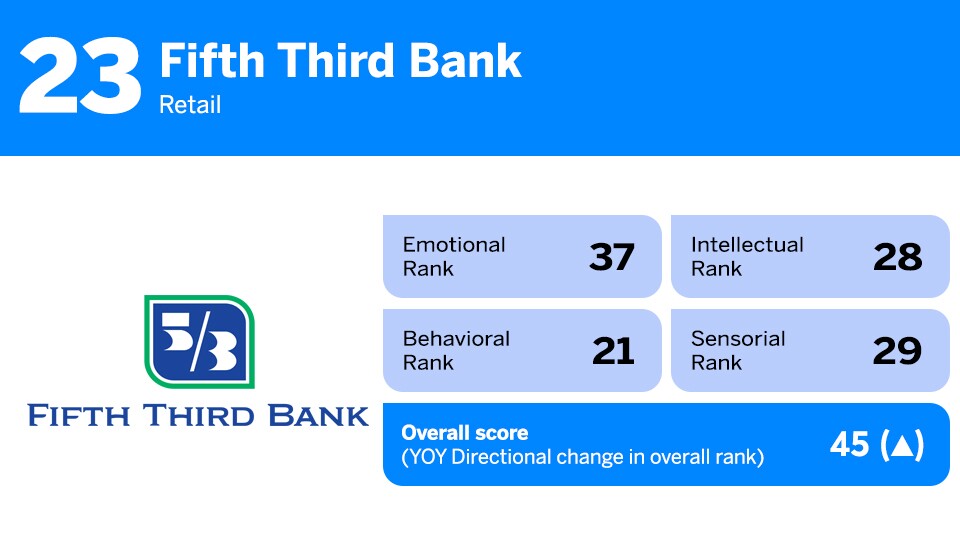

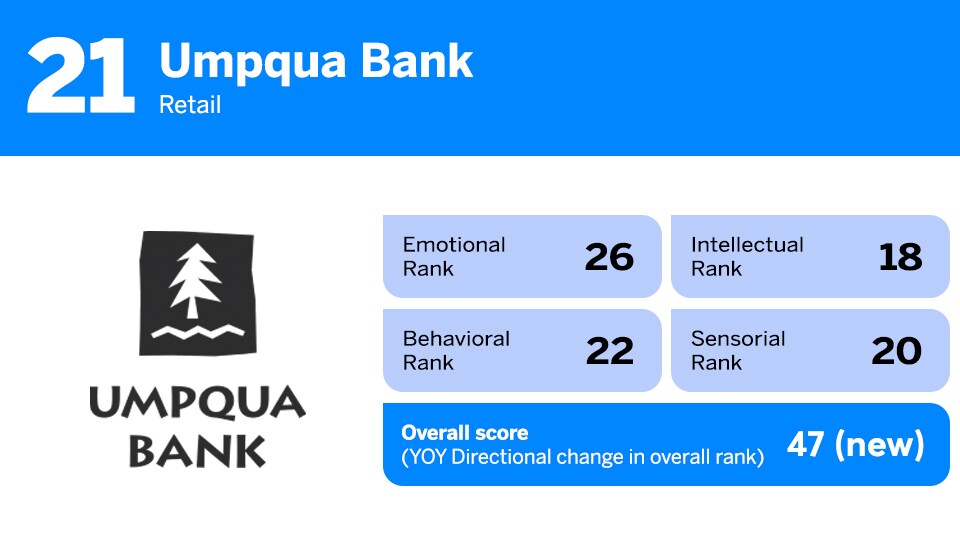

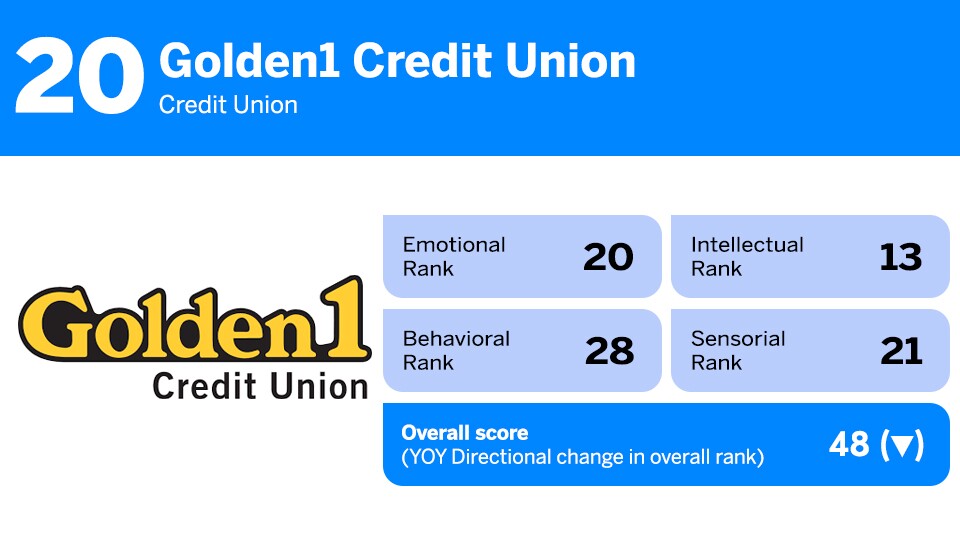

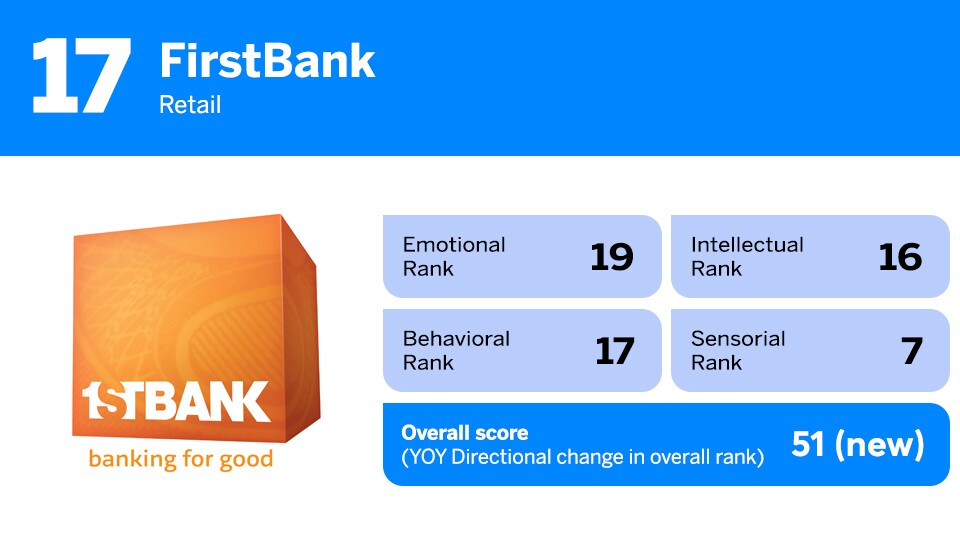

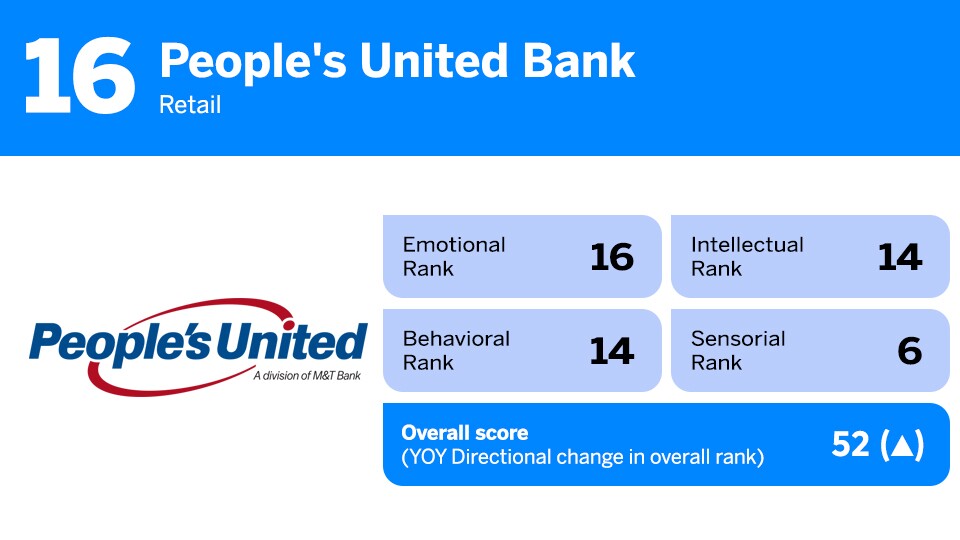

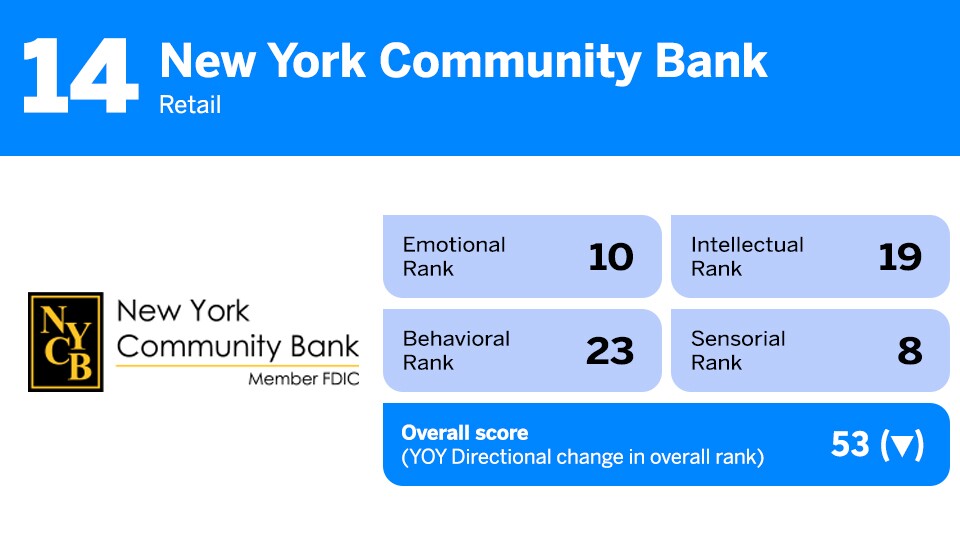

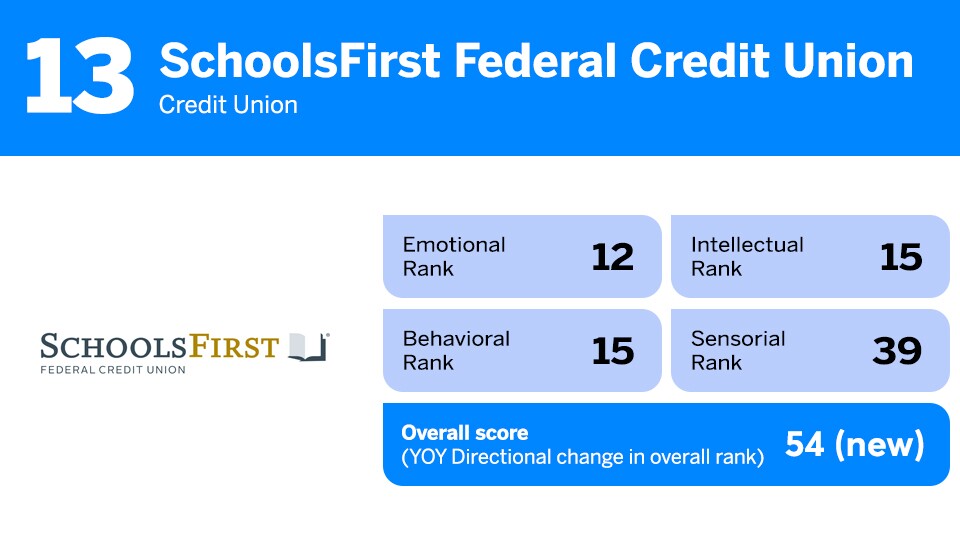

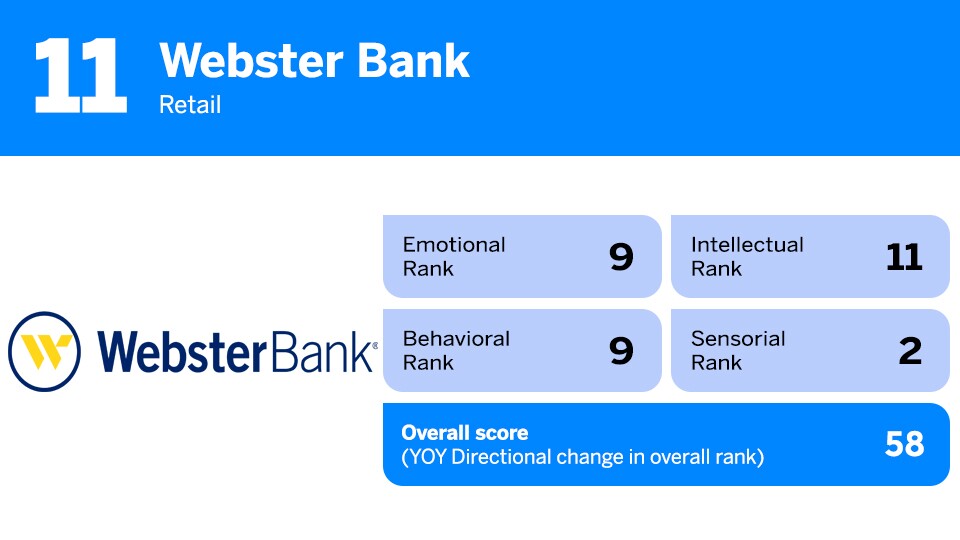

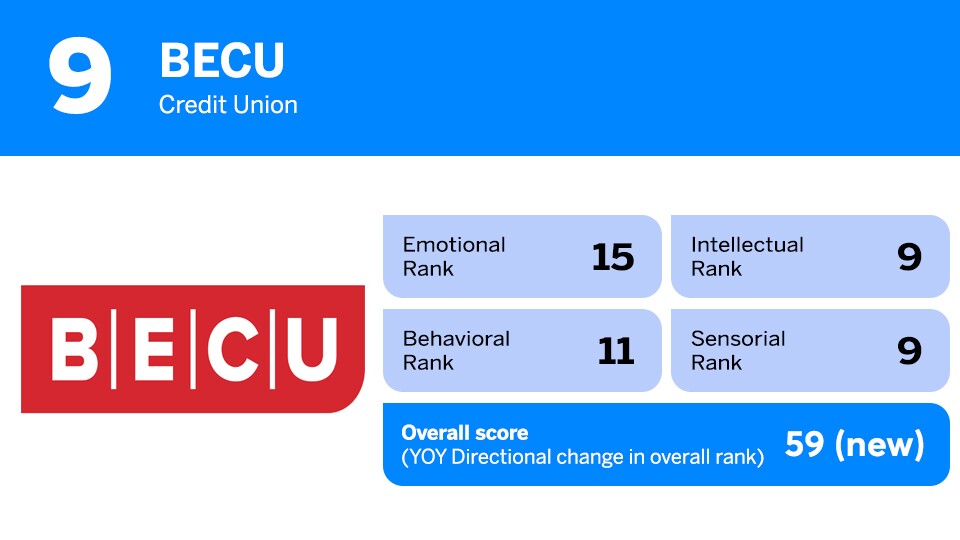

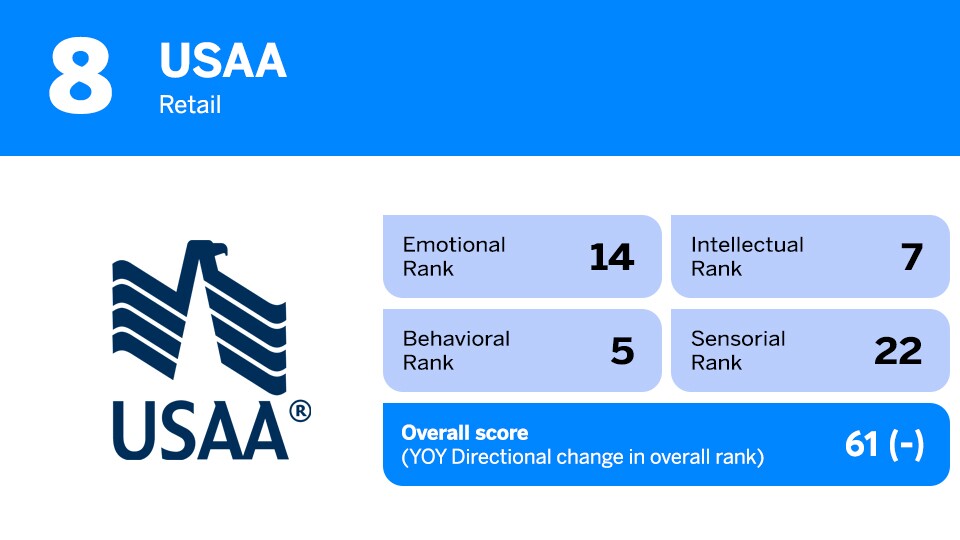

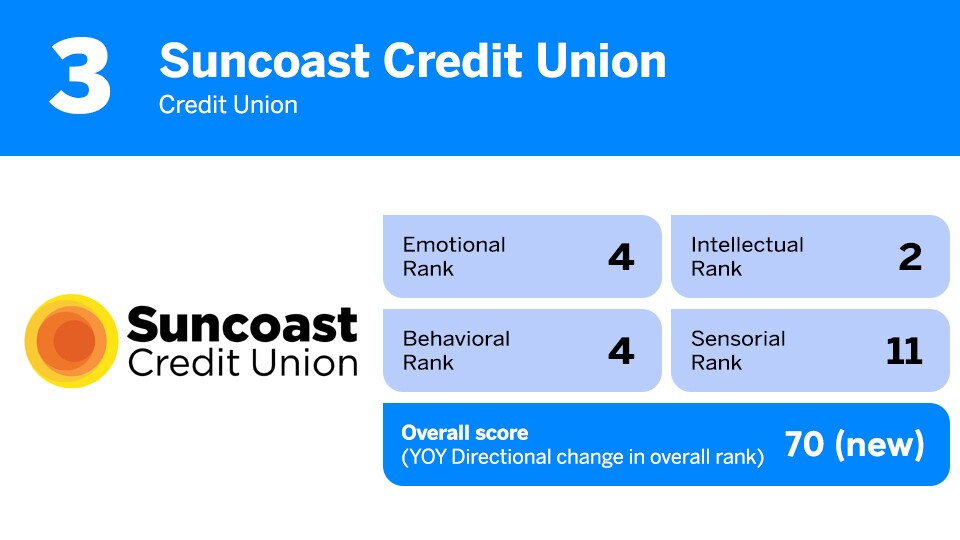

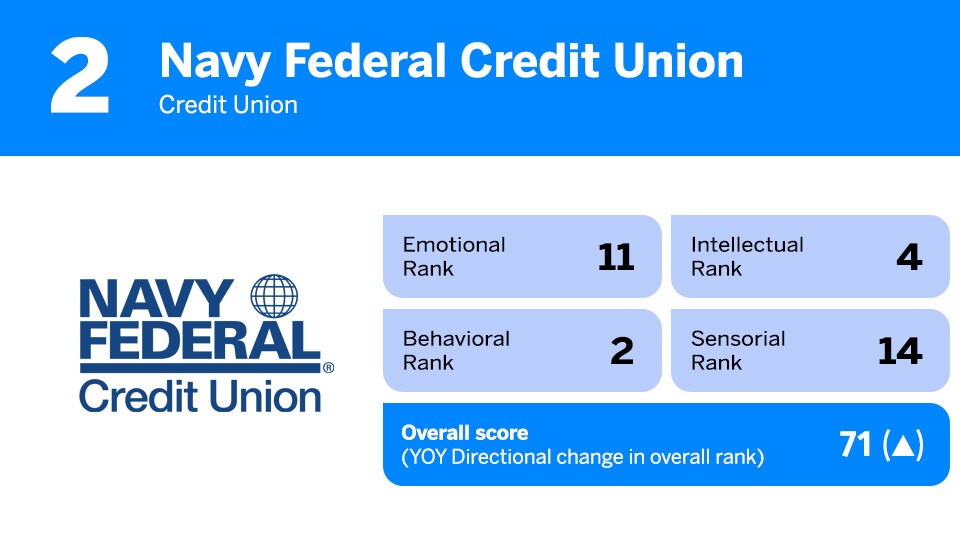

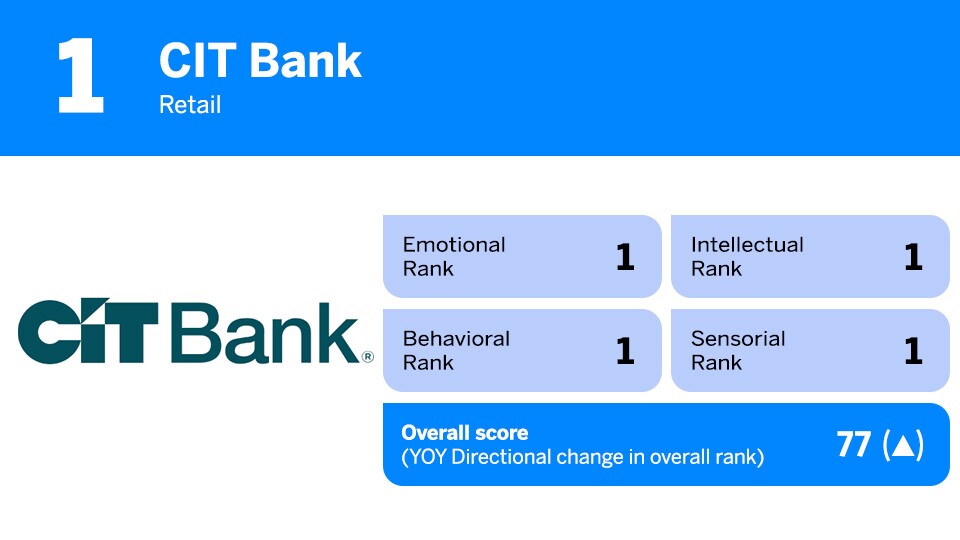

The research leverages a social sciences-based framework that evaluates the most important human elements of experience and accurately predicts customer satisfaction and loyalty. This framework utilizes customer ratings across a series of attributes that are key to a bank's performance in four core pillars: the behavioral, intellectual, sensorial, and emotional experiences of banking. Aggregate performance in all four dimensions drives customer satisfaction and loyalty, and the overall performance score for each bank. In this year's survey more than 5,000 customers participated in evaluating their experience with their primary financial institution.

- Behavioral: The physical and digital interactions people have with financial institutions.

- Intellectual: The functional benefits offered by financial institutions that consumers think about when going through their mental decision making checklists.

- Emotional: The implicit motivators that define what people feel about their banks or credit unions.

- Sensorial: The visual, auditory and olfactory senses people connect with the physical and digital environments created by financial institutions.

The result is a ranking of the 50 retail banks, credit unions, challengers and online-only banks that deliver the best humanized experience in banking. While a retail bank took first place, six of the top 10 providers were credit unions. Scroll through the rankings below to see how the different types of institutions fared and which firms made the top 10.

The full research report and additional details on the methodology can be found